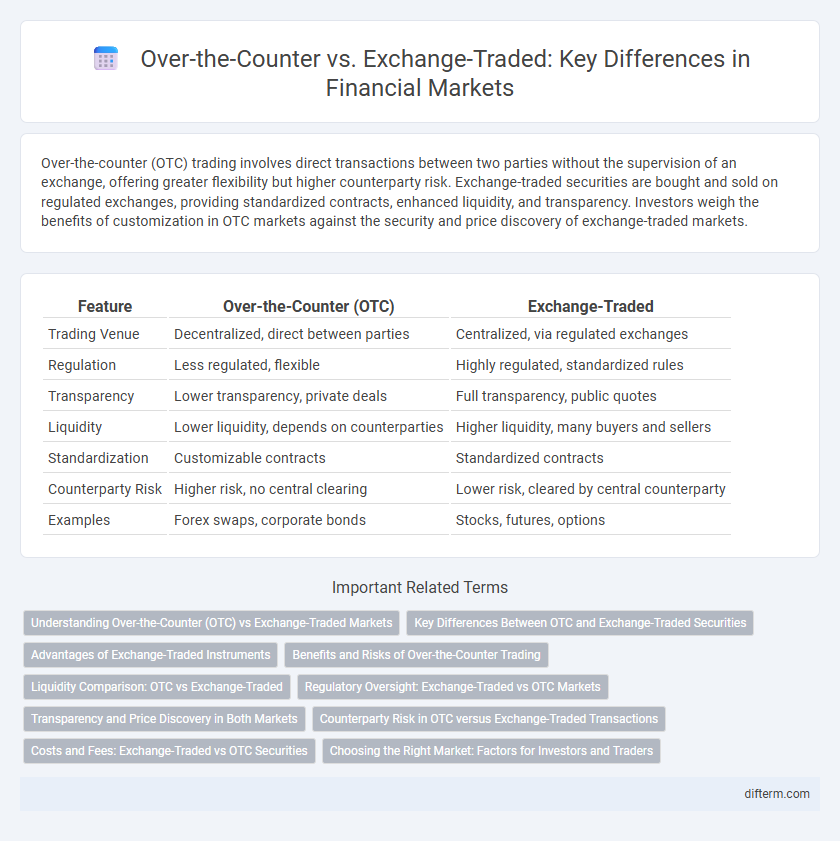

Over-the-counter (OTC) trading involves direct transactions between two parties without the supervision of an exchange, offering greater flexibility but higher counterparty risk. Exchange-traded securities are bought and sold on regulated exchanges, providing standardized contracts, enhanced liquidity, and transparency. Investors weigh the benefits of customization in OTC markets against the security and price discovery of exchange-traded markets.

Table of Comparison

| Feature | Over-the-Counter (OTC) | Exchange-Traded |

|---|---|---|

| Trading Venue | Decentralized, direct between parties | Centralized, via regulated exchanges |

| Regulation | Less regulated, flexible | Highly regulated, standardized rules |

| Transparency | Lower transparency, private deals | Full transparency, public quotes |

| Liquidity | Lower liquidity, depends on counterparties | Higher liquidity, many buyers and sellers |

| Standardization | Customizable contracts | Standardized contracts |

| Counterparty Risk | Higher risk, no central clearing | Lower risk, cleared by central counterparty |

| Examples | Forex swaps, corporate bonds | Stocks, futures, options |

Understanding Over-the-Counter (OTC) vs Exchange-Traded Markets

Over-the-counter (OTC) markets facilitate direct trading between parties without a centralized exchange, offering greater flexibility and access to a wider range of securities such as derivatives and bonds. Exchange-traded markets operate through regulated exchanges like the NYSE or NASDAQ, providing transparency, standardized contracts, and enhanced liquidity. Understanding these distinctions helps investors assess risk, pricing accuracy, and regulatory protections when selecting trading venues.

Key Differences Between OTC and Exchange-Traded Securities

Over-the-counter (OTC) securities are traded directly between parties without a centralized exchange, resulting in less transparency and higher counterparty risk compared to exchange-traded securities, which are listed and regulated on formal exchanges like the NYSE or NASDAQ. Exchange-traded securities benefit from standardized contracts, stricter regulatory oversight, and greater liquidity, enabling easier price discovery and lower transaction costs. OTC markets primarily facilitate trading in less liquid, customized instruments such as certain derivatives and bonds, whereas exchange-traded markets focus on equities, standardized derivatives, and highly liquid instruments.

Advantages of Exchange-Traded Instruments

Exchange-traded instruments provide enhanced transparency due to standardized contracts and centralized trading venues, allowing real-time price discovery and reduced counterparty risk through clearinghouses. These instruments offer greater liquidity, facilitating easier entry and exit for investors compared to over-the-counter (OTC) markets. Regulatory oversight of exchange-traded products ensures investor protection and market integrity, making them more reliable for risk management and speculative purposes.

Benefits and Risks of Over-the-Counter Trading

Over-the-counter (OTC) trading offers greater flexibility by allowing customized contracts and direct negotiation between parties, which is ideal for illiquid or niche markets. However, OTC transactions carry higher counterparty risk due to the lack of centralized clearinghouses and regulatory oversight compared to exchange-traded markets. Participants must carefully assess credit risk and transparency challenges when engaging in OTC trading to mitigate potential financial exposure.

Liquidity Comparison: OTC vs Exchange-Traded

Over-the-counter (OTC) markets generally exhibit lower liquidity compared to exchange-traded markets due to the decentralized and less regulated nature of OTC transactions. Exchange-traded markets benefit from centralized order books, standardized contracts, and higher transparency, which attract more participants and increase trading volume. This enhanced liquidity in exchange-traded instruments reduces bid-ask spreads and facilitates faster execution.

Regulatory Oversight: Exchange-Traded vs OTC Markets

Exchange-traded markets operate under stringent regulatory oversight by entities such as the SEC and CFTC, ensuring transparency, standardized contracts, and investor protection. Over-the-counter (OTC) markets face less direct regulation, resulting in greater counterparty risk and less transparent pricing. This regulatory divergence significantly impacts liquidity, market efficiency, and risk management strategies across both trading environments.

Transparency and Price Discovery in Both Markets

Over-the-counter (OTC) markets exhibit lower transparency due to decentralized trading and limited regulatory oversight, leading to less efficient price discovery compared to exchange-traded markets. Exchange-traded markets provide centralized price quotes and standardized contracts, enhancing transparency and facilitating more accurate and timely price discovery. The increased visibility of real-time transactions and regulatory reporting in exchange-traded venues supports better market integrity and investor confidence.

Counterparty Risk in OTC versus Exchange-Traded Transactions

Over-the-counter (OTC) transactions carry higher counterparty risk due to the absence of a centralized clearinghouse, relying directly on the creditworthiness of the trading parties. Exchange-traded transactions mitigate counterparty risk through standardized contracts and guarantee mechanisms provided by clearinghouses, ensuring settlement even if one party defaults. This structural difference makes exchange-traded instruments more secure and transparent compared to OTC deals, which require rigorous credit risk assessment and collateral management.

Costs and Fees: Exchange-Traded vs OTC Securities

Exchange-traded securities typically involve lower transaction costs and standardized fees due to regulated market infrastructure, enhancing transparency and liquidity. Over-the-counter (OTC) securities often incur higher fees, including wider bid-ask spreads and counterparty risk premiums, as trades are negotiated privately without a centralized exchange. The cost efficiency of exchange-traded products appeals to retail investors, while OTC instruments offer customization at the expense of elevated transaction expenses.

Choosing the Right Market: Factors for Investors and Traders

Investors and traders evaluate liquidity, transparency, and regulatory oversight when choosing between over-the-counter (OTC) and exchange-traded markets. OTC markets offer customized contracts and decentralized trading but carry higher counterparty risk and lower liquidity compared to the standardized, regulated environment of exchange-traded platforms. Assessing factors such as risk tolerance, asset type, and desired market access helps determine the most suitable trading venue.

Over-the-counter vs Exchange-traded Infographic

difterm.com

difterm.com