Hard forks in crypto result in a permanent split from the original blockchain, creating new protocols that are not backward-compatible and often require all participants to upgrade. Soft forks are backward-compatible updates that tighten or add new rules without splitting the network, allowing nodes that do not upgrade to still validate transactions within the new protocol. Understanding the differences between hard forks and soft forks is crucial for investors and developers to navigate changes in blockchain ecosystems effectively.

Table of Comparison

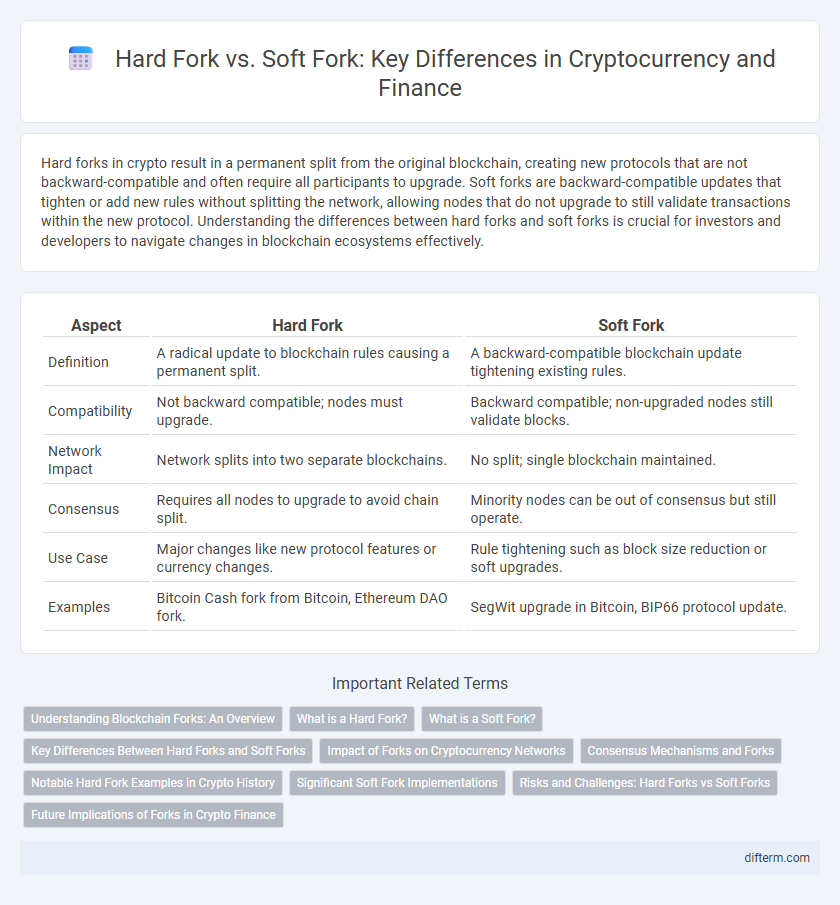

| Aspect | Hard Fork | Soft Fork |

|---|---|---|

| Definition | A radical update to blockchain rules causing a permanent split. | A backward-compatible blockchain update tightening existing rules. |

| Compatibility | Not backward compatible; nodes must upgrade. | Backward compatible; non-upgraded nodes still validate blocks. |

| Network Impact | Network splits into two separate blockchains. | No split; single blockchain maintained. |

| Consensus | Requires all nodes to upgrade to avoid chain split. | Minority nodes can be out of consensus but still operate. |

| Use Case | Major changes like new protocol features or currency changes. | Rule tightening such as block size reduction or soft upgrades. |

| Examples | Bitcoin Cash fork from Bitcoin, Ethereum DAO fork. | SegWit upgrade in Bitcoin, BIP66 protocol update. |

Understanding Blockchain Forks: An Overview

Hard forks in blockchain create a permanent divergence by introducing non-backward-compatible protocol changes, requiring all nodes to upgrade to validate new transactions, often resulting in a split into two separate blockchains. Soft forks maintain backward compatibility by implementing stricter rules that older nodes recognize as valid, allowing the network to continue on a single chain without forcing mandatory upgrades. Understanding the technical differences between hard forks and soft forks is crucial for assessing their impact on consensus mechanisms, network security, and cryptocurrency economics.

What is a Hard Fork?

A hard fork is a significant and incompatible protocol upgrade in a blockchain network that results in the permanent divergence of the blockchain into two separate chains. This type of fork requires all nodes and users to upgrade to the new software version; otherwise, they will remain on the old chain, leading to a split in consensus. Hard forks can introduce new features, fix security vulnerabilities, or reverse transactions, fundamentally altering the rules of the blockchain.

What is a Soft Fork?

A soft fork in cryptocurrency refers to a backward-compatible upgrade to the blockchain protocol, allowing non-upgraded nodes to still recognize and validate new transactions. It introduces new rules that tighten the existing consensus without requiring all participants to upgrade, reducing network disruption. This mechanism contrasts with a hard fork, which creates a permanent divergence in the blockchain requiring all nodes to update.

Key Differences Between Hard Forks and Soft Forks

Hard forks in cryptocurrency involve a permanent divergence in the blockchain that creates two incompatible versions, requiring all nodes to upgrade, whereas soft forks are backward-compatible updates allowing only a subset of nodes to upgrade without splitting the chain. Hard forks often result in a chain split and potential creation of a new cryptocurrency, while soft forks tighten rules without disrupting the existing ledger continuity. Network consensus and upgrade adoption rates are critical factors distinguishing hard forks from soft forks in blockchain governance.

Impact of Forks on Cryptocurrency Networks

Hard forks create irreversible changes in cryptocurrency networks, causing a permanent split that results in two separate blockchains and potentially new tokens, impacting network consensus and user assets. Soft forks maintain backward compatibility, allowing updated nodes to participate without forcing all users to upgrade, which minimizes disruption but may limit network functionality until adoption is widespread. Both fork types significantly influence network security, transaction validation, and overall community trust, shaping the evolution and stability of blockchain ecosystems.

Consensus Mechanisms and Forks

Hard forks represent significant changes to a blockchain's consensus mechanism that create a permanent divergence from the previous version, requiring all nodes to upgrade to the new protocol to continue participating. Soft forks involve backward-compatible updates where only a majority of miners must adopt the changes, allowing non-upgraded nodes to still recognize new blocks as valid. Both fork types impact consensus by altering how transactions are verified and validated, influencing blockchain security, scalability, and community agreement.

Notable Hard Fork Examples in Crypto History

Notable hard fork examples in crypto history include Bitcoin Cash, a split from Bitcoin in 2017 aimed at increasing transaction capacity, and Ethereum Classic, which emerged after the 2016 DAO hack to preserve the original Ethereum blockchain. These hard forks reflect significant protocol changes resulting in permanent divergence from the original blockchain, requiring nodes and miners to upgrade software. Hard forks often generate new cryptocurrencies with distinct ledgers and communities, impacting market dynamics and investor strategies.

Significant Soft Fork Implementations

Significant soft fork implementations in the cryptocurrency space include Bitcoin's Segregated Witness (SegWit), which enhanced scalability and transaction malleability without splitting the blockchain. Another key example is the Taproot upgrade, improving privacy and complex smart contract capabilities while maintaining backward compatibility. These soft forks achieve consensus changes that are backward compatible, allowing non-upgraded nodes to continue validating transactions.

Risks and Challenges: Hard Forks vs Soft Forks

Hard forks pose significant risks such as network splits, leading to the creation of two separate cryptocurrencies that can confuse users and dilute the market value. Soft forks carry a lower risk of chain division but may introduce hidden vulnerabilities due to backward compatibility, increasing the challenge of maintaining consensus across nodes. Both hard and soft forks require extensive community coordination to avoid security breaches, potential loss of funds, and network instability in the cryptocurrency ecosystem.

Future Implications of Forks in Crypto Finance

Hard forks create permanent blockchain splits resulting in new tokens, potentially increasing market volatility and asset diversification opportunities. Soft forks enable backward-compatible updates, preserving cohesion while allowing gradual protocol enhancements critical for scalability and security. Future forks will increasingly influence regulatory frameworks, investor confidence, and innovation trajectories in decentralized finance ecosystems.

Hard Fork vs Soft Fork (crypto context) Infographic

difterm.com

difterm.com