Systematic risk refers to the inherent market-wide risks that affect all securities, such as economic recessions, interest rate changes, and geopolitical events, which cannot be eliminated through diversification. Idiosyncratic risk, on the other hand, is specific to an individual asset or company, stemming from factors like management decisions or product recalls, and can be mitigated by holding a diversified portfolio. Investors must differentiate between these risks to optimize their portfolio strategies and achieve efficient risk management.

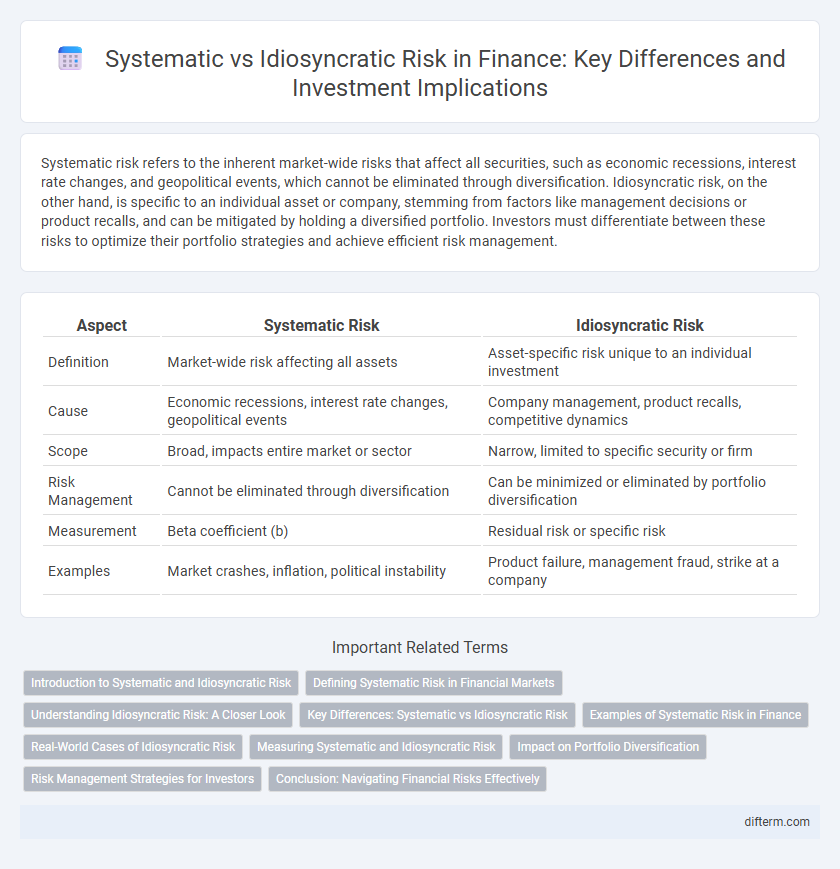

Table of Comparison

| Aspect | Systematic Risk | Idiosyncratic Risk |

|---|---|---|

| Definition | Market-wide risk affecting all assets | Asset-specific risk unique to an individual investment |

| Cause | Economic recessions, interest rate changes, geopolitical events | Company management, product recalls, competitive dynamics |

| Scope | Broad, impacts entire market or sector | Narrow, limited to specific security or firm |

| Risk Management | Cannot be eliminated through diversification | Can be minimized or eliminated by portfolio diversification |

| Measurement | Beta coefficient (b) | Residual risk or specific risk |

| Examples | Market crashes, inflation, political instability | Product failure, management fraud, strike at a company |

Introduction to Systematic and Idiosyncratic Risk

Systematic risk refers to the overall market risk that affects all securities and cannot be eliminated through diversification, driven by macroeconomic factors such as interest rate changes, inflation, or geopolitical events. In contrast, idiosyncratic risk is asset-specific risk unique to an individual company or industry, which can be mitigated by holding a diversified portfolio. Understanding the distinction between systematic and idiosyncratic risk is essential for optimizing portfolio management and risk assessment strategies.

Defining Systematic Risk in Financial Markets

Systematic risk refers to the inherent uncertainty in financial markets that affects the entire market or a broad sector, driven by macroeconomic factors such as interest rates, inflation, and geopolitical events. This type of risk is undiversifiable, meaning it cannot be eliminated through portfolio diversification, impacting all assets to some degree. Understanding systematic risk is critical for portfolio management and risk assessment, as it influences market-wide fluctuations and investment performance.

Understanding Idiosyncratic Risk: A Closer Look

Idiosyncratic risk refers to the uncertainty inherent to a specific company or industry, distinct from market-wide influences and can be mitigated through diversification within a portfolio. Unlike systematic risk, which affects the entire market or economy, idiosyncratic risk stems from factors such as management decisions, product recalls, or regulatory changes specific to an individual firm. Investors aim to minimize idiosyncratic risk by holding a well-diversified portfolio, thereby reducing the impact of any single asset's volatility on overall returns.

Key Differences: Systematic vs Idiosyncratic Risk

Systematic risk refers to market-wide factors such as economic recessions, interest rate changes, and geopolitical events that impact the entire financial system, while idiosyncratic risk arises from company-specific issues like management decisions, product recalls, or labor strikes. Unlike systematic risk, idiosyncratic risk can be reduced or eliminated through diversification within a portfolio. Systematic risk is measured by beta in the Capital Asset Pricing Model (CAPM), reflecting sensitivity to market movements, whereas idiosyncratic risk contributes to a stock's unique variance unexplained by market factors.

Examples of Systematic Risk in Finance

Systematic risk in finance refers to market-wide risks that affect all assets, such as recessions, interest rate changes, inflation, and geopolitical events. Examples include the 2008 global financial crisis, Federal Reserve interest rate hikes, and the COVID-19 pandemic's impact on global markets. These risks cannot be eliminated through diversification and influence the overall market environment.

Real-World Cases of Idiosyncratic Risk

Idiosyncratic risk refers to company-specific or asset-specific risk that can be mitigated through diversification, unlike systematic risk which impacts the entire market. Real-world cases include the 2018 Tesla production delays and CEO controversies that affected Tesla stock independently of broader market movements. Similarly, the 2020 bankruptcy of Hertz demonstrated idiosyncratic risk by impacting its stock while the overall market was recovering from the COVID-19 crash.

Measuring Systematic and Idiosyncratic Risk

Systematic risk is measured using beta, which quantifies an asset's sensitivity to overall market movements, while idiosyncratic risk is assessed through the variance of residuals after accounting for beta in a regression model like the Capital Asset Pricing Model (CAPM). The decomposition of total risk into systematic and idiosyncratic components allows investors to understand market-wide influences versus asset-specific factors. Tools such as the Sharpe ratio and the Fama-French three-factor model enhance precision by isolating systematic risk, whereas diversification primarily reduces idiosyncratic risk.

Impact on Portfolio Diversification

Systematic risk affects the entire market and cannot be eliminated through diversification, making it a critical factor in portfolio risk management. Idiosyncratic risk is specific to individual assets and can be significantly reduced by holding a well-diversified portfolio. Effective diversification minimizes idiosyncratic risk but leaves systematic risk as the primary source of portfolio volatility.

Risk Management Strategies for Investors

Systematic risk affects the entire market and cannot be eliminated through diversification, making strategies like asset allocation and hedging essential for managing market-wide exposure. Idiosyncratic risk is specific to individual assets and can be mitigated by diversifying investment portfolios across various sectors and securities. Investors employ risk management tools such as beta analysis, stop-loss orders, and options to balance both types of risk and enhance portfolio resilience.

Conclusion: Navigating Financial Risks Effectively

Effective navigation of financial risks requires distinguishing between systematic risk, which affects the entire market and cannot be eliminated through diversification, and idiosyncratic risk, which is specific to individual assets and can be mitigated by portfolio diversification. Investors optimize returns by focusing on systematic risk assessment through macroeconomic indicators and market trends while employing diversification strategies to minimize idiosyncratic risk. Understanding these risk types enhances risk management frameworks and informs strategic asset allocation decisions in dynamic financial markets.

Systematic Risk vs Idiosyncratic Risk Infographic

difterm.com

difterm.com