Hedge funds primarily engage in liquid assets and short-term trading strategies to generate high returns, often utilizing leverage and derivatives for risk management. Private equity focuses on long-term investments in private companies, aiming to improve operational performance and realize value through eventual exits like IPOs or acquisitions. Investors seeking liquidity and volatility may prefer hedge funds, while those targeting sustained growth and active management typically choose private equity.

Table of Comparison

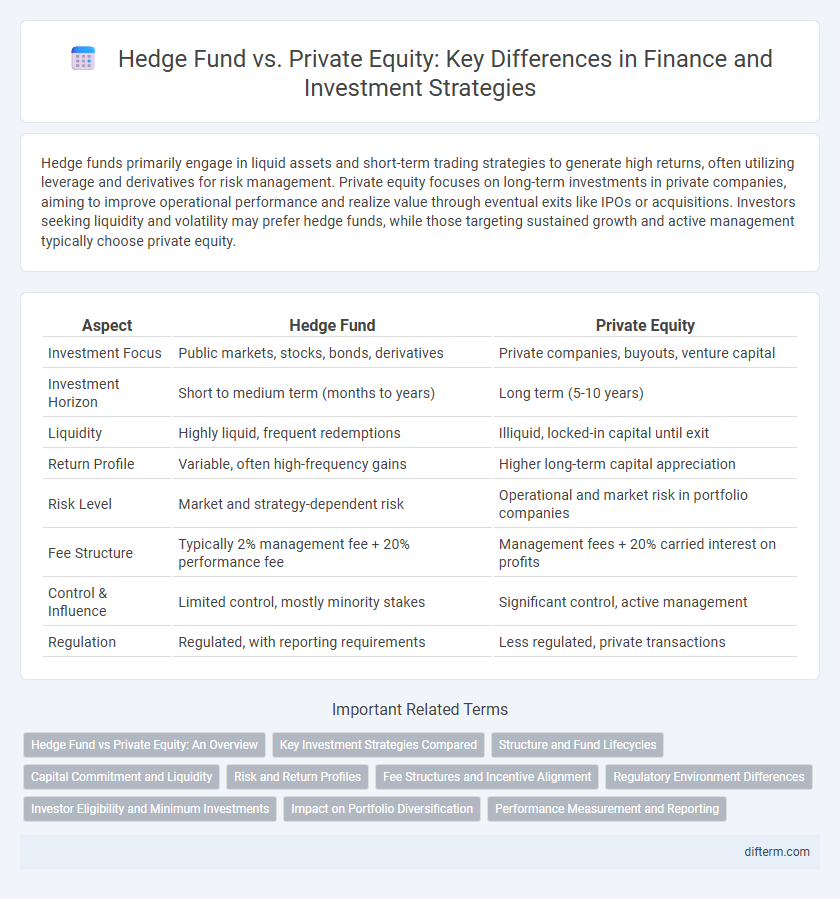

| Aspect | Hedge Fund | Private Equity |

|---|---|---|

| Investment Focus | Public markets, stocks, bonds, derivatives | Private companies, buyouts, venture capital |

| Investment Horizon | Short to medium term (months to years) | Long term (5-10 years) |

| Liquidity | Highly liquid, frequent redemptions | Illiquid, locked-in capital until exit |

| Return Profile | Variable, often high-frequency gains | Higher long-term capital appreciation |

| Risk Level | Market and strategy-dependent risk | Operational and market risk in portfolio companies |

| Fee Structure | Typically 2% management fee + 20% performance fee | Management fees + 20% carried interest on profits |

| Control & Influence | Limited control, mostly minority stakes | Significant control, active management |

| Regulation | Regulated, with reporting requirements | Less regulated, private transactions |

Hedge Fund vs Private Equity: An Overview

Hedge funds primarily engage in liquid, short-term investments across diverse assets to generate high returns with flexible strategies, whereas private equity focuses on acquiring and restructuring private companies for long-term value creation. Hedge funds typically invest in publicly traded securities and use leverage, derivatives, and arbitrage, while private equity commits capital to buyouts, venture capital, and growth equity with a longer investment horizon. Investors in hedge funds expect more liquidity and active portfolio management, contrasted with private equity's illiquid commitments and emphasis on operational improvements in portfolio companies.

Key Investment Strategies Compared

Hedge funds primarily employ liquid, short-term investment strategies such as long/short equity, global macro, and arbitrage to generate alpha with high-frequency trading and leverage. Private equity focuses on long-term, illiquid investments in private companies, emphasizing operational improvements, buyouts, and growth capital to enhance enterprise value. Hedge funds prioritize market timing and liquidity, while private equity targets fundamental business value creation through active management and strategic restructuring.

Structure and Fund Lifecycles

Hedge funds typically operate with a flexible structure, allowing for continuous capital inflows and redemptions, and have an open-ended fund lifecycle that can span several years with quarterly or monthly liquidity options. Private equity funds employ a closed-ended structure with a fixed lifecycle, usually lasting 7 to 10 years, during which capital is committed upfront and invested in illiquid private companies or assets. The distinct fund lifecycles influence liquidity, risk profiles, and investment strategies, with hedge funds emphasizing short-term market opportunities while private equity focuses on long-term value creation and exit strategies.

Capital Commitment and Liquidity

Hedge funds typically require lower capital commitments and offer higher liquidity, allowing investors to redeem shares monthly or quarterly, while private equity demands substantial capital commitments with fixed lock-up periods often lasting 7-10 years. Private equity investments involve capital calls as projects progress, limiting investors' ability to withdraw funds, contrasting hedge funds' open-ended structures that provide greater short-term liquidity. These differences in capital commitment and liquidity directly impact portfolio allocation strategies for institutional and accredited investors in alternative investments.

Risk and Return Profiles

Hedge funds typically exhibit higher liquidity and employ diverse trading strategies to achieve moderate to high returns with varying risk levels, often leveraging derivatives and short-selling techniques. Private equity investments involve longer lock-up periods, targeting substantial returns through active management and operational improvements in portfolio companies, generally carrying higher illiquidity risk but potentially offering superior risk-adjusted returns over time. The risk profile of hedge funds is more market-sensitive and short-term, whereas private equity risk hinges on business-specific factors and longer investment horizons.

Fee Structures and Incentive Alignment

Hedge funds typically charge a 2% management fee on assets under management and a 20% performance fee on profits, aligning incentives by rewarding fund managers only when returns exceed benchmarks. Private equity firms usually impose a 2% management fee on committed capital and a 20% carried interest on realized gains after returning investors' capital, creating strong alignment through long-term investment horizons and value creation. Both fee structures aim to motivate managers to maximize investor returns but differ in their timing and nature of incentivization.

Regulatory Environment Differences

Hedge funds operate under the Investment Advisers Act of 1940 with lighter regulatory oversight, allowing greater leverage and short-selling strategies. Private equity firms face stricter scrutiny from the SEC, especially regarding disclosures and fiduciary duties due to their longer-term, illiquid investments. Regulatory frameworks impact fund transparency, investor protection, and operational flexibility distinctly across these asset management categories.

Investor Eligibility and Minimum Investments

Hedge funds typically require investors to be accredited, with minimum investments ranging from $100,000 to $1 million, targeting high-net-worth individuals and institutional investors. Private equity funds generally have higher eligibility thresholds, often requiring accredited or qualified purchasers with minimum investments usually starting around $250,000 to $5 million. Both investment types demand substantial capital commitments, but private equity funds often impose longer lock-up periods and higher minimums due to their illiquid nature.

Impact on Portfolio Diversification

Hedge funds provide portfolio diversification through liquid, market-neutral strategies that reduce correlation with traditional asset classes, offering flexible risk management and short-term alpha generation. Private equity enhances diversification by adding illiquid, long-term investments in private companies that typically exhibit low correlation with public markets and potential for higher returns. Combining hedge funds with private equity in a portfolio can optimize risk-adjusted returns by balancing liquidity, volatility, and growth opportunities across different market conditions.

Performance Measurement and Reporting

Hedge fund performance measurement primarily relies on metrics such as alpha, beta, Sharpe ratio, and internal rate of return (IRR) to capture risk-adjusted returns over shorter investment horizons. Private equity reporting emphasizes cash flow-based metrics including multiples of invested capital (MOIC) and IRR, reflecting long-term value creation through exit events and portfolio company performance. Transparency in hedge fund reporting is typically higher with frequent NAV updates, while private equity reports focus on periodic valuations adhering to fair value accounting standards.

Hedge Fund vs Private Equity Infographic

difterm.com

difterm.com