Liquidity risk refers to the potential difficulty a financial institution or investor may face in quickly converting assets into cash without significant loss, impacting short-term financial stability. Credit risk involves the possibility that a borrower will default on loan obligations, leading to financial losses for lenders or investors. Both risks critically affect portfolio management, requiring distinct strategies to mitigate potential adverse outcomes.

Table of Comparison

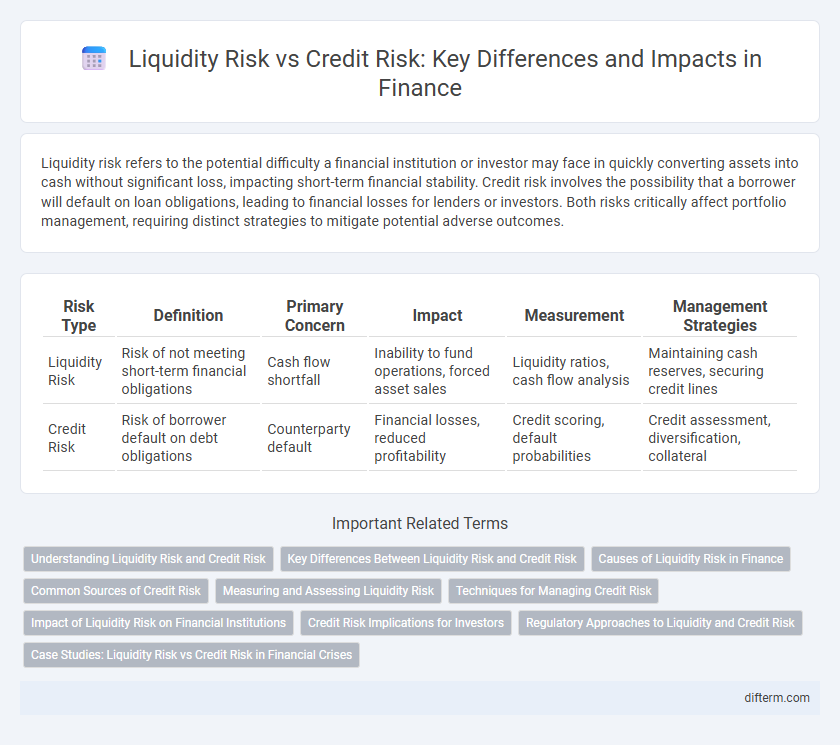

| Risk Type | Definition | Primary Concern | Impact | Measurement | Management Strategies |

|---|---|---|---|---|---|

| Liquidity Risk | Risk of not meeting short-term financial obligations | Cash flow shortfall | Inability to fund operations, forced asset sales | Liquidity ratios, cash flow analysis | Maintaining cash reserves, securing credit lines |

| Credit Risk | Risk of borrower default on debt obligations | Counterparty default | Financial losses, reduced profitability | Credit scoring, default probabilities | Credit assessment, diversification, collateral |

Understanding Liquidity Risk and Credit Risk

Liquidity risk arises when an institution cannot meet its short-term financial obligations due to an inability to convert assets into cash quickly without significant loss. Credit risk involves the potential that a borrower or counterparty will fail to fulfill their financial obligations, resulting in financial loss. Effective risk management requires distinguishing these risks to safeguard cash flow stability and maintain credit quality, ensuring overall financial health.

Key Differences Between Liquidity Risk and Credit Risk

Liquidity risk refers to the potential inability of an entity to meet its short-term financial obligations due to insufficient cash flow or assets that cannot be quickly converted to cash. Credit risk involves the likelihood that a borrower will fail to repay a loan or meet contractual debt obligations, affecting the lender's expected returns. While liquidity risk emphasizes cash flow timing and asset convertibility, credit risk centers on counterparty default and the creditworthiness of borrowers.

Causes of Liquidity Risk in Finance

Liquidity risk in finance primarily arises from an institution's inability to meet short-term financial obligations due to asset illiquidity or unexpected cash outflows. Significant causes include sudden market disruptions, withdrawal surges by depositors or creditors, and a mismatch between the maturity profiles of assets and liabilities. Poor cash flow management and overreliance on short-term funding channels exacerbate the vulnerability to liquidity risk.

Common Sources of Credit Risk

Common sources of credit risk include borrower default, deteriorating credit quality, and economic downturns that impact repayment capabilities. Corporate lending, sovereign debt exposures, and counterparty credit agreements are primary areas where credit risk manifests. Liquidity risk focuses on the inability to meet short-term obligations, while credit risk centers on the probability of loss due to counterparty failure.

Measuring and Assessing Liquidity Risk

Measuring liquidity risk involves analyzing key indicators such as the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) to ensure sufficient short-term assets cover potential cash outflows. Stress testing scenarios simulate sudden withdrawals or market disruptions, revealing vulnerabilities in a firm's liquidity position. Unlike credit risk assessment, which evaluates borrower default probability, liquidity risk measurement emphasizes cash flow timing and market liquidity conditions.

Techniques for Managing Credit Risk

Techniques for managing credit risk include thorough credit assessments, setting credit limits, and continuous monitoring of counterparties' financial health. Use of credit derivatives such as credit default swaps (CDS) helps transfer risk exposure, while collateralization mitigates potential losses. Diversification of credit portfolios and stress testing further enhance a firm's ability to withstand adverse credit events.

Impact of Liquidity Risk on Financial Institutions

Liquidity risk significantly affects financial institutions by limiting their ability to meet short-term obligations without incurring substantial losses. This constraint can lead to forced asset sales at depressed prices, amplifying financial instability and eroding capital reserves. Unlike credit risk, which involves borrower default potential, liquidity risk directly impacts an institution's operational continuity and market confidence.

Credit Risk Implications for Investors

Credit risk directly impacts investors by increasing the probability of default and potential loss on debt securities, affecting portfolio returns and valuation models. Investors must analyze credit ratings, default probabilities, and recovery rates to manage exposure and optimize risk-adjusted returns. Effective credit risk assessment enhances decision-making in bond selection, pricing, and diversification strategies.

Regulatory Approaches to Liquidity and Credit Risk

Regulatory approaches to liquidity risk emphasize maintaining adequate liquid assets and stress testing to ensure institutions can withstand short-term cash flow disruptions, as outlined in Basel III liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) frameworks. Credit risk regulation prioritizes capital adequacy requirements and robust credit risk assessment models to mitigate potential loan defaults, with guidelines set by Basel II's standardized and internal ratings-based approaches. Both regulatory frameworks aim to promote financial stability but address distinct vulnerabilities by enforcing liquidity buffers and capital reserves tailored to liquidity and credit exposures.

Case Studies: Liquidity Risk vs Credit Risk in Financial Crises

Case studies from the 2008 global financial crisis reveal that liquidity risk, characterized by the inability to meet short-term obligations, often precipitated rapid bank failures, while credit risk, involving borrower defaults, contributed to long-term systemic instability. Institutions like Lehman Brothers collapsed primarily due to acute liquidity shortages despite holding substantial assets, highlighting the critical role of liquidity management. In contrast, the Eurozone debt crisis exemplified credit risk materializing through sovereign defaults, which strained banking systems and exacerbated economic downturns.

liquidity risk vs credit risk Infographic

difterm.com

difterm.com