Floating rate loans offer variable interest payments that adjust with market indices, providing potential savings when rates decline but exposing borrowers to increasing costs if rates rise. Fixed rate loans maintain a constant interest rate throughout the loan term, ensuring predictable payments and shielding borrowers from interest rate volatility. Choosing between floating and fixed rates depends on risk tolerance, market outlook, and cash flow stability requirements.

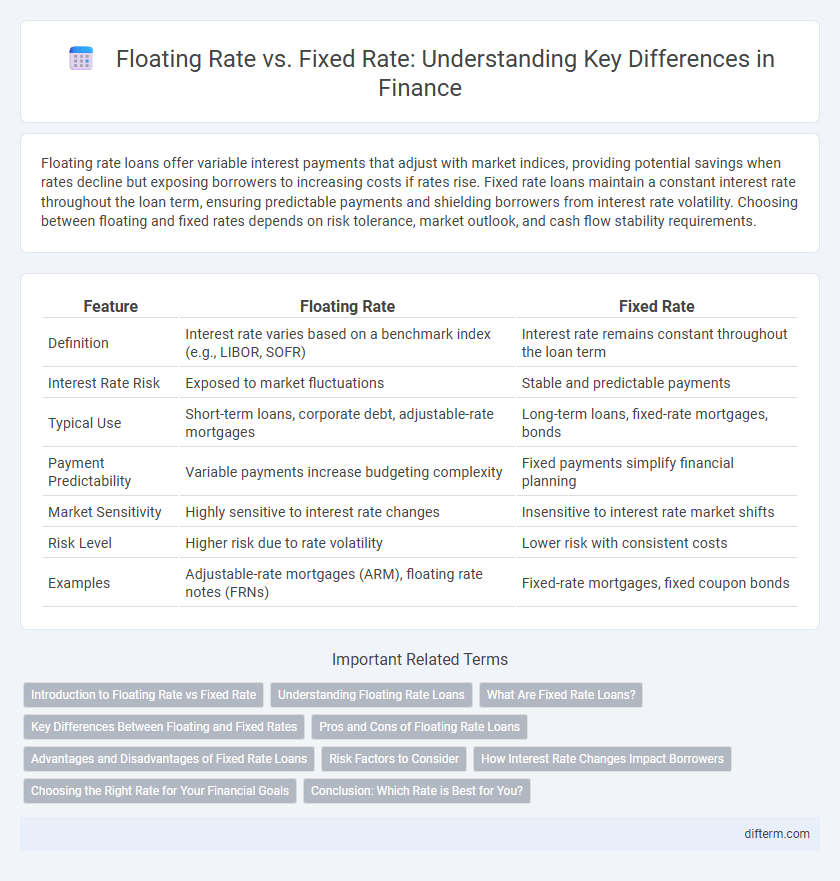

Table of Comparison

| Feature | Floating Rate | Fixed Rate |

|---|---|---|

| Definition | Interest rate varies based on a benchmark index (e.g., LIBOR, SOFR) | Interest rate remains constant throughout the loan term |

| Interest Rate Risk | Exposed to market fluctuations | Stable and predictable payments |

| Typical Use | Short-term loans, corporate debt, adjustable-rate mortgages | Long-term loans, fixed-rate mortgages, bonds |

| Payment Predictability | Variable payments increase budgeting complexity | Fixed payments simplify financial planning |

| Market Sensitivity | Highly sensitive to interest rate changes | Insensitive to interest rate market shifts |

| Risk Level | Higher risk due to rate volatility | Lower risk with consistent costs |

| Examples | Adjustable-rate mortgages (ARM), floating rate notes (FRNs) | Fixed-rate mortgages, fixed coupon bonds |

Introduction to Floating Rate vs Fixed Rate

Floating rate loans have interest rates that fluctuate based on benchmark rates like LIBOR or SOFR, providing borrowers protection against rising costs but introducing payment uncertainty. Fixed rate loans maintain a constant interest rate over the loan term, offering payment stability and predictability regardless of market interest rate changes. Understanding the benefits and risks of floating versus fixed interest rates is crucial for optimizing debt management and financial planning strategies.

Understanding Floating Rate Loans

Floating rate loans feature interest rates that adjust periodically based on a benchmark index such as LIBOR or SOFR, providing borrowers with potentially lower initial rates compared to fixed rate loans. These loans expose borrowers to interest rate risk, as payments can fluctuate with market conditions, impacting budgeting and cash flow stability. Understanding the mechanics of rate resets and cap features is essential for managing the financial implications of floating rate debt effectively.

What Are Fixed Rate Loans?

Fixed rate loans have an interest rate that remains constant throughout the loan term, providing predictable monthly payments and protection against market fluctuations. They are commonly used for mortgages, personal loans, and auto loans, offering stability and easier budgeting for borrowers. Fixed rate loans contrast with floating rate loans, which have variable interest rates that can change with market conditions.

Key Differences Between Floating and Fixed Rates

Floating rates fluctuate based on benchmark interest rates such as LIBOR or SOFR, causing periodic adjustments in loan payments or bond yields. Fixed rates remain constant throughout the loan or bond term, providing predictability and stability in repayment amounts. The choice between floating and fixed rates hinges on risk tolerance and market outlook, with floating rates typically benefiting borrowers in declining interest environments while fixed rates protect against rising rates.

Pros and Cons of Floating Rate Loans

Floating rate loans offer borrowers the advantage of lower initial interest rates, which can reduce early borrowing costs, and they tend to follow market interest rate trends, providing potential savings when rates decline. However, these loans carry the risk of increased payments if interest rates rise, creating uncertainty in budgeting and financial planning. Borrowers should consider their risk tolerance and cash flow stability before choosing floating rate loans over fixed rate alternatives.

Advantages and Disadvantages of Fixed Rate Loans

Fixed rate loans provide borrowers with predictable monthly payments and protection against rising interest rates, offering financial stability and easier budgeting. However, they often come with higher initial interest rates compared to floating rate loans and can lead to missed savings opportunities if market rates decline. Borrowers must weigh the security of a fixed rate against the potential benefits of fluctuating rates to determine the optimal financing strategy.

Risk Factors to Consider

Floating rate loans expose borrowers to interest rate risk, as rates can increase with market fluctuations, leading to higher repayment costs over time. Fixed rate loans provide payment stability by locking in an interest rate, but may result in higher initial costs compared to floating rates. Credit risk and inflation risk also influence both loan types, affecting the borrower's overall financial liability and repayment capacity.

How Interest Rate Changes Impact Borrowers

Borrowers with floating rate loans experience direct fluctuations in their repayment amounts as interest rates rise or fall, often leading to increased financial uncertainty and potential cash flow challenges during rate hikes. Fixed rate borrowers benefit from predictable payments, shielding them from interest rate volatility but potentially missing out on savings when rates decline. Understanding these impacts helps borrowers align their financing strategies with risk tolerance and market conditions.

Choosing the Right Rate for Your Financial Goals

Selecting between floating rate and fixed rate depends on your risk tolerance and interest rate outlook; floating rates adjust with market changes, potentially lowering costs in a declining rate environment, while fixed rates provide stable payments and predictability. Investors aiming for budget certainty often prefer fixed rates to avoid payment fluctuations, whereas those expecting interest rate drops might benefit from floating rates to capitalize on lower financing costs. Analyzing current yield curves, inflation forecasts, and personal financial stability helps determine the best option aligned with long-term financial objectives.

Conclusion: Which Rate is Best for You?

Choosing between floating rate and fixed rate depends on your risk tolerance and market outlook; floating rates offer potential savings when interest rates decline but expose you to higher payments if rates rise. Fixed rates provide stability and predictability, making them ideal for budgeting and long-term financial planning. Assessing current economic conditions and personal financial goals helps determine the ideal choice for your investment or loan strategy.

Floating Rate vs Fixed Rate Infographic

difterm.com

difterm.com