The spot market involves the immediate purchase and sale of financial instruments, with transactions settled "on the spot" at current market prices. In contrast, the derivatives market deals with contracts whose value is derived from underlying assets, allowing investors to hedge risks or speculate on future price movements. Understanding the distinct functions and risk profiles of these markets is essential for effective financial strategy and risk management.

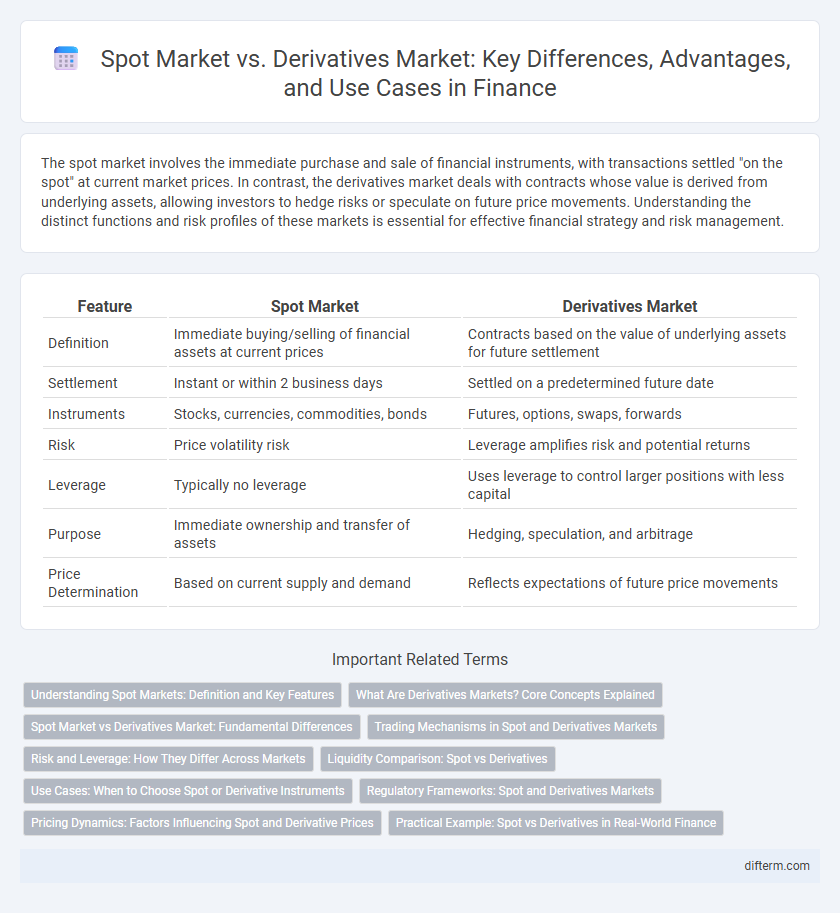

Table of Comparison

| Feature | Spot Market | Derivatives Market |

|---|---|---|

| Definition | Immediate buying/selling of financial assets at current prices | Contracts based on the value of underlying assets for future settlement |

| Settlement | Instant or within 2 business days | Settled on a predetermined future date |

| Instruments | Stocks, currencies, commodities, bonds | Futures, options, swaps, forwards |

| Risk | Price volatility risk | Leverage amplifies risk and potential returns |

| Leverage | Typically no leverage | Uses leverage to control larger positions with less capital |

| Purpose | Immediate ownership and transfer of assets | Hedging, speculation, and arbitrage |

| Price Determination | Based on current supply and demand | Reflects expectations of future price movements |

Understanding Spot Markets: Definition and Key Features

Spot markets facilitate the immediate purchase and sale of financial instruments, including currencies, commodities, and securities, with transactions settled "on the spot" typically within two business days. Key features of spot markets include real-time pricing, physical delivery or settlement, and direct ownership transfer, distinguishing them from derivatives markets where contracts derive value from underlying assets. The transparency and liquidity of spot markets make them essential for price discovery and risk management in financial trading.

What Are Derivatives Markets? Core Concepts Explained

Derivatives markets are financial platforms where contracts derive their value from underlying assets like stocks, bonds, commodities, or currencies. These contracts, including futures, options, and swaps, enable investors to hedge risks, speculate on price movements, or gain access to otherwise inaccessible assets. Unlike spot markets that involve immediate asset exchanges, derivatives markets focus on agreements for future transactions, providing flexibility and leverage in financial strategies.

Spot Market vs Derivatives Market: Fundamental Differences

The spot market involves the immediate purchase and sale of financial instruments at current market prices, with transactions settling "on the spot," typically within two business days. In contrast, the derivatives market deals with contracts whose value is derived from underlying assets, such as futures, options, and swaps, allowing investors to hedge risk or speculate on price movements without owning the assets outright. Key differences include settlement timing, ownership transfer, and risk exposure, where the spot market reflects actual asset exchange, while the derivatives market facilitates leveraged positions and risk management strategies.

Trading Mechanisms in Spot and Derivatives Markets

The spot market facilitates immediate settlement and delivery of financial instruments, where prices are determined by real-time supply and demand dynamics. In contrast, the derivatives market involves contracts like futures and options, allowing traders to speculate or hedge based on the underlying asset's future price without immediate delivery. Trading mechanisms in derivatives rely heavily on margin requirements, leverage, and standardized contract terms to manage risk and liquidity.

Risk and Leverage: How They Differ Across Markets

Spot markets involve immediate settlement and expose traders to direct price risk without leverage, making them inherently less risky. Derivatives markets offer leverage by allowing traders to control large asset positions with a smaller capital outlay, amplifying both potential gains and losses. Risk management in derivatives requires understanding margin requirements and potential for margin calls, which do not exist in spot market transactions.

Liquidity Comparison: Spot vs Derivatives

Liquidity in the spot market is typically higher due to immediate settlement and direct asset exchange, attracting investors seeking quick transactions and price transparency. Derivatives markets often exhibit greater liquidity for large-scale hedging and speculative activities, driven by standardized contracts and leverage opportunities. Spot market liquidity depends heavily on the underlying asset, while derivatives liquidity is influenced by contract popularity and market depth.

Use Cases: When to Choose Spot or Derivative Instruments

Spot markets are ideal for immediate transactions involving physical assets or securities, providing liquidity and price transparency for traders needing quick ownership transfer. Derivatives markets offer strategic tools for hedging against price volatility, leveraging positions, and speculating on future price movements without owning the underlying asset. Investors choose spot markets for straightforward buying or selling, whereas derivatives suit risk management and complex investment strategies in forex, commodities, and equities.

Regulatory Frameworks: Spot and Derivatives Markets

Spot markets operate under regulatory frameworks that emphasize transparency, real-time price discovery, and immediate settlement, often governed by securities commissions and commodity futures trading authorities. Derivatives markets are subject to stricter regulations due to their complexity and leverage, including margin requirements, position limits, and mandatory clearing through authorized clearinghouses to mitigate systemic risk. Regulatory bodies such as the CFTC in the United States and ESMA in Europe enforce compliance to enhance market integrity and protect investors in both spot and derivatives trading environments.

Pricing Dynamics: Factors Influencing Spot and Derivative Prices

Spot market prices reflect current supply and demand conditions, influenced by immediate availability, liquidity, and geopolitical events impacting asset valuation. Derivative prices depend on the underlying asset's spot price, time to expiration, volatility, interest rates, and expected dividends, integrating future market expectations. The interplay between spot price movements and implied volatility drives the premiums of options and futures contracts in the derivatives market.

Practical Example: Spot vs Derivatives in Real-World Finance

In the spot market, a trader purchases 100 shares of Apple Inc. at the current price of $150 per share, with immediate settlement and ownership transfer. Conversely, in the derivatives market, the trader might buy an Apple call option expiring in one month with a strike price of $155, allowing the right to purchase shares later without immediate ownership. This practical example highlights the spot market's focus on instant transactions versus the derivatives market's emphasis on future price speculation and risk management.

Spot Market vs Derivatives Market Infographic

difterm.com

difterm.com