Fixed rate loans offer predictable monthly payments by maintaining a constant interest rate throughout the loan term, which helps in budgeting and financial planning. Floating rate loans, also known as variable or adjustable rate loans, have interest rates that fluctuate with market conditions, potentially lowering initial costs but increasing uncertainty over time. Choosing between fixed and floating rates depends on risk tolerance, interest rate trends, and the borrower's financial strategy.

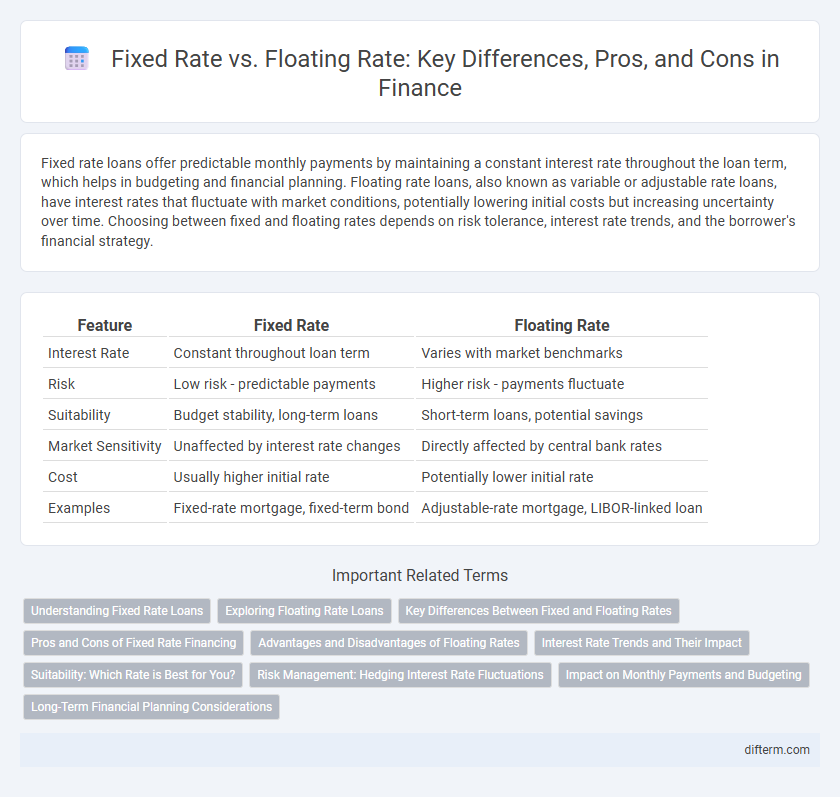

Table of Comparison

| Feature | Fixed Rate | Floating Rate |

|---|---|---|

| Interest Rate | Constant throughout loan term | Varies with market benchmarks |

| Risk | Low risk - predictable payments | Higher risk - payments fluctuate |

| Suitability | Budget stability, long-term loans | Short-term loans, potential savings |

| Market Sensitivity | Unaffected by interest rate changes | Directly affected by central bank rates |

| Cost | Usually higher initial rate | Potentially lower initial rate |

| Examples | Fixed-rate mortgage, fixed-term bond | Adjustable-rate mortgage, LIBOR-linked loan |

Understanding Fixed Rate Loans

Fixed rate loans maintain a consistent interest rate throughout the loan term, providing predictable monthly payments that simplify budgeting and financial planning. This stability protects borrowers from market fluctuations and rising interest rates, making fixed rate loans ideal for long-term financing needs. Understanding the benefits of fixed rate loans helps individuals and businesses assess the trade-off between payment certainty and potentially higher initial costs compared to floating rate options.

Exploring Floating Rate Loans

Floating rate loans feature interest rates that adjust periodically based on benchmark indices such as LIBOR or SOFR, aligning borrower payments with current market conditions. This dynamic rate structure can offer protection against rising interest costs during economic upswings, while exposing borrowers to increased payment volatility. Investors and borrowers seeking rate flexibility often prefer floating rate loans for potential savings during periods of declining interest rates.

Key Differences Between Fixed and Floating Rates

Fixed rates remain constant throughout the loan tenure, providing predictable payments and shielding borrowers from interest rate fluctuations. Floating rates vary based on benchmark indices like LIBOR or SOFR, causing payment amounts to adjust with market conditions. The choice between fixed and floating rates hinges on risk tolerance, with fixed offering stability and floating potentially lowering costs during declining interest periods.

Pros and Cons of Fixed Rate Financing

Fixed rate financing offers predictable monthly payments and protection against interest rate fluctuations, making it easier for budgeting and long-term planning. However, it typically carries higher initial interest rates compared to floating rates, potentially resulting in higher overall costs if market rates decrease. Borrowers may face penalties for early repayment, limiting flexibility to refinance or adjust loan terms in response to changing financial conditions.

Advantages and Disadvantages of Floating Rates

Floating rates offer the advantage of lower initial interest costs and potential savings when market rates decline, providing borrowers with flexibility and protection against overpaying interest during periods of falling rates. However, the primary disadvantage is exposure to interest rate volatility, which can lead to unpredictable payment amounts and increased financial risk if rates rise sharply. Companies with uncertain cash flows or tight budgets may find floating rates challenging to manage due to this variability in interest expenses.

Interest Rate Trends and Their Impact

Fixed rate loans provide stability by locking in interest payments, protecting borrowers from rising rate environments. Floating rate loans fluctuate with market interest trends, often starting lower but exposing borrowers to rate increases tied to benchmarks like LIBOR or SOFR. Understanding current interest rate forecasts helps investors and borrowers choose between predictable costs and potential savings amid market volatility.

Suitability: Which Rate is Best for You?

Fixed rates offer predictable payments and are ideal for risk-averse borrowers seeking budgeting certainty, especially in a stable or rising interest rate environment. Floating rates, linked to benchmark indices like LIBOR or SOFR, benefit borrowers expecting declining rates or possessing high risk tolerance, as payments fluctuate with market conditions. Evaluating financial goals, cash flow stability, and interest rate forecasts is crucial to determine whether a fixed or floating rate aligns best with individual financing needs.

Risk Management: Hedging Interest Rate Fluctuations

Fixed rate loans provide predictable interest payments, enabling precise budgeting and minimizing exposure to rising interest rates. Floating rate loans, while initially lower in cost, expose borrowers to the risk of interest rate volatility, necessitating effective hedging strategies such as interest rate swaps or caps. Employing these financial derivatives can mitigate the risk of fluctuating rates, ensuring more stable cash flows and improved financial planning.

Impact on Monthly Payments and Budgeting

Fixed-rate loans provide predictable monthly payments, allowing for straightforward budgeting and financial planning due to their stable interest rates. Floating-rate loans offer variable payments that fluctuate with market interest rates, introducing uncertainty and potential payment increases over time. Borrowers seeking stability and ease of budget management generally prefer fixed-rate options, while those anticipating lower short-term rates might consider floating-rate loans despite the volatility risk.

Long-Term Financial Planning Considerations

Fixed-rate loans provide stability in long-term financial planning by locking in interest payments, protecting against market volatility and interest rate fluctuations. Floating-rate loans offer potential savings if interest rates decline but introduce uncertainty and risk, requiring careful forecasting and risk management. Evaluating economic trends and future interest rate predictions is essential for selecting the optimal rate structure aligned with long-term financial goals.

Fixed Rate vs Floating Rate Infographic

difterm.com

difterm.com