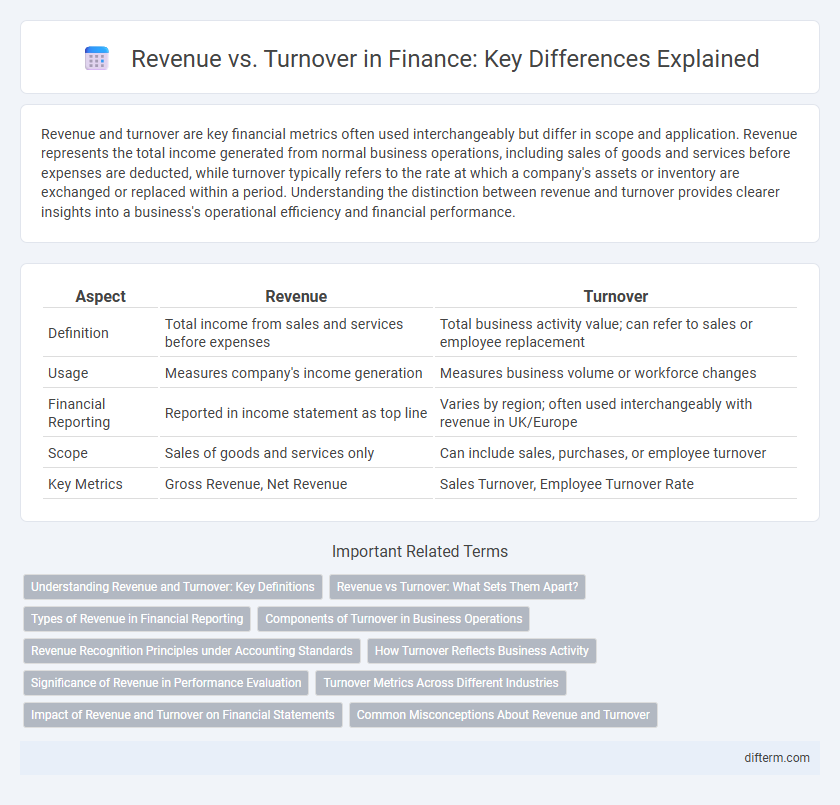

Revenue and turnover are key financial metrics often used interchangeably but differ in scope and application. Revenue represents the total income generated from normal business operations, including sales of goods and services before expenses are deducted, while turnover typically refers to the rate at which a company's assets or inventory are exchanged or replaced within a period. Understanding the distinction between revenue and turnover provides clearer insights into a business's operational efficiency and financial performance.

Table of Comparison

| Aspect | Revenue | Turnover |

|---|---|---|

| Definition | Total income from sales and services before expenses | Total business activity value; can refer to sales or employee replacement |

| Usage | Measures company's income generation | Measures business volume or workforce changes |

| Financial Reporting | Reported in income statement as top line | Varies by region; often used interchangeably with revenue in UK/Europe |

| Scope | Sales of goods and services only | Can include sales, purchases, or employee turnover |

| Key Metrics | Gross Revenue, Net Revenue | Sales Turnover, Employee Turnover Rate |

Understanding Revenue and Turnover: Key Definitions

Revenue represents the total income generated by a company from its core business activities before any expenses are deducted, reflecting overall business performance. Turnover typically refers to the total sales or the amount of goods or services sold within a specific period and can sometimes encompass other business activities depending on the industry. Understanding these key definitions helps financial analysts and stakeholders assess company health and make more accurate financial comparisons.

Revenue vs Turnover: What Sets Them Apart?

Revenue represents the total income generated from a company's core business activities before any expenses are deducted, while turnover often refers to the total sales or the rate at which assets or inventory are replaced within a period. In financial analysis, revenue provides insight into overall business performance, whereas turnover can indicate operational efficiency and asset management. Clear differentiation between revenue and turnover is crucial for accurate financial reporting and strategic decision-making in corporate finance.

Types of Revenue in Financial Reporting

Revenue in financial reporting encompasses various types, including operating revenue derived from core business activities such as sales of goods or services, non-operating revenue from secondary sources like interest or rental income, and recognized revenue from contractual agreements or accrued earnings. Turnover typically refers to the total sales generated within a specific period, often used interchangeably with revenue but mainly emphasizing sales volume rather than all income streams. Understanding the distinction between revenue types aids in accurate financial analysis and performance measurement, highlighting the diverse income components that contribute to a company's financial health.

Components of Turnover in Business Operations

Turnover in business operations primarily includes total sales revenue from goods and services before deducting any expenses. It encompasses components such as net sales, income from secondary business activities, and any other revenue streams tied directly to core business functions. Understanding these components is essential for accurate financial analysis and assessing operational efficiency.

Revenue Recognition Principles under Accounting Standards

Revenue recognition principles under accounting standards determine when and how revenue is recorded in financial statements, distinguishing it clearly from turnover, which generally refers to the total sales generated by a business. Revenue must be recognized when it is earned and realizable, following criteria set by standards such as IFRS 15 or ASC 606, ensuring accurate financial reporting and compliance. This process includes identifying contracts, performance obligations, transaction prices, and allocating revenue appropriately over time or at a point when control transfers to the customer.

How Turnover Reflects Business Activity

Turnover represents the total sales generated by a business within a specific period, providing a clear indicator of the company's operational scale and market demand. Unlike revenue, which may include other income streams such as interest or investments, turnover strictly measures the core business transactions. High turnover signifies robust business activity and efficient sales performance, making it a key metric for assessing overall business health.

Significance of Revenue in Performance Evaluation

Revenue represents the total income generated from core business operations, serving as a critical indicator of company performance and market demand. Unlike turnover, which can refer to asset or inventory turnover rates, revenue directly impacts profitability assessments and investment decisions. By analyzing revenue growth trends, stakeholders can better evaluate operational efficiency and the sustainability of business models.

Turnover Metrics Across Different Industries

Turnover metrics vary significantly across industries, reflecting diverse operational scales and revenue cycles. For example, retail companies often report high turnover due to rapid inventory sales, whereas industries like real estate exhibit lower turnover but higher revenue per transaction. Understanding industry-specific turnover metrics aids investors in benchmarking financial performance and operational efficiency accurately.

Impact of Revenue and Turnover on Financial Statements

Revenue represents the total income generated from core business operations, directly influencing the income statement by driving net profit and affecting earnings per share. Turnover, often synonymous with revenue but sometimes referring to asset turnover, impacts financial ratios such as return on assets and operational efficiency measures on the balance sheet. Understanding the distinctions between revenue and turnover is crucial for accurate financial analysis and forecasting, as both metrics shape investors' perceptions and strategic decision-making.

Common Misconceptions About Revenue and Turnover

Revenue and turnover are often mistakenly used interchangeably, but revenue refers specifically to the total income generated from sales of goods or services before any expenses, while turnover can mean the total volume of sales or the rate at which assets or inventory are replaced. A common misconception is that high turnover automatically indicates high revenue, but businesses can have high turnover with low-profit margins or vice versa. Understanding the distinction is critical for accurate financial analysis and effective decision-making in finance.

Revenue vs Turnover Infographic

difterm.com

difterm.com