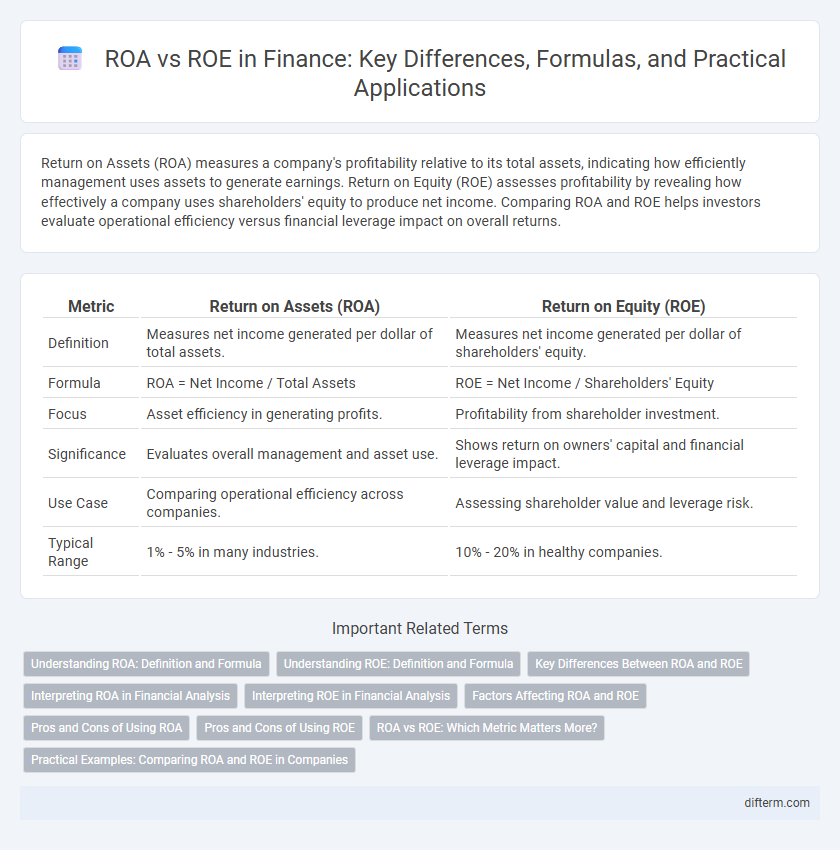

Return on Assets (ROA) measures a company's profitability relative to its total assets, indicating how efficiently management uses assets to generate earnings. Return on Equity (ROE) assesses profitability by revealing how effectively a company uses shareholders' equity to produce net income. Comparing ROA and ROE helps investors evaluate operational efficiency versus financial leverage impact on overall returns.

Table of Comparison

| Metric | Return on Assets (ROA) | Return on Equity (ROE) |

|---|---|---|

| Definition | Measures net income generated per dollar of total assets. | Measures net income generated per dollar of shareholders' equity. |

| Formula | ROA = Net Income / Total Assets | ROE = Net Income / Shareholders' Equity |

| Focus | Asset efficiency in generating profits. | Profitability from shareholder investment. |

| Significance | Evaluates overall management and asset use. | Shows return on owners' capital and financial leverage impact. |

| Use Case | Comparing operational efficiency across companies. | Assessing shareholder value and leverage risk. |

| Typical Range | 1% - 5% in many industries. | 10% - 20% in healthy companies. |

Understanding ROA: Definition and Formula

ROA (Return on Assets) measures a company's ability to generate profit from its total assets, reflecting operational efficiency regardless of financing structure. The formula for ROA is Net Income divided by Average Total Assets, indicating how effectively management utilizes asset investments to produce earnings. Unlike ROE, ROA provides insight into asset utilization without the influence of financial leverage, making it crucial for assessing core business performance.

Understanding ROE: Definition and Formula

Return on Equity (ROE) measures a company's profitability relative to shareholders' equity, indicating how effectively management generates profits from invested capital. It is calculated using the formula: ROE = Net Income / Shareholders' Equity. This ratio is essential for investors to assess financial performance and compare efficiency across firms within the finance sector.

Key Differences Between ROA and ROE

Return on Assets (ROA) measures a company's ability to generate profit from its total assets, reflecting operational efficiency, while Return on Equity (ROE) assesses profitability relative to shareholders' equity, highlighting financial leverage effects. ROA provides insights into asset utilization regardless of capital structure, whereas ROE emphasizes returns to equity investors and is influenced by debt levels. Understanding the distinction aids investors in evaluating both operational performance and the impact of financial leverage on profitability.

Interpreting ROA in Financial Analysis

Return on Assets (ROA) measures a company's ability to generate profit from its total assets, providing insight into operational efficiency and asset utilization. A higher ROA indicates effective management in deploying assets to produce earnings, which is crucial for comparing firms within capital-intensive industries. Unlike Return on Equity (ROE), which highlights shareholder profitability, ROA offers a more comprehensive view of financial health by assessing returns before financial leverage effects.

Interpreting ROE in Financial Analysis

Return on Equity (ROE) measures a company's profitability by revealing how much profit is generated with shareholders' equity, serving as a key indicator of financial performance and management efficiency. In financial analysis, a higher ROE indicates effective utilization of equity capital to generate earnings, reflecting strong operational efficiency and potential for shareholder value growth. Comparing ROE with Return on Assets (ROA) helps analysts understand the impact of financial leverage, as ROE magnifies profits relative to equity, while ROA assesses overall asset efficiency irrespective of financing structure.

Factors Affecting ROA and ROE

Return on Assets (ROA) is primarily influenced by asset efficiency and profit margins, reflecting how effectively a company utilizes its assets to generate earnings. Return on Equity (ROE) depends significantly on financial leverage, equity levels, and net income, revealing the profitability generated from shareholders' investments. Variations in asset turnover, debt ratios, and profitability margins directly impact the divergence between ROA and ROE values.

Pros and Cons of Using ROA

Return on Assets (ROA) measures a company's efficiency in generating profit from its total assets, offering a clear view of operational performance regardless of capital structure. It highlights how effectively management uses assets to produce earnings, which is especially useful for asset-intensive industries but may undervalue companies with high leverage. Limitations include its sensitivity to asset valuation and depreciation methods, potentially distorting comparisons across firms with varying asset bases and financing strategies.

Pros and Cons of Using ROE

Return on Equity (ROE) measures a company's profitability by revealing how much profit is generated with shareholders' equity, making it a key indicator of financial performance and shareholder value creation. Its pros include highlighting management effectiveness in using equity capital and attracting investors seeking high returns, while cons involve potential distortion by high debt levels and excluding asset efficiency insights that Return on Assets (ROA) provides. Investors and analysts should consider ROE alongside other ratios like ROA to get a comprehensive view of financial health and risk.

ROA vs ROE: Which Metric Matters More?

Return on Assets (ROA) measures a company's efficiency in generating profit from its total assets, while Return on Equity (ROE) assesses profitability relative to shareholders' equity. ROA is crucial for evaluating asset utilization and operational efficiency, particularly in asset-intensive industries, whereas ROE highlights financial leverage's impact on shareholder returns. Investors prioritize ROE when assessing equity profitability but use ROA for understanding core business performance without debt influence.

Practical Examples: Comparing ROA and ROE in Companies

ROA (Return on Assets) measures a company's efficiency in generating profits from its total assets, while ROE (Return on Equity) indicates profitability relative to shareholders' equity. For example, a manufacturing firm with high leverage might show a moderate ROA but a significantly higher ROE due to debt financing amplifying returns on equity. Conversely, a tech company with minimal debt could have similar ROA and ROE values, reflecting efficient asset use without financial leverage distortions.

ROA vs ROE Infographic

difterm.com

difterm.com