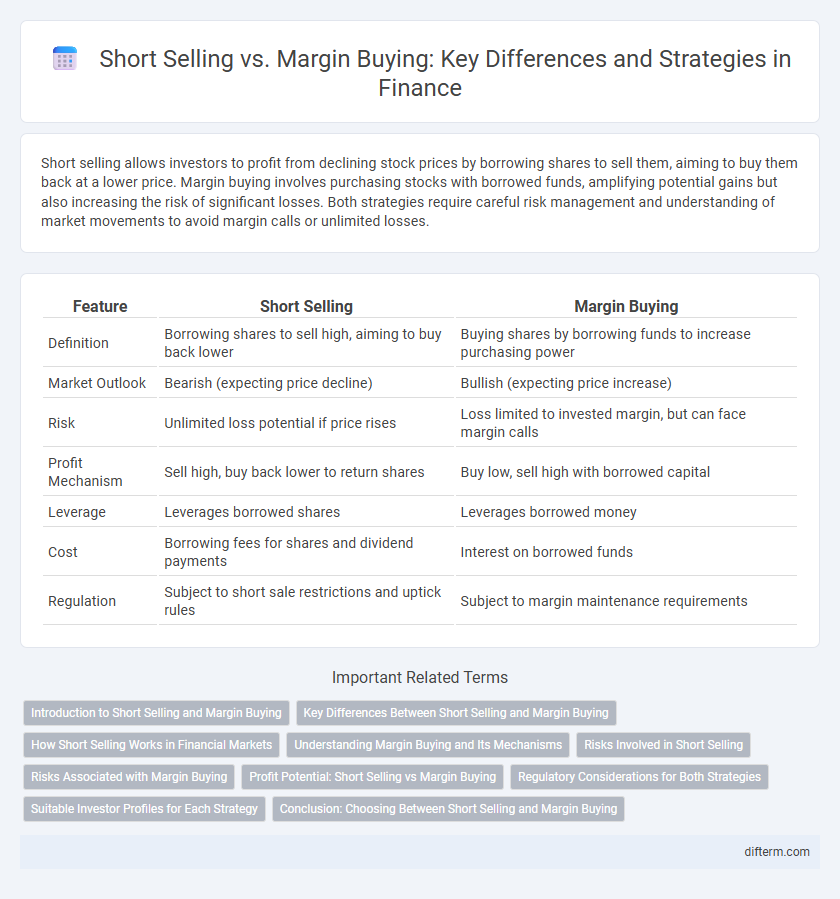

Short selling allows investors to profit from declining stock prices by borrowing shares to sell them, aiming to buy them back at a lower price. Margin buying involves purchasing stocks with borrowed funds, amplifying potential gains but also increasing the risk of significant losses. Both strategies require careful risk management and understanding of market movements to avoid margin calls or unlimited losses.

Table of Comparison

| Feature | Short Selling | Margin Buying |

|---|---|---|

| Definition | Borrowing shares to sell high, aiming to buy back lower | Buying shares by borrowing funds to increase purchasing power |

| Market Outlook | Bearish (expecting price decline) | Bullish (expecting price increase) |

| Risk | Unlimited loss potential if price rises | Loss limited to invested margin, but can face margin calls |

| Profit Mechanism | Sell high, buy back lower to return shares | Buy low, sell high with borrowed capital |

| Leverage | Leverages borrowed shares | Leverages borrowed money |

| Cost | Borrowing fees for shares and dividend payments | Interest on borrowed funds |

| Regulation | Subject to short sale restrictions and uptick rules | Subject to margin maintenance requirements |

Introduction to Short Selling and Margin Buying

Short selling involves borrowing shares to sell them at the current price, aiming to buy them back later at a lower price to profit from a decline in the stock's value. Margin buying allows investors to purchase stocks using borrowed funds from a broker, amplifying potential gains but also increasing risk exposure. Both strategies require understanding leverage, market volatility, and the risks of enhanced losses in highly dynamic financial markets.

Key Differences Between Short Selling and Margin Buying

Short selling involves borrowing shares to sell them at a high price with the intention of buying them back at a lower price to profit from a decline in stock value, while margin buying entails borrowing funds to purchase shares, aiming to profit from an anticipated price increase. Risk exposure differs significantly; short selling carries potentially unlimited losses if the stock price rises, whereas margin buying risk is limited to the invested amount plus interest on borrowed funds. Regulatory requirements also vary, with short selling often subject to stricter rules such as uptick restrictions, while margin buying requires maintaining a minimum equity level in the brokerage account.

How Short Selling Works in Financial Markets

Short selling involves borrowing shares from a broker to sell them at the current market price, aiming to repurchase them later at a lower price and return them to the lender, profiting from the price difference. This strategy relies on anticipating a decline in the stock's value, making it a high-risk maneuver if the price rises instead. Margin requirements and interest on borrowed shares make short selling costlier compared to margin buying, which involves purchasing securities using borrowed funds expecting asset appreciation.

Understanding Margin Buying and Its Mechanisms

Margin buying involves borrowing funds from a broker to purchase securities, amplifying buying power beyond available capital. Investors must maintain a minimum margin requirement, typically set by regulatory bodies like FINRA, to avoid margin calls that demand additional funds or liquidation. This leveraging mechanism increases both potential gains and risks, as losses are magnified if the market moves against the investor's position.

Risks Involved in Short Selling

Short selling involves significant risks such as unlimited loss potential since a stock's price can rise indefinitely, making it more dangerous compared to margin buying where losses are limited to the invested amount plus interest. Borrowing shares to sell short exposes investors to margin calls and forced buy-ins if the stock price increases sharply, leading to substantial financial strain. Market volatility and short squeezes can rapidly escalate losses, highlighting the importance of risk management strategies in short selling.

Risks Associated with Margin Buying

Margin buying involves borrowing funds from a broker to purchase securities, which amplifies potential gains but also increases financial risk. The primary risk associated with margin buying is the possibility of a margin call, requiring investors to deposit additional funds or sell assets when the value of borrowed securities declines. This can lead to substantial losses that exceed the initial investment, exposing investors to amplified market volatility and interest costs on borrowed funds.

Profit Potential: Short Selling vs Margin Buying

Short selling and margin buying both leverage financial instruments to amplify profit potential, but their mechanisms differ significantly. Short selling profits from a decline in asset prices by borrowing shares to sell high and repurchasing them at lower prices, while margin buying aims to gain from asset price appreciation by borrowing funds to purchase more shares than the available capital. The risk in short selling includes unlimited losses if prices rise, whereas margin buying risk includes margin calls and forced liquidation if prices fall, influencing the overall profit potential and risk profile for investors.

Regulatory Considerations for Both Strategies

Regulatory considerations for short selling include strict rules on borrowing shares, mandatory disclosure of short positions, and compliance with the SEC's Regulation SHO to prevent naked short selling. Margin buying is regulated through maintenance margin requirements set by FINRA and the Federal Reserve Board's Regulation T, which governs the minimum initial margin and margin calls to manage credit risk. Both strategies require robust risk management frameworks to adhere to compliance standards and mitigate potential market manipulation or excessive leverage.

Suitable Investor Profiles for Each Strategy

Short selling suits experienced investors with high risk tolerance who anticipate a stock's decline and can manage potential unlimited losses. Margin buying is appropriate for investors seeking leverage to amplify gains while having moderate risk tolerance and sufficient capital to meet margin calls. Both strategies require a strong understanding of market dynamics, risk management, and access to margin accounts.

Conclusion: Choosing Between Short Selling and Margin Buying

Selecting between short selling and margin buying depends on your market outlook and risk tolerance; short selling profits from falling prices while margin buying benefits from rising prices. Both strategies involve borrowing and carry significant risks, including potential losses exceeding the initial investment. Investors should assess market conditions, leverage limits, and personal risk appetite before choosing the optimal approach for maximizing returns.

Short Selling vs Margin Buying Infographic

difterm.com

difterm.com