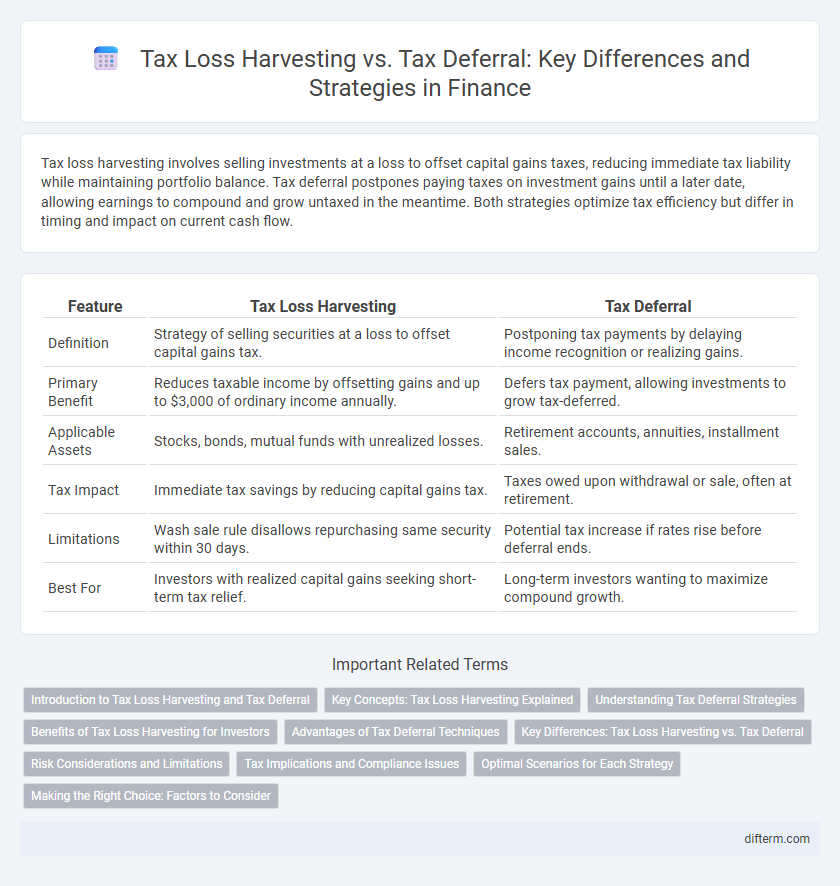

Tax loss harvesting involves selling investments at a loss to offset capital gains taxes, reducing immediate tax liability while maintaining portfolio balance. Tax deferral postpones paying taxes on investment gains until a later date, allowing earnings to compound and grow untaxed in the meantime. Both strategies optimize tax efficiency but differ in timing and impact on current cash flow.

Table of Comparison

| Feature | Tax Loss Harvesting | Tax Deferral |

|---|---|---|

| Definition | Strategy of selling securities at a loss to offset capital gains tax. | Postponing tax payments by delaying income recognition or realizing gains. |

| Primary Benefit | Reduces taxable income by offsetting gains and up to $3,000 of ordinary income annually. | Defers tax payment, allowing investments to grow tax-deferred. |

| Applicable Assets | Stocks, bonds, mutual funds with unrealized losses. | Retirement accounts, annuities, installment sales. |

| Tax Impact | Immediate tax savings by reducing capital gains tax. | Taxes owed upon withdrawal or sale, often at retirement. |

| Limitations | Wash sale rule disallows repurchasing same security within 30 days. | Potential tax increase if rates rise before deferral ends. |

| Best For | Investors with realized capital gains seeking short-term tax relief. | Long-term investors wanting to maximize compound growth. |

Introduction to Tax Loss Harvesting and Tax Deferral

Tax loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce taxable income, enhancing after-tax returns. Tax deferral postpones tax payments on investment income or gains to a future date, such as through retirement accounts like IRAs or 401(k)s, allowing investments to grow tax-deferred. Both strategies optimize tax efficiency, but tax loss harvesting focuses on current tax-year benefits, while tax deferral emphasizes long-term growth potential.

Key Concepts: Tax Loss Harvesting Explained

Tax loss harvesting involves selling securities at a loss to offset capital gains taxes on other investments, effectively reducing taxable income. This strategy contrasts with tax deferral, which postpones tax payments by holding onto investments longer, allowing gains to grow tax-deferred until sale. Understanding the distinct mechanisms helps investors optimize after-tax returns by strategically realizing losses versus delaying taxable events.

Understanding Tax Deferral Strategies

Tax deferral strategies enable investors to postpone paying taxes on investment gains until a later date, often allowing their assets to grow tax-deferred in accounts like 401(k)s or IRAs. Unlike tax loss harvesting, which offsets gains with realized losses to reduce current tax liability, tax deferral focuses on timing the recognition of income to optimize tax efficiency. Understanding these strategies helps investors manage cash flow and maximize after-tax returns over the long term.

Benefits of Tax Loss Harvesting for Investors

Tax loss harvesting allows investors to offset capital gains with realized losses, significantly reducing taxable income and enhancing after-tax returns. This strategy provides immediate tax benefits by lowering current tax liabilities while maintaining portfolio exposure through reinvestment. Unlike tax deferral, which postpones taxes until asset disposition, tax loss harvesting actively manages tax burdens within the tax year, improving overall tax efficiency.

Advantages of Tax Deferral Techniques

Tax deferral techniques allow investors to postpone tax payments on gains, enabling the growth of investments on a tax-deferred basis and maximizing compound returns. By deferring taxes, individuals can potentially lower their current tax bracket and strategically manage income recognition over time, improving cash flow and investment flexibility. Utilizing tax deferral methods, such as retirement accounts and annuities, helps optimize long-term wealth accumulation compared to immediate tax liabilities from tax loss harvesting.

Key Differences: Tax Loss Harvesting vs. Tax Deferral

Tax loss harvesting involves selling investments at a loss to offset taxable gains, reducing immediate tax liability, while tax deferral postpones tax payments by delaying the recognition of income or gains until a later date. Tax loss harvesting actively utilizes capital losses to minimize taxes within the current tax year, whereas tax deferral allows investors to retain assets and benefit from compounded growth before taxes are due. Key differences include the timing of tax relief and the strategy's impact on portfolio management and cash flow.

Risk Considerations and Limitations

Tax loss harvesting carries the risk of wash sale violations, which can disallow the claimed losses if identical securities are repurchased within 30 days, limiting its effectiveness. Tax deferral strategies may increase exposure to market volatility and timing risk, potentially delaying tax liabilities but not eliminating them. Both approaches require careful assessment of individual tax brackets, investment horizons, and regulatory constraints to optimize long-term after-tax returns.

Tax Implications and Compliance Issues

Tax loss harvesting involves selling securities at a loss to offset capital gains taxes, which can reduce current tax liability but requires strict adherence to IRS wash-sale rules to avoid disallowed losses. Tax deferral postpones tax payments on investment gains, typically through retirement accounts like 401(k)s or IRAs, but subjects withdrawals to ordinary income tax rates and potential penalties if taken early. Both strategies demand meticulous record-keeping and compliance with tax regulations to optimize benefits and prevent audits or penalties.

Optimal Scenarios for Each Strategy

Tax loss harvesting is most beneficial in scenarios where investors have realized capital gains and seek to offset those gains by selling underperforming assets, thereby minimizing immediate tax liability. Tax deferral proves optimal when investors aim to postpone tax payments on income or gains, typically through retirement accounts or structured investment plans, to leverage compounding growth and potentially benefit from lower tax rates in the future. Investors should evaluate their current tax brackets, investment horizon, and the timing of asset liquidation to determine the most effective strategy for maximizing after-tax returns.

Making the Right Choice: Factors to Consider

Tax loss harvesting involves selling securities at a loss to offset taxable gains, reducing current tax liabilities, while tax deferral postpones tax payments by delaying income recognition or accelerating deductions. Key factors in making the right choice include your current and projected tax brackets, liquidity needs, and investment goals, as well as the timing of gains and losses within your portfolio. Evaluating these elements helps optimize tax efficiency and long-term wealth accumulation strategies.

Tax loss harvesting vs Tax deferral Infographic

difterm.com

difterm.com