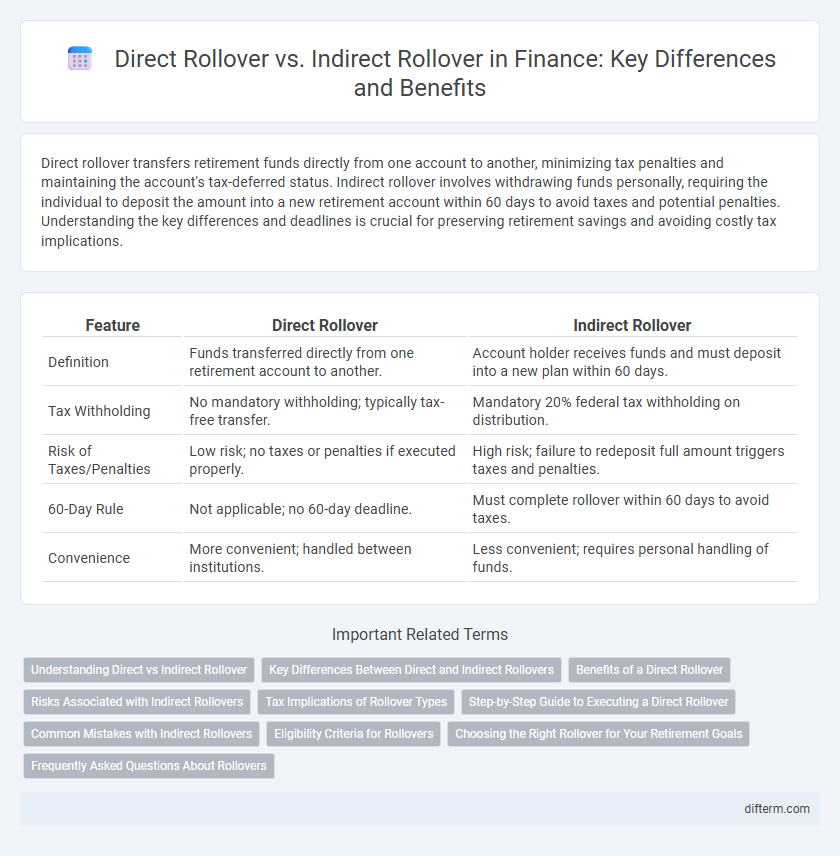

Direct rollover transfers retirement funds directly from one account to another, minimizing tax penalties and maintaining the account's tax-deferred status. Indirect rollover involves withdrawing funds personally, requiring the individual to deposit the amount into a new retirement account within 60 days to avoid taxes and potential penalties. Understanding the key differences and deadlines is crucial for preserving retirement savings and avoiding costly tax implications.

Table of Comparison

| Feature | Direct Rollover | Indirect Rollover |

|---|---|---|

| Definition | Funds transferred directly from one retirement account to another. | Account holder receives funds and must deposit into a new plan within 60 days. |

| Tax Withholding | No mandatory withholding; typically tax-free transfer. | Mandatory 20% federal tax withholding on distribution. |

| Risk of Taxes/Penalties | Low risk; no taxes or penalties if executed properly. | High risk; failure to redeposit full amount triggers taxes and penalties. |

| 60-Day Rule | Not applicable; no 60-day deadline. | Must complete rollover within 60 days to avoid taxes. |

| Convenience | More convenient; handled between institutions. | Less convenient; requires personal handling of funds. |

Understanding Direct vs Indirect Rollover

Direct rollover transfers retirement funds directly from one qualified plan to another without the account holder receiving the money, minimizing tax withholding and penalties. Indirect rollover requires the account holder to take possession of the funds before depositing them into a new retirement account within 60 days, risking mandatory tax withholding and potential tax liability if deadlines are missed. Understanding the differences between direct and indirect rollovers is crucial for efficient retirement fund management and avoiding unnecessary tax consequences.

Key Differences Between Direct and Indirect Rollovers

Direct rollovers transfer retirement funds directly from one qualified plan to another, avoiding tax withholding and potential penalties. Indirect rollovers involve the account holder receiving the distribution and then redepositing it within 60 days, risking mandatory 20% tax withholding and possible taxes if the deadline is missed. The IRS imposes strict rules on indirect rollovers, making direct rollovers the preferred method for preserving tax advantages in retirement accounts.

Benefits of a Direct Rollover

Direct rollovers offer tax advantages by transferring retirement funds directly between qualified accounts without triggering immediate tax liabilities or penalties. This method reduces the risk of funds being temporarily withheld or lost due to missed deadlines, ensuring seamless continuation of tax-deferred growth. Additionally, direct rollovers simplify the process by eliminating the need for the account holder to handle the funds personally.

Risks Associated with Indirect Rollovers

Indirect rollovers carry significant risks, including mandatory tax withholding of 20% by the plan administrator and the possibility of missing the 60-day deadline to reinvest funds, which triggers a taxable distribution and potential early withdrawal penalties. This process requires individuals to manage funds personally, increasing the chance of errors that can result in loss of tax-deferred status. Investors must consider these risks carefully when choosing between direct and indirect rollovers to avoid unexpected tax liabilities.

Tax Implications of Rollover Types

Direct rollovers transfer retirement funds directly between accounts, avoiding immediate tax liability and penalties by maintaining the tax-deferred status of the assets. Indirect rollovers require the account holder to receive the distribution before redepositing into another qualified plan within 60 days, risking withholding taxes and potential penalties if not completed timely. Failure to complete an indirect rollover within the timeframe results in the distribution being treated as taxable income, increasing the tax burden and possibly incurring early withdrawal penalties.

Step-by-Step Guide to Executing a Direct Rollover

To execute a direct rollover, first contact your current retirement plan administrator to request a rollover distribution form, ensuring funds are transferred directly to your new qualified plan or IRA without any tax withholding. Next, provide the receiving institution's details to your plan administrator, who will handle the transaction, avoiding any mandatory 20% federal tax withholding typical in indirect rollovers. Finally, confirm the funds have been credited to your new account within 60 days to maintain the tax-deferred status and prevent penalties or taxes on the rollover amount.

Common Mistakes with Indirect Rollovers

Common mistakes with indirect rollovers include missing the 60-day deadline to redeposit funds into another retirement account, which triggers taxes and penalties. Another frequent error is failing to withhold the mandatory 20% federal tax, leading to insufficient rollover funds and additional tax liabilities. Many investors also mistakenly assume indirect rollovers avoid penalties, but improper handling results in tax consequences and account disqualification.

Eligibility Criteria for Rollovers

Eligibility criteria for direct rollovers require that funds be transferred directly between qualified retirement accounts, such as from a 401(k) to an IRA, without the account holder taking possession, thereby avoiding tax withholding and penalties. Indirect rollovers permit the account holder to receive the distribution and then redeposit the amount into another qualified plan within 60 days, but typically require withholding 20% for taxes and restrict rollovers to one per 12-month period across all IRAs. Both rollovers mandate that the recipient account qualifies under IRS rules, with direct rollovers often preferred for maintaining tax-deferred status and simplifying compliance.

Choosing the Right Rollover for Your Retirement Goals

Choosing the right rollover for your retirement goals hinges on understanding direct rollover and indirect rollover options. A direct rollover transfers funds directly between retirement accounts, minimizing tax liabilities and avoiding mandatory withholding, making it ideal for those seeking seamless account management. On the other hand, an indirect rollover requires you to temporarily hold the funds, triggering a 60-day window to redeposit while risking tax penalties if missed, which may suit investors preferring short-term control over distributions.

Frequently Asked Questions About Rollovers

Direct rollovers transfer retirement funds directly from one qualified plan to another, minimizing tax consequences and avoiding mandatory withholding. Indirect rollovers involve the account holder receiving the distribution first, requiring deposit into a new plan within 60 days to prevent taxes and penalties. Common questions include the differences in tax treatment, deadlines for deposits, and potential withholding requirements.

Direct rollover vs Indirect rollover Infographic

difterm.com

difterm.com