Spread betting offers tax-free trading opportunities in certain jurisdictions by allowing speculation on price movements without owning the underlying asset, while CFD trading provides leveraged exposure and the ability to take both long and short positions. Both methods involve significant risk due to leverage, but CFDs often come with higher margin requirements and potential overnight financing costs. Traders should carefully compare spreads, fees, and regulatory protections to determine which strategy aligns best with their risk tolerance and investment goals.

Table of Comparison

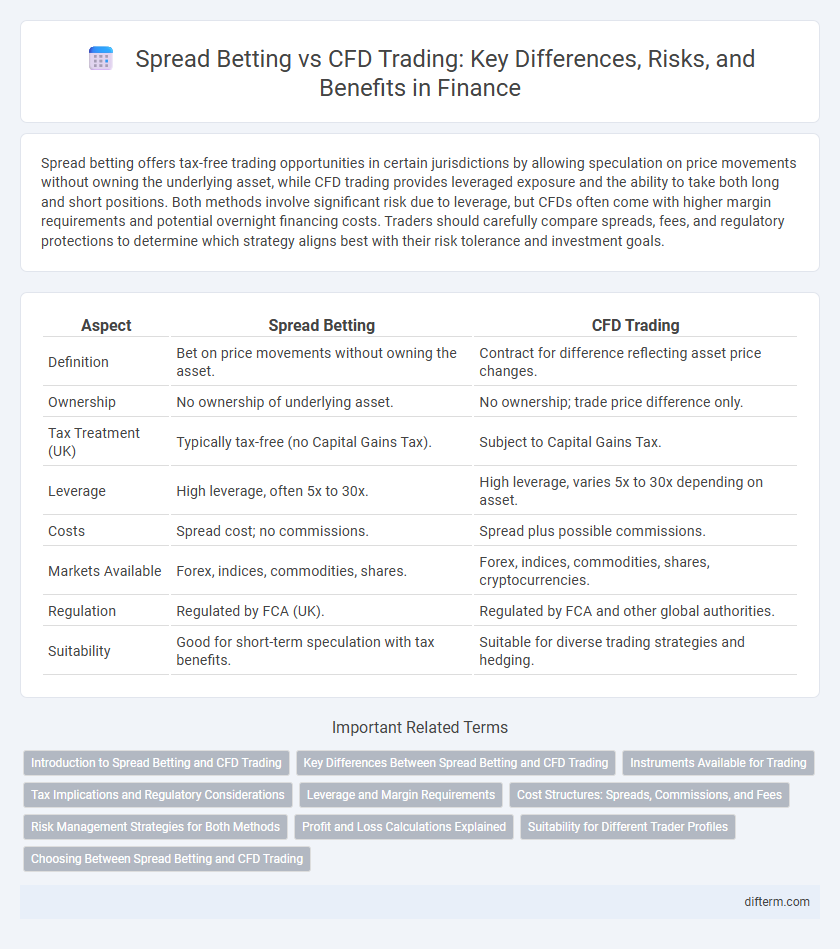

| Aspect | Spread Betting | CFD Trading |

|---|---|---|

| Definition | Bet on price movements without owning the asset. | Contract for difference reflecting asset price changes. |

| Ownership | No ownership of underlying asset. | No ownership; trade price difference only. |

| Tax Treatment (UK) | Typically tax-free (no Capital Gains Tax). | Subject to Capital Gains Tax. |

| Leverage | High leverage, often 5x to 30x. | High leverage, varies 5x to 30x depending on asset. |

| Costs | Spread cost; no commissions. | Spread plus possible commissions. |

| Markets Available | Forex, indices, commodities, shares. | Forex, indices, commodities, shares, cryptocurrencies. |

| Regulation | Regulated by FCA (UK). | Regulated by FCA and other global authorities. |

| Suitability | Good for short-term speculation with tax benefits. | Suitable for diverse trading strategies and hedging. |

Introduction to Spread Betting and CFD Trading

Spread betting allows investors to speculate on price movements without owning the underlying asset, offering tax-free profits in some jurisdictions. CFD trading involves contracts that mirror market price fluctuations, enabling leveraged exposure to assets like stocks, indices, and commodities. Both instruments provide flexible trading strategies but differ in regulatory treatment, tax implications, and risk profiles.

Key Differences Between Spread Betting and CFD Trading

Spread betting offers tax-free profits and allows traders to speculate on price movements without owning the underlying asset, while CFD trading involves contracts for difference that enable leverage and the ability to go long or short on various financial instruments. Spread betting is predominantly popular in the UK and Ireland due to its tax advantages, whereas CFD trading is more widely available internationally but subject to capital gains tax. Risk management varies as CFDs often require margin calls, contrasting with spread betting's fixed stake per bet, affecting potential losses and exposure.

Instruments Available for Trading

Spread betting offers a wide range of instruments including indices, forex pairs, commodities, shares, and cryptocurrencies, allowing traders to speculate on price movements without owning the underlying asset. CFD trading similarly provides access to diverse markets such as equities, commodities, forex, indices, and cryptocurrencies, enabling leveraged exposure to price fluctuations. Both methods support extensive market coverage, but CFDs often feature more comprehensive instrument options with varied contract specifications.

Tax Implications and Regulatory Considerations

Spread betting profits are typically tax-free in the UK due to their classification as gambling, whereas CFD trading profits are subject to capital gains tax and may require self-assessment tax returns. Regulatory oversight for spread betting falls under the Financial Conduct Authority (FCA) with strict consumer protection rules, while CFDs are also FCA-regulated but classified as derivatives, leading to tighter leverage restrictions and margin requirements. Investors must consider the impact of tax liabilities and compliance with FCA rules when choosing between spread betting and CFD trading for their financial strategies.

Leverage and Margin Requirements

Spread betting offers tax-free profits in some jurisdictions and typically requires lower margin levels, making it accessible for small investors aiming to leverage their positions. CFD trading provides flexible leverage options that can amplify gains and losses significantly, with margin requirements varying by asset class and broker regulations. Understanding the differences in leverage ratios and margin calls is critical for managing risk effectively in both spread betting and CFD trading.

Cost Structures: Spreads, Commissions, and Fees

Spread betting typically involves no commissions, with costs embedded in wider spreads between bid and ask prices. CFD trading often requires both spreads and commissions, especially on shares, leading to potentially higher overall costs. Understanding these cost structures is essential for traders to manage expenses and maximize profitability.

Risk Management Strategies for Both Methods

Effective risk management strategies in spread betting and CFD trading include setting strict stop-loss orders to limit potential losses and utilizing position sizing to control exposure relative to account size. Diversification across different assets and maintaining disciplined leverage levels help mitigate market volatility risks inherent in both methods. Regularly reviewing and adjusting risk parameters based on market conditions is essential for preserving capital and optimizing long-term trading performance.

Profit and Loss Calculations Explained

Profit and loss calculations in spread betting are determined by the number of points the market moves multiplied by the stake per point, with gains and losses being tax-free in some jurisdictions. CFD trading calculates profit and loss based on the difference between the opening and closing prices multiplied by the number of CFDs held, with taxable implications depending on local laws. Both trading methods involve leverage, which amplifies potential profits but also increases the risk of significant losses.

Suitability for Different Trader Profiles

Spread betting offers tax advantages and suits traders seeking shorter-term exposure with limited capital, often appealing to retail investors prioritizing simplicity and flexibility. CFD trading provides greater versatility with access to a wider range of markets and the option for longer-term positions, making it ideal for experienced traders who require advanced risk management and hedging strategies. Both instruments involve leverage and risks, but the choice depends on individual trading goals, risk tolerance, and regulatory considerations in the trader's jurisdiction.

Choosing Between Spread Betting and CFD Trading

Choosing between spread betting and CFD trading depends on factors like tax treatment, trading costs, and regulatory status. Spread betting often offers tax advantages such as exemption from capital gains tax in the UK, while CFD trading provides ownership flexibility and access to a wider range of markets. Traders should evaluate their investment goals, risk tolerance, and jurisdictional regulations to determine the most suitable financial instrument.

Spread Betting vs CFD Trading Infographic

difterm.com

difterm.com