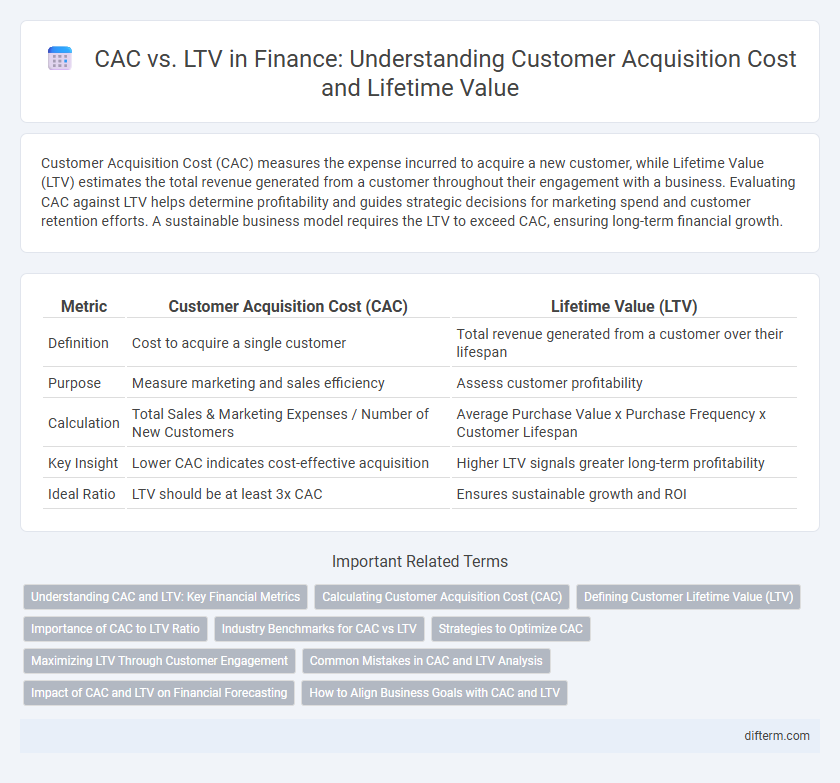

Customer Acquisition Cost (CAC) measures the expense incurred to acquire a new customer, while Lifetime Value (LTV) estimates the total revenue generated from a customer throughout their engagement with a business. Evaluating CAC against LTV helps determine profitability and guides strategic decisions for marketing spend and customer retention efforts. A sustainable business model requires the LTV to exceed CAC, ensuring long-term financial growth.

Table of Comparison

| Metric | Customer Acquisition Cost (CAC) | Lifetime Value (LTV) |

|---|---|---|

| Definition | Cost to acquire a single customer | Total revenue generated from a customer over their lifespan |

| Purpose | Measure marketing and sales efficiency | Assess customer profitability |

| Calculation | Total Sales & Marketing Expenses / Number of New Customers | Average Purchase Value x Purchase Frequency x Customer Lifespan |

| Key Insight | Lower CAC indicates cost-effective acquisition | Higher LTV signals greater long-term profitability |

| Ideal Ratio | LTV should be at least 3x CAC | Ensures sustainable growth and ROI |

Understanding CAC and LTV: Key Financial Metrics

Customer Acquisition Cost (CAC) measures the total expense required to acquire a new customer, including marketing, sales, and onboarding costs, providing insight into the efficiency of customer acquisition strategies. Lifetime Value (LTV) estimates the net revenue generated from a customer throughout their relationship with the business, helping to evaluate the profitability of customer segments and retention efforts. Comparing CAC and LTV enables businesses to assess the sustainability of growth by ensuring that the value earned from customers exceeds the cost of acquiring them.

Calculating Customer Acquisition Cost (CAC)

Calculating Customer Acquisition Cost (CAC) involves dividing the total marketing and sales expenses by the number of new customers acquired during a specific period. Precise tracking of advertising spend, sales team salaries, and onboarding costs ensures an accurate CAC measurement. A well-calculated CAC is essential for comparing against Customer Lifetime Value (LTV) to evaluate profitability and optimize marketing ROI.

Defining Customer Lifetime Value (LTV)

Customer Lifetime Value (LTV) quantifies the total revenue generated from a single customer throughout their entire relationship with a business. It incorporates metrics such as average purchase value, purchase frequency, and customer retention rate to provide a comprehensive estimate of long-term profitability. Understanding LTV is essential for optimizing marketing budgets and enhancing customer acquisition strategies by balancing it against the Customer Acquisition Cost (CAC).

Importance of CAC to LTV Ratio

The CAC to LTV ratio is a critical financial metric that measures the efficiency of acquiring customers relative to the revenue they generate over time. A balanced ratio, ideally around 1:3, indicates sustainable customer acquisition strategies and profitability. Monitoring this ratio helps businesses optimize marketing spend and predict long-term growth potential.

Industry Benchmarks for CAC vs LTV

Industry benchmarks for Customer Acquisition Cost (CAC) versus Lifetime Value (LTV) emphasize maintaining an LTV to CAC ratio between 3:1 and 5:1 for sustainable growth. SaaS companies typically report an average CAC of $1,000 to $1,500, with LTV ranging from $3,000 to $7,500, reflecting efficient customer profitability. Brands with ratios below 3:1 risk high churn and low profitability, while ratios beyond 5:1 may indicate underinvestment in customer acquisition or missed growth opportunities.

Strategies to Optimize CAC

Reducing Customer Acquisition Cost (CAC) involves targeting high-intent customer segments through precision marketing and leveraging data analytics to optimize ad spend efficiency. Implementing referral programs and improving onboarding processes increase conversion rates, thereby lowering CAC over time. Regularly analyzing customer lifetime value (LTV) ratios ensures that acquisition strategies focus on profitable, long-term customers.

Maximizing LTV Through Customer Engagement

Maximizing Customer Lifetime Value (LTV) hinges on fostering deep customer engagement, which drives repeat purchases and brand loyalty, ultimately reducing churn rates. By leveraging personalized marketing strategies and continuous interaction via multiple touchpoints, businesses can enhance customer satisfaction and increase average order frequency. Effective engagement not only extends customer lifespan but also optimizes the ratio of LTV to Customer Acquisition Cost (CAC), resulting in improved profitability and sustainable growth.

Common Mistakes in CAC and LTV Analysis

Misinterpreting Customer Acquisition Cost (CAC) and Lifetime Value (LTV) metrics often leads to flawed financial strategies in business growth management. Common mistakes include underestimating the CAC by ignoring hidden expenses such as marketing overhead and customer onboarding costs, and overestimating the LTV by failing to account for customer churn rates and changing purchasing behaviors. Accurate CAC and LTV analysis requires integrating comprehensive data tracking and employing dynamic models to reflect real-time customer value and acquisition efficiency.

Impact of CAC and LTV on Financial Forecasting

Customer Acquisition Cost (CAC) directly influences cash flow projections by determining how much capital is required to acquire each new customer, impacting budget allocation and break-even timelines. Lifetime Value (LTV) provides a predictive measure of revenue per customer, guiding investment decisions and long-term profitability assessments. Balancing CAC against LTV enhances accuracy in financial forecasting, enabling businesses to optimize marketing spend and maximize return on investment.

How to Align Business Goals with CAC and LTV

Aligning business goals with Customer Acquisition Cost (CAC) and Lifetime Value (LTV) requires tracking these metrics to optimize budget allocation toward channels that maximize LTV to CAC ratio. Setting targets where LTV significantly exceeds CAC ensures sustainable growth and higher profitability. Regularly analyzing customer behavior and acquisition costs enables businesses to refine marketing strategies, ultimately driving alignment between financial objectives and operational execution.

CAC vs LTV Infographic

difterm.com

difterm.com