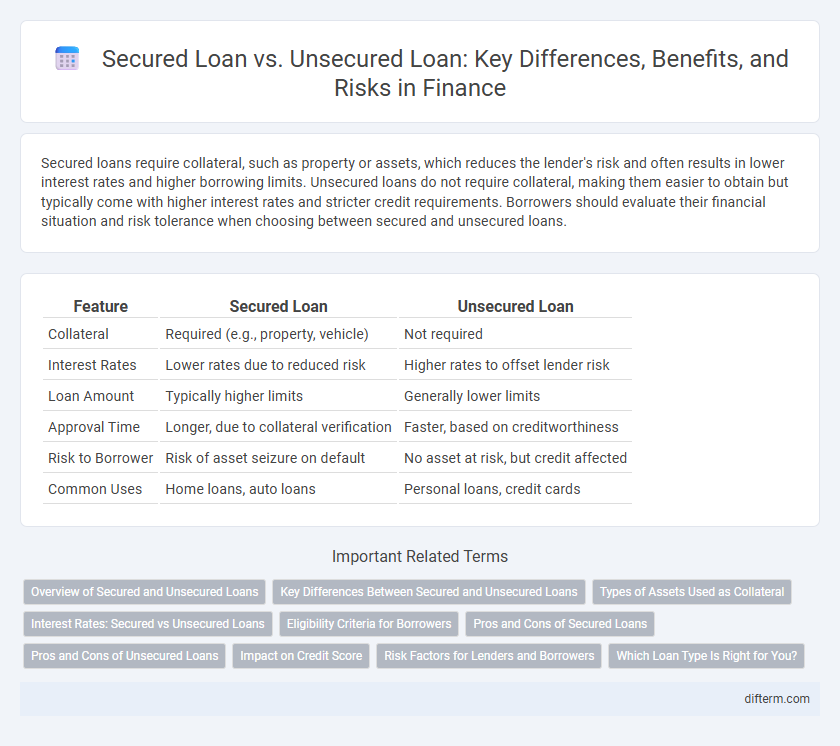

Secured loans require collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates and higher borrowing limits. Unsecured loans do not require collateral, making them easier to obtain but typically come with higher interest rates and stricter credit requirements. Borrowers should evaluate their financial situation and risk tolerance when choosing between secured and unsecured loans.

Table of Comparison

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral | Required (e.g., property, vehicle) | Not required |

| Interest Rates | Lower rates due to reduced risk | Higher rates to offset lender risk |

| Loan Amount | Typically higher limits | Generally lower limits |

| Approval Time | Longer, due to collateral verification | Faster, based on creditworthiness |

| Risk to Borrower | Risk of asset seizure on default | No asset at risk, but credit affected |

| Common Uses | Home loans, auto loans | Personal loans, credit cards |

Overview of Secured and Unsecured Loans

Secured loans require collateral, such as property or assets, reducing lender risk and often resulting in lower interest rates. Unsecured loans do not require collateral, relying on the borrower's creditworthiness, typically leading to higher interest rates and stricter qualification criteria. Understanding the distinction helps borrowers choose the optimal financing option based on their risk tolerance and financial situation.

Key Differences Between Secured and Unsecured Loans

Secured loans require collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates and higher borrowing limits. Unsecured loans do not require collateral, relying solely on the borrower's creditworthiness, leading to higher interest rates and stricter qualification criteria. The key differences between these loan types impact repayment terms, approval processes, and potential consequences in case of default.

Types of Assets Used as Collateral

Secured loans require tangible assets as collateral, commonly including real estate properties, vehicles, savings accounts, or investment portfolios, which lenders can seize if the borrower defaults. Unsecured loans do not involve physical asset pledges, relying on the borrower's creditworthiness and income instead. The presence or absence of collateral significantly influences interest rates, loan amounts, and approval likelihood in financing decisions.

Interest Rates: Secured vs Unsecured Loans

Secured loans typically feature lower interest rates due to the collateral that reduces lender risk, often ranging between 3% to 8% depending on creditworthiness and market conditions. Unsecured loans carry higher interest rates, usually between 8% and 20%, to offset the increased risk lenders face without collateral backing. Understanding these rate differences is crucial for borrowers aiming to optimize borrowing costs and financial planning.

Eligibility Criteria for Borrowers

Secured loans require borrowers to provide collateral such as property or savings, which significantly lowers the risk for lenders and typically results in easier approval for individuals with less-than-perfect credit. Unsecured loans rely solely on the borrower's creditworthiness, income stability, and debt-to-income ratio, making the eligibility criteria stricter and approval more challenging for those with poor credit history. Lenders assess factors including credit scores, employment status, and existing financial obligations to determine borrower eligibility for both loan types.

Pros and Cons of Secured Loans

Secured loans offer lower interest rates and higher borrowing limits due to collateral backing, reducing lender risk and making them accessible for large purchases like homes or vehicles. However, the main disadvantage is the risk of asset repossession if the borrower defaults, potentially leading to significant financial loss. These loans also often involve longer approval times and stricter credit requirements compared to unsecured loans.

Pros and Cons of Unsecured Loans

Unsecured loans offer the advantage of not requiring collateral, making them accessible for borrowers without valuable assets. They typically have higher interest rates compared to secured loans due to the increased risk for lenders, which can result in higher overall borrowing costs. The lack of collateral means defaulting can lead to damage to credit scores and legal actions, but not immediate loss of property.

Impact on Credit Score

Secured loans typically have a more positive impact on credit scores due to lower risk for lenders, often resulting in higher approval chances and better interest rates. In contrast, unsecured loans carry higher risk and may lead to stricter credit evaluations, potentially causing greater fluctuations in credit scores if payments are missed. Consistent, on-time payments on either loan type are critical for maintaining or improving credit rating.

Risk Factors for Lenders and Borrowers

Secured loans reduce risk for lenders by collateralizing assets, minimizing potential losses in case of default, while unsecured loans expose lenders to higher risks due to the lack of collateral. Borrowers face the risk of losing pledged assets with secured loans, whereas unsecured loans often carry higher interest rates to compensate for increased lender risk. Both loan types require careful assessment of creditworthiness and repayment capacity to mitigate financial risks effectively.

Which Loan Type Is Right for You?

Assess your financial situation and collateral availability when deciding between a secured loan and an unsecured loan, as secured loans require assets like property or vehicles to reduce lender risk, often resulting in lower interest rates. Unsecured loans, lacking collateral, typically have higher interest rates but offer quicker approval and less risk to personal assets. Choose a secured loan for larger amounts and longer terms if you own valuable collateral; opt for an unsecured loan for smaller sums or short-term needs without risking your property.

Secured Loan vs Unsecured Loan Infographic

difterm.com

difterm.com