Tax loss harvesting involves selling investments at a loss to offset taxable gains, reducing overall tax liability, while tax gain harvesting entails selling appreciated assets to realize gains that can be taxed at a lower rate or reset the cost basis for future gains. Both strategies optimize tax efficiency by leveraging market fluctuations and individual tax situations. Implementing these techniques requires careful analysis of current tax brackets, investment goals, and timing to maximize after-tax returns.

Table of Comparison

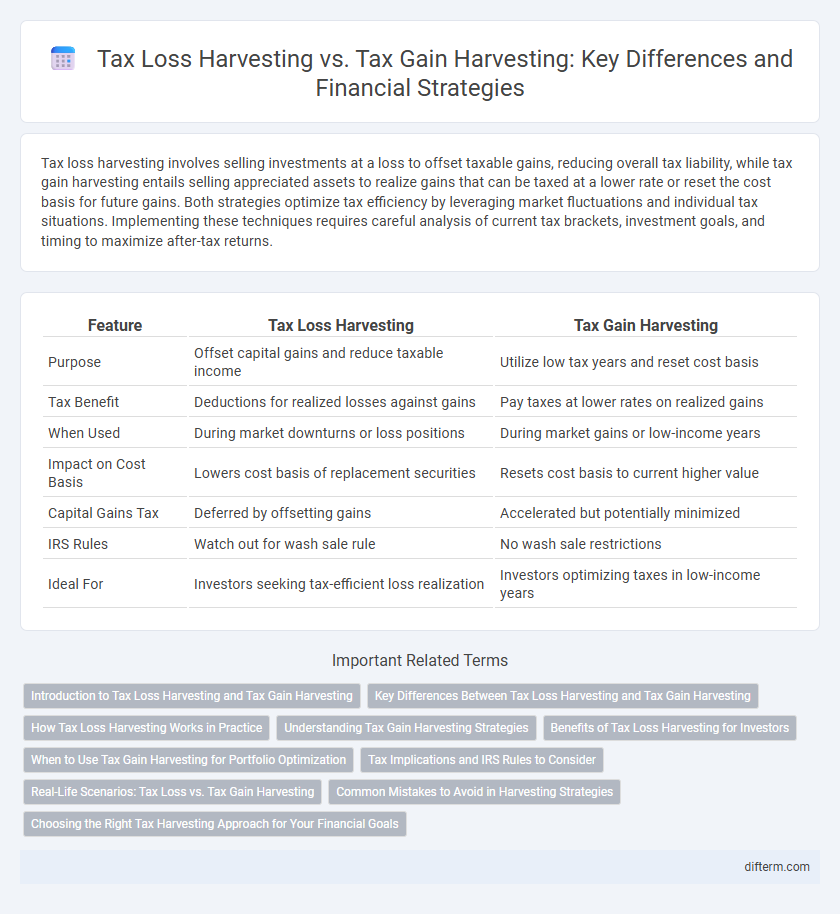

| Feature | Tax Loss Harvesting | Tax Gain Harvesting |

|---|---|---|

| Purpose | Offset capital gains and reduce taxable income | Utilize low tax years and reset cost basis |

| Tax Benefit | Deductions for realized losses against gains | Pay taxes at lower rates on realized gains |

| When Used | During market downturns or loss positions | During market gains or low-income years |

| Impact on Cost Basis | Lowers cost basis of replacement securities | Resets cost basis to current higher value |

| Capital Gains Tax | Deferred by offsetting gains | Accelerated but potentially minimized |

| IRS Rules | Watch out for wash sale rule | No wash sale restrictions |

| Ideal For | Investors seeking tax-efficient loss realization | Investors optimizing taxes in low-income years |

Introduction to Tax Loss Harvesting and Tax Gain Harvesting

Tax Loss Harvesting involves selling securities at a loss to offset capital gains taxable income, effectively reducing an investor's tax liability. Tax Gain Harvesting, on the other hand, entails selling securities at a gain to take advantage of lower capital gains tax rates, especially during years with reduced income. Both strategies optimize portfolio tax efficiency by strategically timing asset sales to minimize overall tax impact while maintaining investment goals.

Key Differences Between Tax Loss Harvesting and Tax Gain Harvesting

Tax loss harvesting involves selling securities at a loss to offset capital gains tax liability, while tax gain harvesting entails selling investments at a gain to utilize lower tax brackets or reset the cost basis. The key difference lies in tax timing: loss harvesting reduces taxable income immediately, whereas gain harvesting strategically manages future tax exposure. Both strategies optimize after-tax returns by leveraging market fluctuations and investor tax profiles.

How Tax Loss Harvesting Works in Practice

Tax loss harvesting involves selling securities at a loss to offset capital gains tax liabilities, thereby reducing an investor's taxable income. The harvested losses can be used to offset gains dollar-for-dollar, and if losses exceed gains, up to $3,000 can be deducted from ordinary income annually, with any excess carried over to future years. Investors must adhere to IRS wash sale rules, which prohibit repurchasing the same or substantially identical security within 30 days to maintain the tax benefit.

Understanding Tax Gain Harvesting Strategies

Tax gain harvesting involves intentionally selling appreciated assets to realize capital gains, which can be beneficial in a low-income year to utilize lower tax brackets or reset cost basis for future tax planning. This strategy leverages the opportunity to pay taxes on gains when the taxpayer's marginal tax rate is minimal, potentially reducing the overall tax burden in subsequent years. Understanding tax gain harvesting allows investors to strategically manage their capital gains exposure while maintaining a balanced portfolio aligned with long-term financial goals.

Benefits of Tax Loss Harvesting for Investors

Tax Loss Harvesting allows investors to offset capital gains with realized losses, reducing taxable income and lowering overall tax liability. This strategy enhances portfolio diversification by enabling the reinvestment of proceeds into different assets while maintaining market exposure. Additionally, it can carry forward unused losses to future tax years, providing ongoing tax relief and improving after-tax returns.

When to Use Tax Gain Harvesting for Portfolio Optimization

Tax Gain Harvesting is most effective when investors face low taxable income years, allowing them to realize gains while minimizing tax liabilities by utilizing lower capital gains rates. This strategy is also beneficial for resetting cost basis in appreciated assets before anticipated tax rate increases or market declines, optimizing long-term portfolio tax efficiency. Employing Tax Gain Harvesting strategically can enhance after-tax returns by capitalizing on favorable tax brackets and managing future tax exposure.

Tax Implications and IRS Rules to Consider

Tax loss harvesting involves selling securities at a loss to offset taxable gains, reducing overall tax liability, while tax gain harvesting entails selling assets at a gain to capitalize on lower tax rates or reset cost basis. The IRS enforces the "wash sale" rule, which disallows claiming a loss if the same or substantially identical security is repurchased within 30 days, impacting tax loss harvesting strategies. Understanding long-term vs. short-term capital gains tax rates and holding periods is crucial in both techniques to optimize tax outcomes under current IRS regulations.

Real-Life Scenarios: Tax Loss vs. Tax Gain Harvesting

Tax loss harvesting involves selling investments at a loss to offset capital gains and reduce taxable income, often used after market downturns to improve tax efficiency. Conversely, tax gain harvesting entails selling appreciated assets to realize gains, potentially benefiting from lower capital gains tax rates in low-income years or to reset the cost basis. Real-life scenarios show investors use tax loss harvesting to shield gains and tax gain harvesting to manage tax brackets strategically, optimizing after-tax returns.

Common Mistakes to Avoid in Harvesting Strategies

Common mistakes in tax loss harvesting include selling investments without considering wash sale rules, which can nullify the tax benefit, and failing to account for transaction costs that reduce overall gains. In tax gain harvesting, investors often overlook the tax brackets and timing of gains, potentially triggering higher taxes than anticipated. Both strategies require careful portfolio rebalancing to avoid unintended exposure to market volatility or asset misallocation.

Choosing the Right Tax Harvesting Approach for Your Financial Goals

Tax loss harvesting involves selling investments at a loss to offset capital gains and reduce taxable income, benefiting those seeking immediate tax relief, while tax gain harvesting entails selling appreciated assets to utilize lower tax brackets or reset cost basis, ideal for long-term tax planning. Choosing the right tax harvesting approach depends on your current income level, investment horizon, and future tax expectations, aligning strategies with personalized financial goals. Regular portfolio reviews and collaboration with a tax advisor ensure the optimal balance between minimizing tax liabilities and maximizing after-tax returns.

Tax Loss Harvesting vs Tax Gain Harvesting Infographic

difterm.com

difterm.com