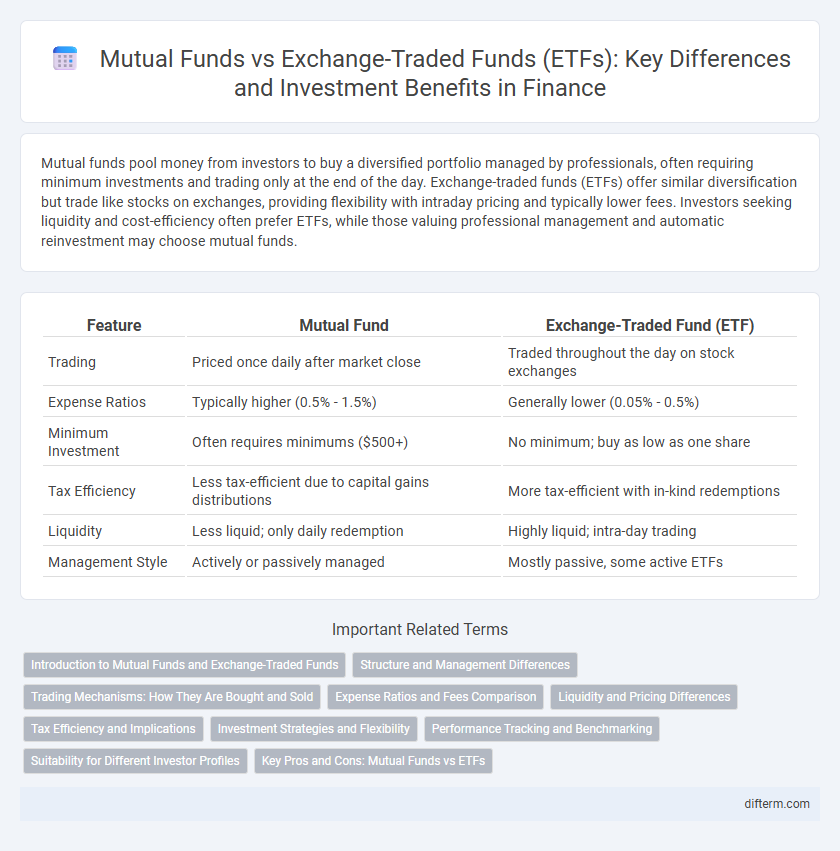

Mutual funds pool money from investors to buy a diversified portfolio managed by professionals, often requiring minimum investments and trading only at the end of the day. Exchange-traded funds (ETFs) offer similar diversification but trade like stocks on exchanges, providing flexibility with intraday pricing and typically lower fees. Investors seeking liquidity and cost-efficiency often prefer ETFs, while those valuing professional management and automatic reinvestment may choose mutual funds.

Table of Comparison

| Feature | Mutual Fund | Exchange-Traded Fund (ETF) |

|---|---|---|

| Trading | Priced once daily after market close | Traded throughout the day on stock exchanges |

| Expense Ratios | Typically higher (0.5% - 1.5%) | Generally lower (0.05% - 0.5%) |

| Minimum Investment | Often requires minimums ($500+) | No minimum; buy as low as one share |

| Tax Efficiency | Less tax-efficient due to capital gains distributions | More tax-efficient with in-kind redemptions |

| Liquidity | Less liquid; only daily redemption | Highly liquid; intra-day trading |

| Management Style | Actively or passively managed | Mostly passive, some active ETFs |

Introduction to Mutual Funds and Exchange-Traded Funds

Mutual funds pool capital from multiple investors to invest in a diversified portfolio managed by professional fund managers, offering accessible diversification and liquidity. Exchange-traded funds (ETFs) trade on stock exchanges like individual stocks, providing real-time pricing and often lower expense ratios compared to mutual funds. Both investment vehicles allow exposure to various asset classes, but ETFs offer greater flexibility with intraday trading and typically lower minimum investments.

Structure and Management Differences

Mutual funds are actively managed by professional portfolio managers who make daily decisions to buy or sell assets based on the fund's objectives, while exchange-traded funds (ETFs) often rely on passive management strategies that track specific indices. Mutual funds operate with a net asset value (NAV) priced once at the end of each trading day, whereas ETFs trade on stock exchanges throughout the day at market-driven prices. The structural difference also lies in how shares are created and redeemed: mutual funds issue and redeem shares directly with investors, contrasting with ETFs' creation and redemption process involving authorized participants to maintain liquidity and price alignment.

Trading Mechanisms: How They Are Bought and Sold

Mutual funds are bought and sold at the end of the trading day at the net asset value (NAV) price, reflecting the total value of the fund's assets minus liabilities. Exchange-traded funds (ETFs) trade throughout the day on stock exchanges at market prices, allowing investors to buy or sell shares at any time during trading hours. The real-time pricing of ETFs offers greater flexibility and liquidity compared to mutual funds' once-daily transaction process.

Expense Ratios and Fees Comparison

Mutual funds typically have higher expense ratios, averaging around 0.85%, due to active management and administrative costs, whereas exchange-traded funds (ETFs) often feature lower expense ratios, averaging 0.45%, benefiting from passive management and streamlined trading structures. Mutual funds may also incur sales loads and redemption fees, while ETFs generally avoid these costs, trading like stocks on an exchange with brokerage commissions that can be minimized via commission-free platforms. Expense ratio differences significantly impact long-term investment returns, making ETFs a cost-effective option for fee-sensitive investors seeking tax efficiency and liquidity.

Liquidity and Pricing Differences

Mutual funds are priced once daily after market close based on net asset value (NAV), limiting liquidity to end-of-day transactions, while exchange-traded funds (ETFs) trade throughout the day on stock exchanges with real-time pricing. ETFs offer greater liquidity as investors can buy or sell shares anytime during market hours at fluctuating market prices, often close to NAV, unlike mutual funds which execute orders at the single daily NAV price. This dynamic pricing enables ETFs to provide intraday flexibility and potentially lower transaction costs compared to mutual funds, which involve minimum investment amounts and redemption restrictions.

Tax Efficiency and Implications

Mutual funds often trigger capital gains taxes due to frequent portfolio rebalancing, which can reduce after-tax returns for investors. Exchange-traded funds (ETFs) utilize an in-kind creation and redemption process that minimizes capital gains distributions, enhancing tax efficiency. Investors in ETFs typically benefit from lower tax liabilities, making them a preferred choice for tax-sensitive portfolios.

Investment Strategies and Flexibility

Mutual funds typically employ active management strategies with a focus on long-term growth, offering limited flexibility due to set trading times and higher minimum investments. Exchange-traded funds (ETFs) provide greater flexibility by allowing intraday trading and lower investment minimums, often tracking indexes through passive management strategies. Investors favor ETFs for tactical asset allocation and cost efficiency, while mutual funds suit those seeking professional portfolio management and diversified exposure.

Performance Tracking and Benchmarking

Mutual funds often measure performance against a specific benchmark index, but their daily NAV pricing can lead to tracking errors due to delayed price reflections. Exchange-traded funds (ETFs) closely track benchmark indices through real-time trading, resulting in tighter tracking and more accurate performance replication. The liquidity and intraday trading of ETFs enable investors to react promptly to market changes, enhancing benchmark alignment compared to traditional mutual funds.

Suitability for Different Investor Profiles

Mutual funds are suitable for investors seeking professional management and willing to invest larger sums with less frequent trading, often ideal for long-term goals and risk diversification. Exchange-traded funds (ETFs) cater to cost-conscious investors desiring intraday trading flexibility, lower expense ratios, and tax efficiency, appealing to active traders and those with smaller investment amounts. Understanding investor risk tolerance, investment horizon, and liquidity needs is crucial in selecting between mutual funds and ETFs.

Key Pros and Cons: Mutual Funds vs ETFs

Mutual funds offer professional management and diversification with ease of investment but often come with higher expense ratios and less trading flexibility compared to ETFs. ETFs provide lower costs, intraday trading, and tax efficiency but may require a brokerage account and expose investors to market price fluctuations. Understanding investment goals and trading preferences helps determine the best choice between mutual funds and ETFs for portfolio construction.

Mutual fund vs Exchange-traded fund Infographic

difterm.com

difterm.com