Negative convexity occurs when bond prices increase at a decreasing rate as yields fall, often seen in callable bonds where issuers may redeem bonds early. Positive convexity describes bonds whose prices increase at an accelerating rate as yields decline, typical of traditional fixed-rate bonds without embedded options. Understanding the impact of convexity on bond price sensitivity helps investors manage interest rate risk and portfolio duration more effectively.

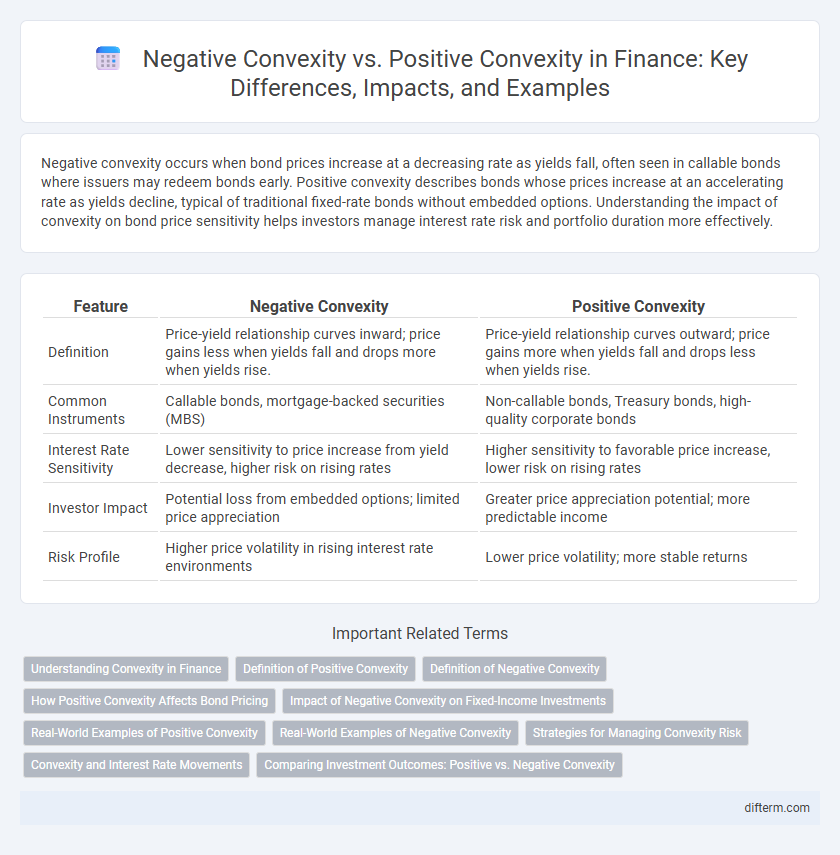

Table of Comparison

| Feature | Negative Convexity | Positive Convexity |

|---|---|---|

| Definition | Price-yield relationship curves inward; price gains less when yields fall and drops more when yields rise. | Price-yield relationship curves outward; price gains more when yields fall and drops less when yields rise. |

| Common Instruments | Callable bonds, mortgage-backed securities (MBS) | Non-callable bonds, Treasury bonds, high-quality corporate bonds |

| Interest Rate Sensitivity | Lower sensitivity to price increase from yield decrease, higher risk on rising rates | Higher sensitivity to favorable price increase, lower risk on rising rates |

| Investor Impact | Potential loss from embedded options; limited price appreciation | Greater price appreciation potential; more predictable income |

| Risk Profile | Higher price volatility in rising interest rate environments | Lower price volatility; more stable returns |

Understanding Convexity in Finance

Convexity in finance measures the sensitivity of a bond's duration to changes in interest rates, influencing price volatility and risk assessment. Negative convexity occurs when bond prices increase at a decreasing rate as yields fall, common in callable bonds, leading to higher reinvestment risk. Positive convexity characterizes most plain vanilla bonds, where prices increase at an increasing rate as yields drop, providing investors with greater price appreciation potential during declining interest rates.

Definition of Positive Convexity

Positive convexity refers to the characteristic of a bond or fixed-income instrument where its price increases at an accelerating rate as interest rates decline, enhancing price appreciation in a falling rate environment. This feature is typical of traditional fixed-rate bonds and is highly valued because it results in less price volatility and greater potential gains compared to bonds with negative convexity. Investors prioritize positive convexity for its favorable impact on portfolio risk management and return optimization amidst fluctuating interest rates.

Definition of Negative Convexity

Negative convexity refers to a bond's price behavior where the duration increases as yields rise, causing price decreases to accelerate during interest rate hikes. This phenomenon is common in callable bonds and mortgage-backed securities, where the embedded option limits price appreciation when rates fall. Investors facing negative convexity experience higher interest rate risk and potential reinvestment risk compared to those holding bonds with positive convexity.

How Positive Convexity Affects Bond Pricing

Positive convexity causes bond prices to increase at an accelerating rate as interest rates decline, enhancing potential capital gains for investors. This characteristic reduces the price risk of bonds because the price appreciation when yields fall is greater than the price depreciation when yields rise by the same amount. Bonds with positive convexity, such as most government and high-quality corporate bonds, tend to be more attractive to investors due to their favorable risk-return profile in volatile interest rate environments.

Impact of Negative Convexity on Fixed-Income Investments

Negative convexity in fixed-income investments causes bond prices to increase less when interest rates fall and decrease more when rates rise, leading to higher interest rate risk for investors. Mortgage-backed securities often exhibit negative convexity due to prepayment risk, which can reduce expected returns during declining rate environments. This risk compels investors to demand higher yields to compensate for potential price declines and reinvestment rate uncertainty.

Real-World Examples of Positive Convexity

Mortgage-backed securities (MBS) often exhibit positive convexity when interest rates decline and prepayment speeds accelerate, allowing investors to benefit from higher price appreciation. Treasury bonds provide a clear example of positive convexity as their prices increase at an increasing rate when yields fall, reflecting lower interest rate risk. Corporate bonds with call protection also demonstrate positive convexity, maintaining price sensitivity that favors holders during market stress.

Real-World Examples of Negative Convexity

Negative convexity commonly occurs in mortgage-backed securities (MBS), where prepayment risk causes price appreciation to be limited as interest rates fall. Callable bonds also exhibit negative convexity since issuers tend to call the bonds when rates decline, capping price gains for investors. In contrast, traditional government bonds showcase positive convexity, increasing in value more at a decreasing rate as yields drop.

Strategies for Managing Convexity Risk

Managing convexity risk requires strategies tailored to the specific characteristics of negative and positive convexity. For negative convexity, investors often use hedging approaches such as interest rate swaps or options to mitigate price sensitivity and extension risk in callable bonds. In contrast, positive convexity can be leveraged by increasing exposure to duration, enhancing portfolio sensitivity to interest rate declines while benefiting from price appreciation during rate drops.

Convexity and Interest Rate Movements

Convexity measures the sensitivity of a bond's duration to changes in interest rates, with positive convexity indicating that bond prices rise more when interest rates fall than they fall when rates rise. Negative convexity occurs in bonds like mortgage-backed securities, where price increases slow down as interest rates drop, due to prepayment risks. Understanding convexity enables investors to better assess interest rate risk and price volatility in fixed income portfolios.

Comparing Investment Outcomes: Positive vs. Negative Convexity

Positive convexity in bond investments generally leads to higher price appreciation when interest rates fall and smaller price declines when rates rise, enhancing total returns. Negative convexity, often found in mortgage-backed securities, causes prices to increase less during declining rates and fall more sharply when rates rise, introducing reinvestment risks and limiting upside potential. Comparing these outcomes, positive convexity offers more stable and favorable risk-adjusted returns, while negative convexity requires careful management to mitigate potential losses during interest rate fluctuations.

Negative Convexity vs Positive Convexity Infographic

difterm.com

difterm.com