Systematic risk refers to the inherent market-wide risks that affect all investments, such as economic recessions, interest rate changes, and geopolitical events, making it unavoidable through diversification. Unsystematic risk, also known as specific or idiosyncratic risk, stems from individual company or industry factors and can be minimized or eliminated by holding a diversified portfolio. Understanding the distinction between systematic and unsystematic risk is crucial for investors to develop effective risk management and asset allocation strategies.

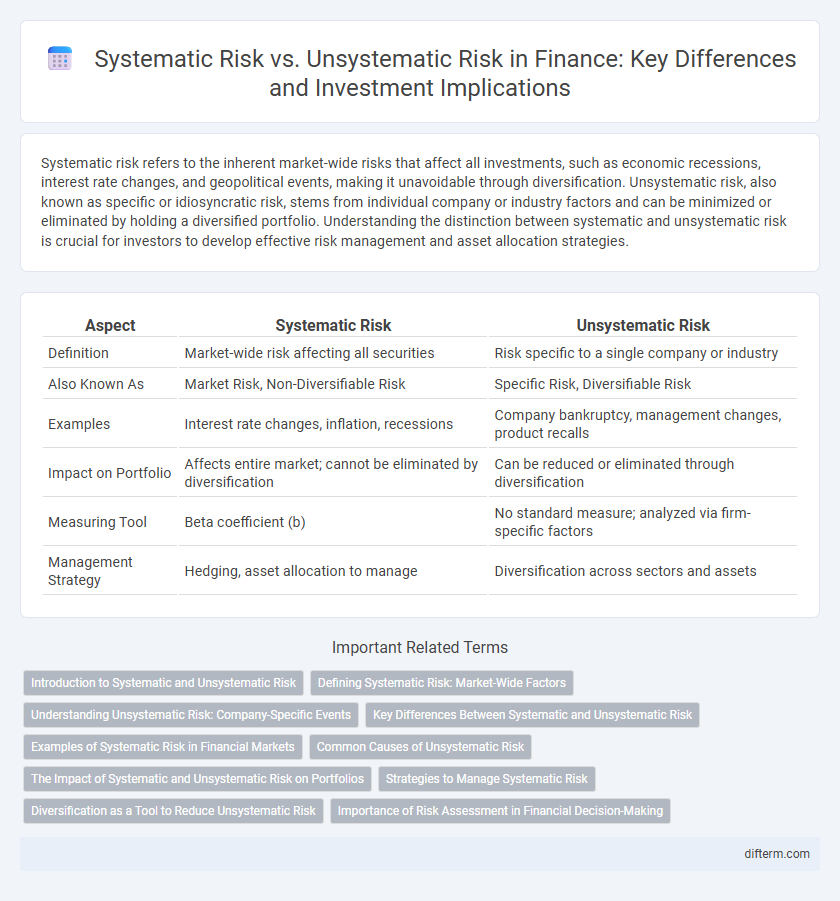

Table of Comparison

| Aspect | Systematic Risk | Unsystematic Risk |

|---|---|---|

| Definition | Market-wide risk affecting all securities | Risk specific to a single company or industry |

| Also Known As | Market Risk, Non-Diversifiable Risk | Specific Risk, Diversifiable Risk |

| Examples | Interest rate changes, inflation, recessions | Company bankruptcy, management changes, product recalls |

| Impact on Portfolio | Affects entire market; cannot be eliminated by diversification | Can be reduced or eliminated through diversification |

| Measuring Tool | Beta coefficient (b) | No standard measure; analyzed via firm-specific factors |

| Management Strategy | Hedging, asset allocation to manage | Diversification across sectors and assets |

Introduction to Systematic and Unsystematic Risk

Systematic risk, also known as market risk, affects the entire financial market and cannot be eliminated through diversification, including factors like interest rate fluctuations, inflation, and geopolitical events. Unsystematic risk, or specific risk, impacts individual companies or industries and can be mitigated by diversifying a portfolio across different assets and sectors. Understanding the distinction between systematic and unsystematic risk is crucial for effective portfolio management and risk assessment.

Defining Systematic Risk: Market-Wide Factors

Systematic risk, also known as market risk, refers to the inherent uncertainty affecting the entire financial market due to macroeconomic factors such as interest rate changes, inflation, recessions, or geopolitical events. Unlike unsystematic risk, which is specific to individual assets or companies, systematic risk cannot be diversified away through portfolio selection. Key indicators of systematic risk include market beta, which measures an asset's sensitivity to overall market movements.

Understanding Unsystematic Risk: Company-Specific Events

Unsystematic risk refers to the potential for loss arising from company-specific events such as management changes, product recalls, or regulatory investigations. Unlike systematic risk, which impacts the entire market, unsystematic risk affects individual companies or industries and can be mitigated through diversification. Investors analyze financial statements, market news, and industry trends to identify and manage these risks effectively.

Key Differences Between Systematic and Unsystematic Risk

Systematic risk, also known as market risk, affects the entire financial market and includes factors such as inflation, interest rates, and geopolitical events, making it unavoidable through diversification. Unsystematic risk, or specific risk, pertains to individual companies or industries and can be mitigated by maintaining a diversified portfolio. Understanding the distinction helps investors manage risk effectively by focusing diversification strategies on reducing unsystematic risk while acknowledging the persistence of systematic risk.

Examples of Systematic Risk in Financial Markets

Examples of systematic risk in financial markets include interest rate fluctuations, inflation rates, recessions, and geopolitical events that impact the entire economy. Market-wide phenomena such as changes in government monetary policy or global pandemics also represent systematic risk affecting all asset classes. These risks cannot be eliminated through diversification, as they influence the overall market systemically.

Common Causes of Unsystematic Risk

Unsystematic risk arises from factors specific to a company or industry, such as management decisions, product recalls, or regulatory changes. Common causes include corporate governance failures, labor strikes, and supply chain disruptions, which directly impact a firm's financial performance. Unlike systematic risk, unsystematic risk can be mitigated through diversification within an investment portfolio.

The Impact of Systematic and Unsystematic Risk on Portfolios

Systematic risk, also known as market risk, affects the entire market and cannot be eliminated through diversification, impacting portfolio returns during economic downturns, interest rate changes, or geopolitical events. Unsystematic risk, specific to individual companies or industries, can be minimized or mitigated by holding a well-diversified portfolio, thus reducing the overall volatility of returns. Effective portfolio management focuses on balancing exposure to systematic risk while diversifying holdings to control unsystematic risk, enhancing risk-adjusted performance.

Strategies to Manage Systematic Risk

Systematic risk, also known as market risk, affects the entire financial system and cannot be eliminated through diversification. Strategies to manage systematic risk include asset allocation across different asset classes, investing in hedging instruments such as options and futures, and employing defensive sectors like utilities and consumer staples that tend to be less sensitive to economic cycles. Incorporating global diversification and using risk management techniques like Value at Risk (VaR) models further help in mitigating the impact of market-wide uncertainties.

Diversification as a Tool to Reduce Unsystematic Risk

Diversification reduces unsystematic risk by spreading investments across various assets, industries, and geographies, minimizing the impact of any single asset's poor performance. Systematic risk, which affects the entire market, cannot be eliminated through diversification but can be managed through asset allocation and hedging strategies. Effective diversification lowers portfolio volatility and enhances risk-adjusted returns by targeting idiosyncratic risks specific to individual securities.

Importance of Risk Assessment in Financial Decision-Making

Systematic risk, also known as market risk, impacts the entire financial market and cannot be eliminated through diversification, while unsystematic risk is specific to individual assets or companies and can be mitigated by a well-diversified portfolio. Accurate assessment of both risk types is crucial for portfolio managers and investors to optimize asset allocation and achieve desired risk-adjusted returns. Incorporating quantitative risk models, such as the Capital Asset Pricing Model (CAPM), improves decision-making by quantifying expected returns relative to market risk exposure.

Systematic Risk vs Unsystematic Risk Infographic

difterm.com

difterm.com