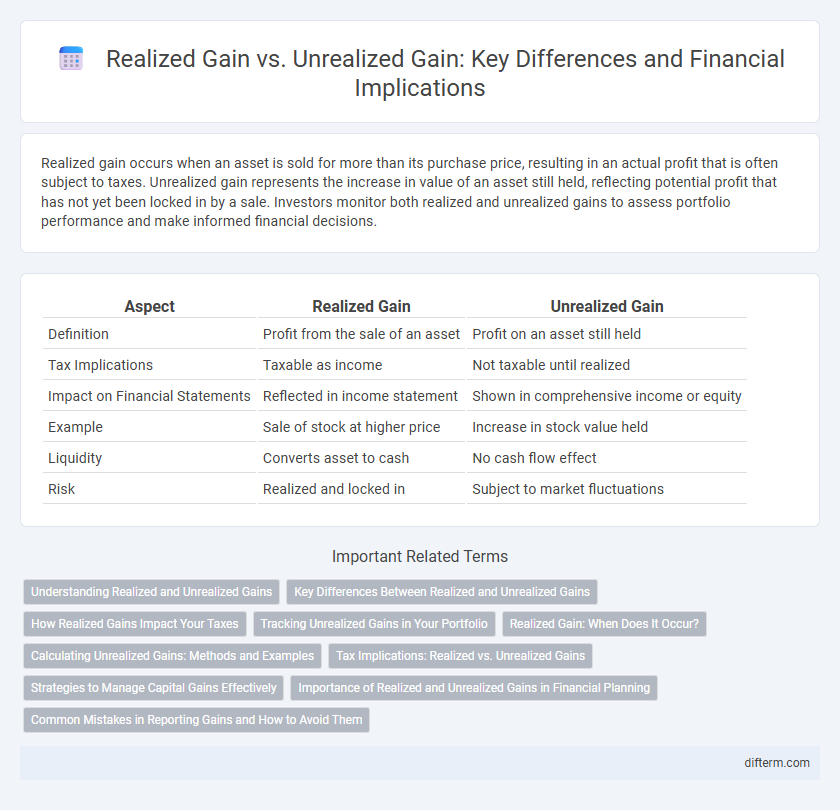

Realized gain occurs when an asset is sold for more than its purchase price, resulting in an actual profit that is often subject to taxes. Unrealized gain represents the increase in value of an asset still held, reflecting potential profit that has not yet been locked in by a sale. Investors monitor both realized and unrealized gains to assess portfolio performance and make informed financial decisions.

Table of Comparison

| Aspect | Realized Gain | Unrealized Gain |

|---|---|---|

| Definition | Profit from the sale of an asset | Profit on an asset still held |

| Tax Implications | Taxable as income | Not taxable until realized |

| Impact on Financial Statements | Reflected in income statement | Shown in comprehensive income or equity |

| Example | Sale of stock at higher price | Increase in stock value held |

| Liquidity | Converts asset to cash | No cash flow effect |

| Risk | Realized and locked in | Subject to market fluctuations |

Understanding Realized and Unrealized Gains

Realized gains occur when an asset is sold for a profit, resulting in an actual increase in wealth that can be taxed immediately. Unrealized gains represent the potential profit on an asset still held, fluctuating with market value but not triggering tax liability until the sale. Understanding the distinction between realized and unrealized gains is crucial for effective portfolio management and tax planning strategies.

Key Differences Between Realized and Unrealized Gains

Realized gains occur when an asset is sold for a profit, locking in the financial benefit and triggering tax obligations. Unrealized gains represent the increase in value of an asset still held, reflecting potential profit without immediate tax consequences. The key difference lies in the liquidity event and tax impact: realized gains are taxable events, while unrealized gains are theoretical and subject to market fluctuations.

How Realized Gains Impact Your Taxes

Realized gains occur when an asset is sold for a profit, directly influencing your taxable income and potentially increasing your tax liability for that year. Unrealized gains, by contrast, represent paper profits on investments still held, which do not trigger immediate taxes until the asset is sold. Understanding the difference helps in tax planning, as realized gains must be reported and taxed at capital gains rates that depend on holding period and income bracket.

Tracking Unrealized Gains in Your Portfolio

Tracking unrealized gains in your portfolio involves monitoring the increase in value of your investments that have not yet been sold, providing insight into potential future profits. Regular evaluation using real-time market data helps investors make informed decisions about when to realize gains and optimize tax strategies. Employing portfolio management tools with precise gain/loss tracking features enhances the accuracy and timing of these assessments.

Realized Gain: When Does It Occur?

Realized gain occurs when an asset is sold for a higher price than its original purchase cost, locking in the profit. This gain is taxable in the fiscal year the sale takes place and reflects the actual monetary benefit received by the investor. Understanding the timing of realized gains is crucial for effective tax planning and portfolio management.

Calculating Unrealized Gains: Methods and Examples

Unrealized gains are calculated by subtracting the original purchase price of an asset from its current market value, reflecting potential profits not yet realized through sale. Common methods include the FIFO (First In, First Out), LIFO (Last In, First Out), and specific identification approaches to accurately assess the holding period and cost basis. For example, if an investor bought shares at $50 each and the market price rises to $70, the unrealized gain per share is $20, which impacts portfolio valuation but not taxable income until realized.

Tax Implications: Realized vs. Unrealized Gains

Realized gains trigger tax liabilities because they are recognized when an asset is sold or disposed of, requiring investors to report the profit on their tax returns. Unrealized gains represent the increase in value of an asset still held and are not subject to immediate taxation, allowing tax deferral until the asset is sold. Understanding the tax implications of realized versus unrealized gains is crucial for strategic financial planning and optimizing after-tax returns.

Strategies to Manage Capital Gains Effectively

Strategically managing capital gains involves carefully timing asset sales to optimize tax liabilities, focusing on realizing gains during lower-income years to benefit from reduced tax brackets. Employing tax-loss harvesting allows investors to offset realized gains with capital losses, thereby minimizing taxable income. Diversifying portfolio holdings and utilizing tax-advantaged accounts, such as IRAs and 401(k)s, further enhances the ability to control the impact of both realized and unrealized gains on overall financial outcomes.

Importance of Realized and Unrealized Gains in Financial Planning

Realized gains, representing profits from completed asset sales, directly impact taxable income and cash flow, making them crucial for effective financial planning and tax strategy. Unrealized gains reflect the potential increase in asset value, guiding investment decisions and portfolio rebalancing without immediate tax consequences. Balancing realized and unrealized gains enables investors to optimize liquidity while managing risk and long-term growth objectives.

Common Mistakes in Reporting Gains and How to Avoid Them

Confusing realized gains with unrealized gains often leads to inaccurate financial reporting, as realized gains represent actual profits from sold assets while unrealized gains reflect potential profits on held assets. Failing to distinguish these can result in misstated tax obligations and misleading investor information. To avoid these errors, maintain clear documentation of transaction dates and values, and use accounting software that differentiates between realized and unrealized gains during reporting periods.

Realized Gain vs Unrealized Gain Infographic

difterm.com

difterm.com