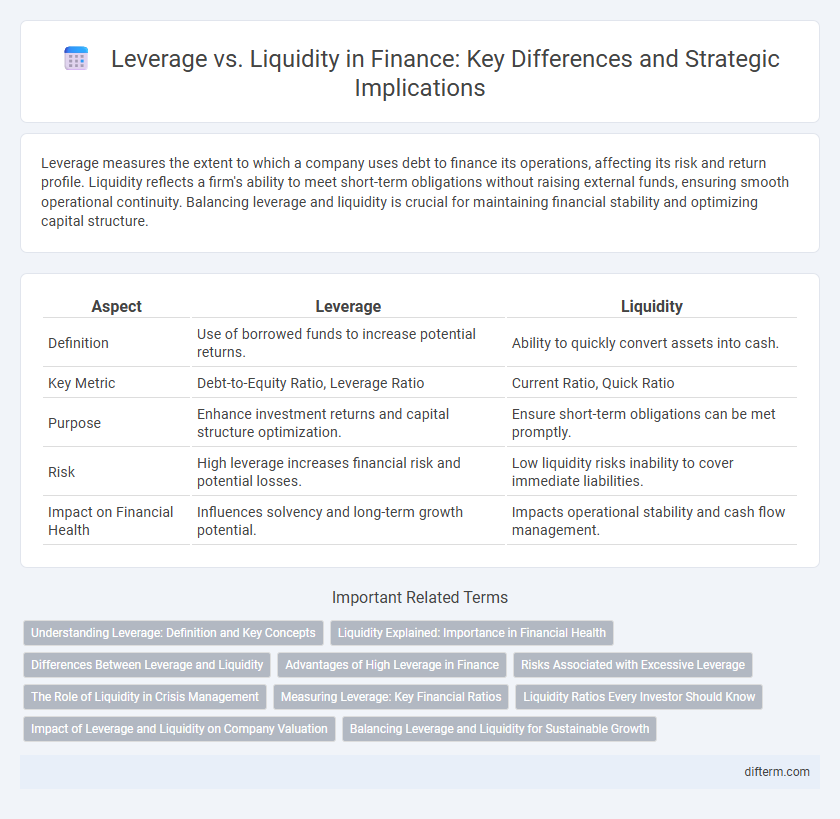

Leverage measures the extent to which a company uses debt to finance its operations, affecting its risk and return profile. Liquidity reflects a firm's ability to meet short-term obligations without raising external funds, ensuring smooth operational continuity. Balancing leverage and liquidity is crucial for maintaining financial stability and optimizing capital structure.

Table of Comparison

| Aspect | Leverage | Liquidity |

|---|---|---|

| Definition | Use of borrowed funds to increase potential returns. | Ability to quickly convert assets into cash. |

| Key Metric | Debt-to-Equity Ratio, Leverage Ratio | Current Ratio, Quick Ratio |

| Purpose | Enhance investment returns and capital structure optimization. | Ensure short-term obligations can be met promptly. |

| Risk | High leverage increases financial risk and potential losses. | Low liquidity risks inability to cover immediate liabilities. |

| Impact on Financial Health | Influences solvency and long-term growth potential. | Impacts operational stability and cash flow management. |

Understanding Leverage: Definition and Key Concepts

Leverage in finance refers to the use of borrowed capital to increase the potential return on investment, amplifying both gains and risks. Key concepts include the debt-to-equity ratio, which measures the proportion of debt financing relative to shareholders' equity, and interest coverage ratio, indicating the firm's ability to meet interest obligations. Understanding leverage is essential for assessing a company's financial risk, capital structure, and potential for growth or distress.

Liquidity Explained: Importance in Financial Health

Liquidity measures a company's ability to meet short-term obligations by converting assets into cash quickly without significant loss of value. High liquidity ensures operational stability, preventing cash flow crises during economic downturns or unexpected expenses. Maintaining adequate liquid assets is crucial for sustaining financial health and enabling strategic investment opportunities.

Differences Between Leverage and Liquidity

Leverage measures the degree to which a company uses borrowed funds to finance its assets, affecting financial risk and return potential, while liquidity indicates a firm's ability to meet short-term obligations using readily available assets. Leverage impacts long-term solvency and capital structure, whereas liquidity reflects short-term financial health and operational efficiency. Understanding the differences between leverage and liquidity is crucial for effective financial management, risk assessment, and strategic planning.

Advantages of High Leverage in Finance

High leverage in finance amplifies potential returns by allowing investors to control larger asset positions with less capital, increasing profit opportunities during favorable market conditions. It enhances capital efficiency by freeing up funds for diversification or other investment ventures. Moreover, leveraging can improve the return on equity (ROE), making businesses or portfolios more attractive to investors seeking higher growth rates.

Risks Associated with Excessive Leverage

Excessive leverage increases the risk of insolvency as companies may struggle to meet debt obligations during cash flow shortfalls, amplifying financial distress in volatile markets. High leverage reduces liquidity buffers, limiting firms' ability to respond to unexpected expenses or economic downturns, which can trigger a negative feedback loop of asset sales and further leverage escalation. Regulatory bodies often impose leverage ratios to mitigate systemic risk, emphasizing the importance of maintaining balanced capital structures to ensure financial stability and creditor confidence.

The Role of Liquidity in Crisis Management

Liquidity serves as a critical buffer during financial crises by ensuring institutions can meet short-term obligations without liquidating assets at distress prices. High liquidity reduces the risk of insolvency and supports market confidence, thereby stabilizing systemic risk. Effective crisis management depends on maintaining sufficient liquid reserves to navigate sudden cash flow disruptions and mitigate leverage-related vulnerabilities.

Measuring Leverage: Key Financial Ratios

Measuring leverage involves key financial ratios such as the Debt-to-Equity Ratio and the Debt Ratio, which assess a company's reliance on borrowed funds relative to its equity and total assets. The Interest Coverage Ratio indicates the ability to meet interest obligations, reflecting financial stability under leverage conditions. These ratios provide critical insights into risk exposure and capital structure to optimize financial strategy and maintain liquidity balance.

Liquidity Ratios Every Investor Should Know

Liquidity ratios such as the current ratio, quick ratio, and cash ratio provide critical insights into a company's ability to meet short-term obligations, making them essential for investors assessing financial health. These ratios measure the availability of liquid assets relative to current liabilities, helping to avoid risks associated with over-leveraging. Understanding liquidity ratios enables investors to evaluate operational efficiency and financial stability, vital for making informed investment decisions.

Impact of Leverage and Liquidity on Company Valuation

Leverage directly affects company valuation by increasing financial risk and potentially magnifying returns on equity, leading to higher volatility in market value. Liquidity influences valuation by ensuring a firm's ability to meet short-term obligations, reducing default risk, and enhancing investor confidence. Optimal balance of leverage and liquidity supports sustainable growth and stabilizes valuation in volatile financial markets.

Balancing Leverage and Liquidity for Sustainable Growth

Balancing leverage and liquidity is essential for sustainable growth, as excessive leverage increases financial risk while sufficient liquidity ensures operational flexibility. Companies must optimize debt levels to maintain solvency and avoid liquidity crunches that can disrupt cash flow and investment opportunities. Strategic management of leverage ratios and liquid assets supports long-term financial stability and enhances the capacity to weather market volatility.

Leverage vs Liquidity Infographic

difterm.com

difterm.com