A buyback reduces the number of outstanding shares, potentially boosting earnings per share and signaling confidence in the company's future prospects. Dividend payouts provide shareholders with immediate income, appealing to investors seeking regular cash flow. Both strategies influence shareholder value but cater to different investor preferences and tax considerations.

Table of Comparison

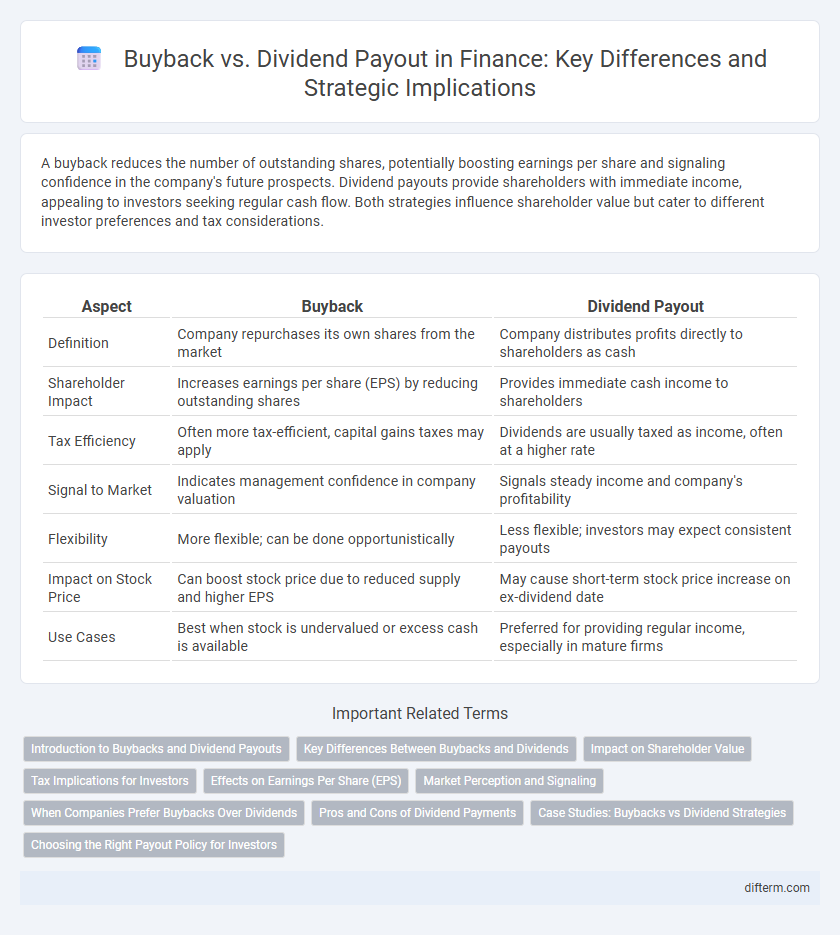

| Aspect | Buyback | Dividend Payout |

|---|---|---|

| Definition | Company repurchases its own shares from the market | Company distributes profits directly to shareholders as cash |

| Shareholder Impact | Increases earnings per share (EPS) by reducing outstanding shares | Provides immediate cash income to shareholders |

| Tax Efficiency | Often more tax-efficient, capital gains taxes may apply | Dividends are usually taxed as income, often at a higher rate |

| Signal to Market | Indicates management confidence in company valuation | Signals steady income and company's profitability |

| Flexibility | More flexible; can be done opportunistically | Less flexible; investors may expect consistent payouts |

| Impact on Stock Price | Can boost stock price due to reduced supply and higher EPS | May cause short-term stock price increase on ex-dividend date |

| Use Cases | Best when stock is undervalued or excess cash is available | Preferred for providing regular income, especially in mature firms |

Introduction to Buybacks and Dividend Payouts

Stock buybacks and dividend payouts are two primary methods companies use to return capital to shareholders, each with distinct financial implications and strategic purposes. Buybacks involve the repurchase of a company's own shares from the market, reducing outstanding shares and often increasing earnings per share. Dividend payouts distribute a portion of a company's earnings directly to shareholders, providing a steady income stream and signaling financial health and confidence.

Key Differences Between Buybacks and Dividends

Buybacks reduce the number of outstanding shares, increasing earnings per share and potentially boosting stock prices, while dividends distribute cash directly to shareholders as income. Buybacks offer tax advantages because capital gains taxes often apply only when shares are sold, whereas dividends are taxed as income upon receipt. Dividend payouts provide predictable income streams, appealing to income-focused investors, whereas buybacks offer flexibility to companies to manage capital without committing to regular cash payments.

Impact on Shareholder Value

Buybacks reduce the number of outstanding shares, increasing earnings per share (EPS) and potentially boosting stock prices, which can enhance shareholder value by signaling management's confidence in the company's growth prospects. Dividend payouts provide immediate cash returns to shareholders, appealing to income-focused investors and reflecting stable profitability, but they may limit reinvestment opportunities for future growth. The choice between buybacks and dividends significantly affects shareholder wealth depending on tax implications, market perception, and the firm's long-term strategy.

Tax Implications for Investors

Buybacks often provide more favorable tax treatment for investors because capital gains tax rates are typically lower than dividend income tax rates, allowing shareholders to defer taxes until they sell their shares. In contrast, dividend payouts are taxed as ordinary income at the investor's income tax rate, which can be higher depending on the taxpayer's bracket. This tax efficiency makes share repurchases attractive, especially for investors in higher tax brackets seeking to minimize immediate tax liabilities.

Effects on Earnings Per Share (EPS)

Buybacks reduce the number of outstanding shares, directly increasing Earnings Per Share (EPS) by concentrating net income across fewer shares. Dividend payouts do not change the share count but distribute profits to shareholders, leaving EPS unaffected in the short term. Companies often prefer buybacks when aiming to boost EPS metrics without altering net income.

Market Perception and Signaling

Buybacks often signal management's confidence in the company's undervalued stock, which can lead to a positive market perception and potential stock price appreciation. Dividend payouts are perceived as a sign of stable and predictable cash flows, appealing to income-focused investors seeking sustained returns. Market participants interpret buybacks as flexible capital return strategies, while dividends are viewed as commitments reflecting long-term financial health.

When Companies Prefer Buybacks Over Dividends

Companies often prefer buybacks over dividends when aiming to enhance shareholder value through stock price appreciation and retain flexibility in capital allocation. Buybacks can signal management's confidence in undervalued shares and allow tax-efficient returns compared to dividends, which are immediately taxable income for shareholders. Firms with fluctuating earnings or needing to optimize capital structure frequently choose repurchases to avoid the commitment associated with recurring dividend payments.

Pros and Cons of Dividend Payments

Dividend payments provide a steady income stream to shareholders, often signaling company confidence and financial stability, which can attract long-term investors and enhance stock value. However, consistent dividend payouts reduce retained earnings, limiting reinvestment opportunities for growth and potentially leading to higher taxation for shareholders compared to capital gains from buybacks. Companies must weigh the benefit of rewarding shareholders immediately against maintaining sufficient capital for expansion and operational flexibility.

Case Studies: Buybacks vs Dividend Strategies

Analyzing case studies reveals that companies like Apple and Microsoft have leveraged buybacks to enhance shareholder value by reducing outstanding shares and boosting earnings per share, while firms like Procter & Gamble prioritize dividend payouts to provide steady income and attract long-term investors. Buybacks often allow for flexible capital allocation and can signal management's confidence in the company's future prospects, whereas dividends create a predictable cash flow appealing to income-focused investors. Empirical data shows buyback-heavy strategies typically correlate with stock price appreciation, whereas consistent dividend payments foster investor loyalty and reduce volatility.

Choosing the Right Payout Policy for Investors

Buyback programs return capital to shareholders by repurchasing shares, often signaling undervaluation and providing tax advantages. Dividend payouts offer consistent income, appealing to investors seeking stable cash flow and signaling steady earnings. Selecting the right payout policy depends on investor preferences for immediate income versus potential capital gains and tax considerations.

Buyback vs Dividend payout Infographic

difterm.com

difterm.com