Exchange Traded Funds (ETFs) offer greater liquidity and lower expense ratios compared to mutual funds, making them attractive for cost-conscious investors seeking flexibility. Mutual funds provide professional management and the potential for diversification through pooled investments, often requiring minimum investment amounts and trading only at the end of the trading day. Investors should consider their trading preferences, fees, and investment goals when choosing between ETFs and mutual funds.

Table of Comparison

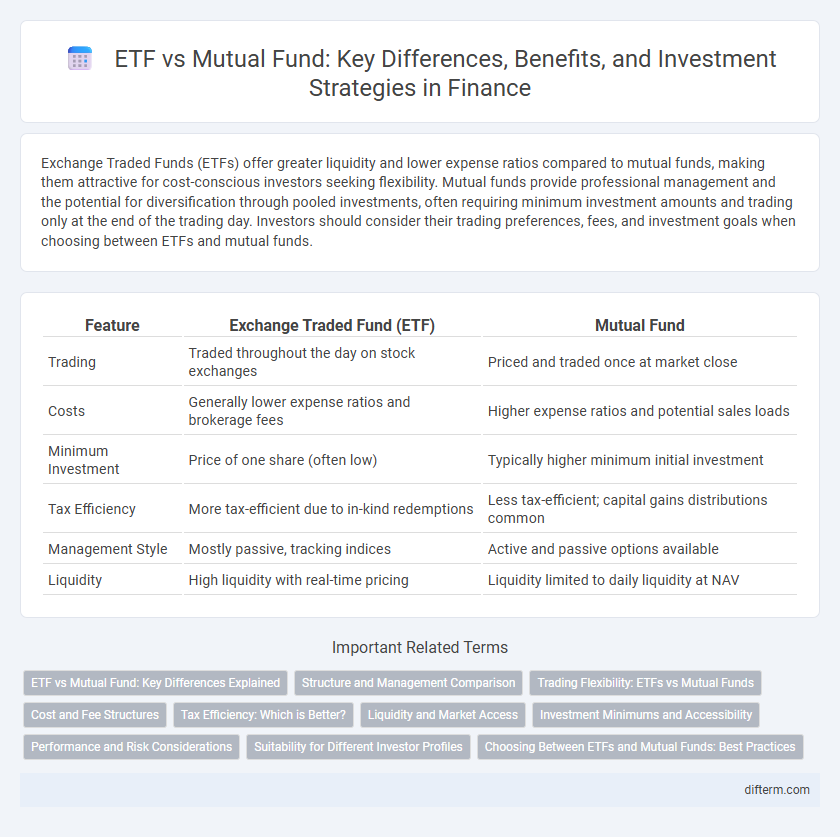

| Feature | Exchange Traded Fund (ETF) | Mutual Fund |

|---|---|---|

| Trading | Traded throughout the day on stock exchanges | Priced and traded once at market close |

| Costs | Generally lower expense ratios and brokerage fees | Higher expense ratios and potential sales loads |

| Minimum Investment | Price of one share (often low) | Typically higher minimum initial investment |

| Tax Efficiency | More tax-efficient due to in-kind redemptions | Less tax-efficient; capital gains distributions common |

| Management Style | Mostly passive, tracking indices | Active and passive options available |

| Liquidity | High liquidity with real-time pricing | Liquidity limited to daily liquidity at NAV |

ETF vs Mutual Fund: Key Differences Explained

Exchange Traded Funds (ETFs) offer intraday trading flexibility with prices fluctuating throughout the market day, unlike Mutual Funds which are priced once at the end of the trading day. ETFs generally have lower expense ratios and tax efficiency due to their unique creation and redemption mechanism, whereas Mutual Funds often incur higher capital gains distributions. The transparency of ETFs, which disclose holdings daily, contrasts with Mutual Funds that provide periodic disclosures, influencing investor decision-making and portfolio management.

Structure and Management Comparison

Exchange Traded Funds (ETFs) are structured as open-end funds or unit investment trusts, providing intraday trading flexibility on exchanges, while Mutual Funds are typically open-end funds priced only once per day after market close. ETFs are passively managed more often than Mutual Funds, which frequently employ active management strategies involving professional portfolio managers selecting securities. The structural difference results in ETFs generally having lower expense ratios and greater tax efficiency compared to Mutual Funds due to their in-kind creation and redemption processes.

Trading Flexibility: ETFs vs Mutual Funds

ETFs offer superior trading flexibility compared to mutual funds, as they can be bought and sold throughout the trading day at market prices, similar to stocks. Mutual funds, however, are only priced and traded once daily after the market closes, limiting timely market access. This intraday trading advantage of ETFs allows investors to react quickly to market conditions and implement real-time strategies.

Cost and Fee Structures

Exchange Traded Funds (ETFs) typically have lower expense ratios compared to mutual funds due to their passive management style and lower operating costs. Mutual funds often charge higher fees, including front-end or back-end loads and higher management fees associated with active management. Investors benefit from ETFs' cost efficiency through reduced annual fees and no sales loads, making them a more cost-effective choice for long-term portfolios.

Tax Efficiency: Which is Better?

Exchange Traded Funds (ETFs) generally offer superior tax efficiency compared to mutual funds due to their unique in-kind creation and redemption process, which helps minimize capital gains distributions. Mutual funds often realize capital gains when portfolio managers buy and sell securities within the fund, leading to taxable events for investors. Investors seeking to reduce tax liabilities may prefer ETFs, as they typically generate fewer taxable events throughout the year.

Liquidity and Market Access

Exchange Traded Funds (ETFs) offer higher liquidity compared to mutual funds, as they trade on stock exchanges throughout the trading day, allowing investors to buy and sell shares at real-time prices. Mutual funds, in contrast, are priced once daily after market close, limiting immediate market access and trade execution flexibility. ETFs provide greater market access with the ability to utilize limit orders, short selling, and intraday trading strategies, enhancing responsiveness to market conditions.

Investment Minimums and Accessibility

Exchange Traded Funds (ETFs) generally require lower investment minimums compared to mutual funds, often allowing investors to purchase as little as one share, making them highly accessible for individual investors. Mutual funds typically impose higher minimum initial investments, sometimes ranging from $1,000 to $3,000, which can limit entry for those with smaller capital. ETFs trade on stock exchanges throughout the day, providing greater liquidity and accessibility, while mutual funds are priced at the end of the trading day, impacting immediate access and transaction flexibility.

Performance and Risk Considerations

Exchange Traded Funds (ETFs) often deliver performance closely tracking their underlying indices due to lower expense ratios and passive management, whereas mutual funds may offer active management potentially leading to higher returns but also increased fees. ETFs provide intraday liquidity allowing investors to react quickly to market changes, reducing exposure to price fluctuations compared to the end-of-day pricing structure of mutual funds. Risk considerations include the diversified nature of both investment vehicles, but ETFs' transparency and tax efficiency can make them a more attractive option for cost-conscious investors seeking consistent performance.

Suitability for Different Investor Profiles

Exchange Traded Funds (ETFs) offer greater flexibility and lower expense ratios, making them suitable for cost-conscious, active traders seeking intraday liquidity and tax efficiency. Mutual Funds, with professional management and automatic reinvestment options, appeal to long-term investors prioritizing diversified portfolios without daily trading complexities. Conservative investors benefit from Mutual Funds' stability, while ETFs attract those comfortable with market fluctuations and self-directed investment strategies.

Choosing Between ETFs and Mutual Funds: Best Practices

Selecting between Exchange Traded Funds (ETFs) and Mutual Funds hinges on factors such as trading flexibility, cost efficiency, and investment goals. ETFs offer intraday trading and typically lower expense ratios, making them suitable for active investors seeking liquidity and cost-effectiveness. Mutual funds provide professional management and ease of automatic reinvestment, appealing to long-term investors prioritizing hands-off portfolio growth.

Exchange Traded Fund (ETF) vs Mutual Fund Infographic

difterm.com

difterm.com