Derivatives are financial contracts whose value is derived from the performance of underlying assets such as stocks, bonds, or commodities, while securities represent ownership or creditor relationships in those assets. Unlike securities, derivatives do not confer ownership rights but are used primarily for hedging risk or speculative purposes. Understanding the distinct roles and risk profiles of derivatives versus securities is essential for effective portfolio management and regulatory compliance.

Table of Comparison

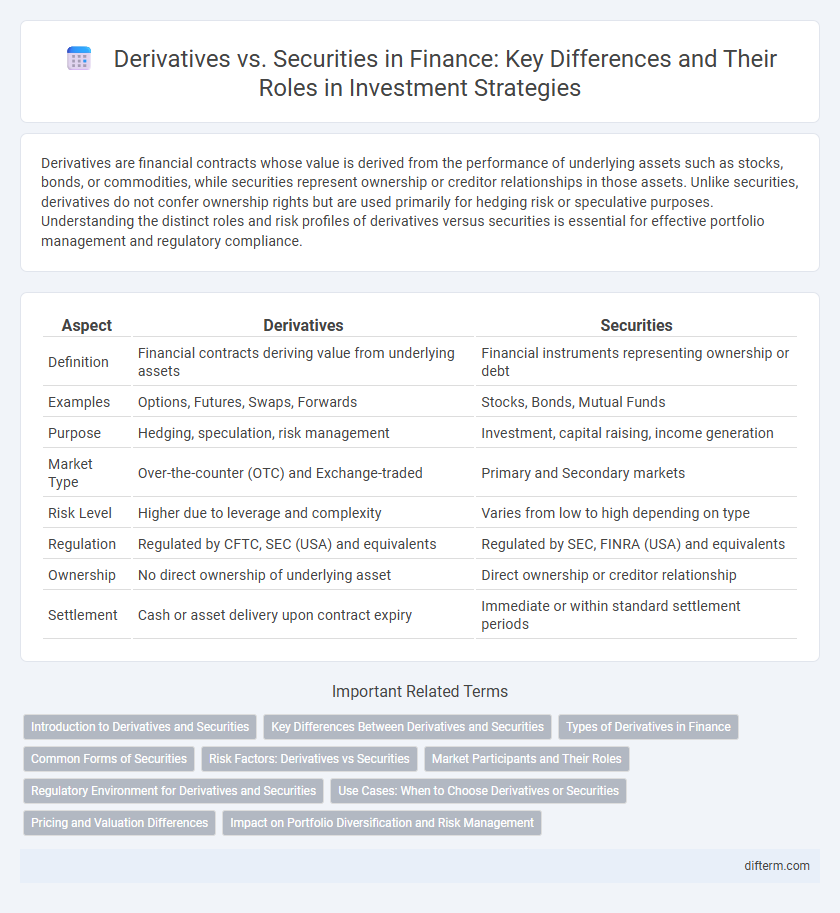

| Aspect | Derivatives | Securities |

|---|---|---|

| Definition | Financial contracts deriving value from underlying assets | Financial instruments representing ownership or debt |

| Examples | Options, Futures, Swaps, Forwards | Stocks, Bonds, Mutual Funds |

| Purpose | Hedging, speculation, risk management | Investment, capital raising, income generation |

| Market Type | Over-the-counter (OTC) and Exchange-traded | Primary and Secondary markets |

| Risk Level | Higher due to leverage and complexity | Varies from low to high depending on type |

| Regulation | Regulated by CFTC, SEC (USA) and equivalents | Regulated by SEC, FINRA (USA) and equivalents |

| Ownership | No direct ownership of underlying asset | Direct ownership or creditor relationship |

| Settlement | Cash or asset delivery upon contract expiry | Immediate or within standard settlement periods |

Introduction to Derivatives and Securities

Derivatives are financial contracts whose value is derived from the price of an underlying asset, such as stocks, bonds, commodities, or market indexes. Securities encompass a broad range of tradable financial instruments including equities, bonds, and derivatives, serving as investment vehicles that represent ownership or creditor relationships. Understanding the distinction between derivatives and securities is crucial for managing risk, portfolio diversification, and leveraging market opportunities in modern finance.

Key Differences Between Derivatives and Securities

Derivatives are financial contracts whose value is derived from the underlying asset, such as stocks, bonds, commodities, or interest rates, whereas securities represent ownership or debt instruments with intrinsic value. Key differences include derivatives often used for hedging or speculation with leveraged exposure, while securities are typically investment vehicles providing dividends, interest, or capital gains. Securities are traded on regulated exchanges or over-the-counter markets, but derivatives can have more complex pricing influenced by factors like volatility, time decay, and underlying asset fluctuations.

Types of Derivatives in Finance

Derivatives in finance include futures, options, forwards, and swaps, each serving as contracts that derive value from underlying assets like stocks, bonds, currencies, or interest rates. Futures contracts obligate the parties to transact an asset at a predetermined price on a specified future date, while options provide the right but not the obligation to buy or sell at a set price within a certain period. Swaps allow parties to exchange cash flows or liabilities, commonly used for interest rate or currency risk management, distinguishing derivatives from traditional securities like stocks or bonds that represent ownership or debt.

Common Forms of Securities

Common forms of securities include equities, such as stocks, and debt instruments like bonds, which represent ownership and creditor relationships, respectively. Derivatives differ by deriving value from underlying securities or assets, including options, futures, and swaps. Understanding securities is crucial for portfolio diversification and risk management in financial markets.

Risk Factors: Derivatives vs Securities

Derivatives expose investors to higher leverage-related risks compared to traditional securities, amplifying both potential gains and losses. Securities, such as stocks and bonds, generally present lower market and credit risks, offering more stable investment profiles. The complexity and counterparty risk inherent in derivatives demand advanced risk management techniques to mitigate potential financial volatility.

Market Participants and Their Roles

Derivatives market participants include hedgers, speculators, and arbitrageurs who manage risk, seek profits, and exploit price discrepancies respectively, while securities market participants mainly consist of investors, issuers, and intermediaries focused on capital allocation and ownership stakes. Hedgers in derivatives use contracts like futures and options to mitigate financial exposure, contrasting with security investors who directly buy stocks or bonds for income or growth. Market makers and brokers facilitate liquidity and trade execution in both markets but operate under distinct regulatory frameworks tailored to the specific characteristics of derivatives versus securities.

Regulatory Environment for Derivatives and Securities

The regulatory environment for derivatives is often more complex and stringent due to their higher risk and potential for systemic impact, with frameworks such as Dodd-Frank Act and EMIR imposing mandatory clearing, reporting, and margin requirements. Securities regulation is governed by agencies like the SEC in the United States and involves extensive disclosure, registration, and investor protection rules under laws such as the Securities Act of 1933 and the Securities Exchange Act of 1934. Compliance for derivatives demands continuous risk monitoring and transparency in over-the-counter markets, whereas securities regulation emphasizes market integrity and fraud prevention in issued stocks and bonds.

Use Cases: When to Choose Derivatives or Securities

Derivatives excel in risk management by enabling hedging against price fluctuations in assets like commodities, currencies, or interest rates, making them ideal for managing financial exposure. Securities provide direct investment opportunities in ownership or debt instruments, suited for long-term wealth accumulation and income generation through dividends or interest payments. Choosing derivatives is optimal when seeking leverage or protection, while securities are best for investors aiming for capital growth or stable cash flows.

Pricing and Valuation Differences

Derivatives derive their value from underlying assets such as stocks, bonds, or commodities, and their pricing relies heavily on models that factor in variables like time to expiration, volatility, and interest rates, with the Black-Scholes model being a prominent example. Securities, including stocks and bonds, are typically valued based on fundamental analysis involving factors like earnings, dividends, and credit risk, often using discounted cash flow models. The key pricing difference is that derivatives require sophisticated mathematical frameworks to capture time-sensitive risks and leverage effects, whereas securities valuation depends more on intrinsic asset performance and market conditions.

Impact on Portfolio Diversification and Risk Management

Derivatives enable portfolio diversification by allowing investors to hedge against risk through contracts based on underlying assets, reducing exposure to market volatility. Securities, such as stocks and bonds, offer direct ownership or debt claims but typically carry inherent market risks tied to the asset's performance. Utilizing derivatives alongside securities enhances risk management strategies by providing tools for downside protection and leverage optimization in diversified portfolios.

Derivatives vs Securities Infographic

difterm.com

difterm.com