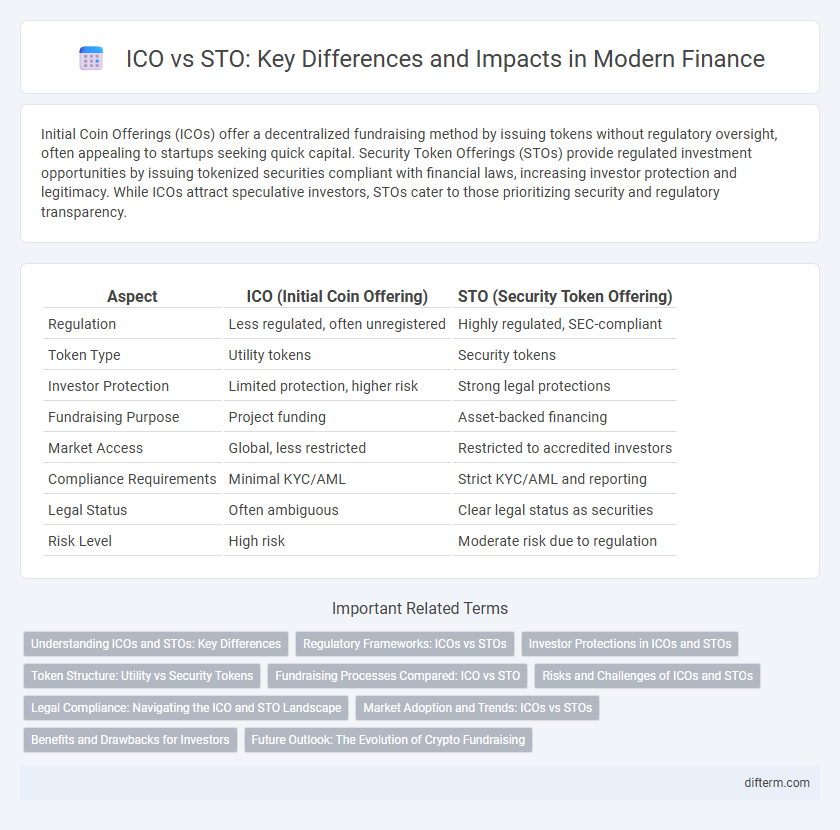

Initial Coin Offerings (ICOs) offer a decentralized fundraising method by issuing tokens without regulatory oversight, often appealing to startups seeking quick capital. Security Token Offerings (STOs) provide regulated investment opportunities by issuing tokenized securities compliant with financial laws, increasing investor protection and legitimacy. While ICOs attract speculative investors, STOs cater to those prioritizing security and regulatory transparency.

Table of Comparison

| Aspect | ICO (Initial Coin Offering) | STO (Security Token Offering) |

|---|---|---|

| Regulation | Less regulated, often unregistered | Highly regulated, SEC-compliant |

| Token Type | Utility tokens | Security tokens |

| Investor Protection | Limited protection, higher risk | Strong legal protections |

| Fundraising Purpose | Project funding | Asset-backed financing |

| Market Access | Global, less restricted | Restricted to accredited investors |

| Compliance Requirements | Minimal KYC/AML | Strict KYC/AML and reporting |

| Legal Status | Often ambiguous | Clear legal status as securities |

| Risk Level | High risk | Moderate risk due to regulation |

Understanding ICOs and STOs: Key Differences

Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) differ fundamentally in regulatory compliance and asset representation. ICOs often involve offering utility tokens that provide access to a product or service without representing ownership, while STOs issue security tokens backed by real assets, adhering to securities laws and offering investor protections. Understanding these distinctions is critical for investors assessing risk, legal implications, and the legitimacy of fundraising mechanisms in blockchain finance.

Regulatory Frameworks: ICOs vs STOs

ICOs (Initial Coin Offerings) operate in a largely unregulated environment, often facing scrutiny due to the lack of clear legal guidelines, which increases risks for investors and issuers. STOs (Security Token Offerings) comply with stringent securities regulations imposed by authorities like the SEC, ensuring investor protection through transparent disclosures and adherence to financial laws. The regulatory frameworks governing STOs provide a legally compliant structure that mitigates fraud risks, contrasting with the more ambiguous status of ICOs in global financial markets.

Investor Protections in ICOs and STOs

ICOs (Initial Coin Offerings) often lack regulatory oversight, exposing investors to higher risks such as fraud and market manipulation, whereas STOs (Security Token Offerings) comply with securities laws, providing enhanced investor protections like transparency, legal rights, and regulatory supervision. STOs require issuers to adhere to strict disclosure requirements and undergo audits, which help safeguard investor interests and reduce the chances of misrepresentation. The regulatory framework governing STOs fosters trust and accountability, making them a safer option compared to the largely unregulated ICO market.

Token Structure: Utility vs Security Tokens

Initial Coin Offerings (ICOs) primarily issue utility tokens, which provide access to a platform or service without representing ownership or investment. Security Token Offerings (STOs) involve security tokens that signify ownership stakes or investment contracts, subject to regulatory compliance under securities laws. Utility tokens enable transactional functionality, while security tokens offer rights such as dividends, voting, and profit-sharing, reflecting a fundamental difference in token structure and investor protection.

Fundraising Processes Compared: ICO vs STO

Initial Coin Offerings (ICO) enable startups to raise capital by issuing tokens to a broad audience with minimal regulatory oversight, facilitating rapid fundraising but exposing investors to higher risks. Security Token Offerings (STO) involve issuing regulated security tokens that represent ownership or assets, ensuring compliance with financial authorities and offering enhanced investor protection through transparent fundraising processes. STOs typically require thorough due diligence and legal frameworks, resulting in slower fundraising but greater legitimacy and investor confidence compared to ICOs.

Risks and Challenges of ICOs and STOs

ICOs carry significant risks including regulatory uncertainty, high susceptibility to fraud, and lack of investor protections, which often result in market volatility and potential loss of capital. STOs, while more regulated and offering greater transparency through securities compliance, face challenges such as higher costs, complex legal requirements, and limited accessibility for smaller investors. Both ICOs and STOs demand thorough due diligence due to evolving regulatory landscapes and technological vulnerabilities inherent in blockchain-based fundraising.

Legal Compliance: Navigating the ICO and STO Landscape

ICOs often face regulatory uncertainties due to their broader token classifications, whereas STOs comply with strict securities laws, providing clearer legal frameworks and investor protections. STOs require adherence to established financial regulations such as the Securities Act, ensuring transparency, anti-fraud measures, and accredited investor participation. Navigating these compliance differences is crucial for issuers seeking to balance fundraising efficiency with regulatory security.

Market Adoption and Trends: ICOs vs STOs

Initial Coin Offerings (ICOs) experienced rapid market adoption during 2017-2018 due to minimal regulatory oversight, attracting a wide range of retail investors seeking high returns. Security Token Offerings (STOs) have gained traction more recently, driven by increased regulatory compliance, institutional interest, and the demand for transparent, legally compliant digital securities. Market trends indicate a gradual shift from ICOs to STOs, as investors prioritize regulatory certainty and security token liquidity in capital-raising mechanisms.

Benefits and Drawbacks for Investors

ICOs offer high liquidity and easy participation but carry significant regulatory risks and potential for scams, making them volatile for investors. STOs provide greater regulatory compliance and investor protection through asset-backed tokens, enhancing transparency and reducing fraud likelihood. However, STOs often involve longer approval times and lower liquidity compared to ICOs, impacting immediate trade flexibility.

Future Outlook: The Evolution of Crypto Fundraising

Initial Coin Offerings (ICOs) initially dominated crypto fundraising due to low regulatory barriers, but Security Token Offerings (STOs) are emerging as the preferred method because they offer enhanced compliance with securities laws and investor protections. The future of crypto fundraising leans towards STOs integrating blockchain transparency with traditional finance safeguards, attracting institutional investors and promoting long-term market stability. This evolution signals a shift towards regulated digital assets that balance innovation with legal certainty.

ICO vs STO Infographic

difterm.com

difterm.com