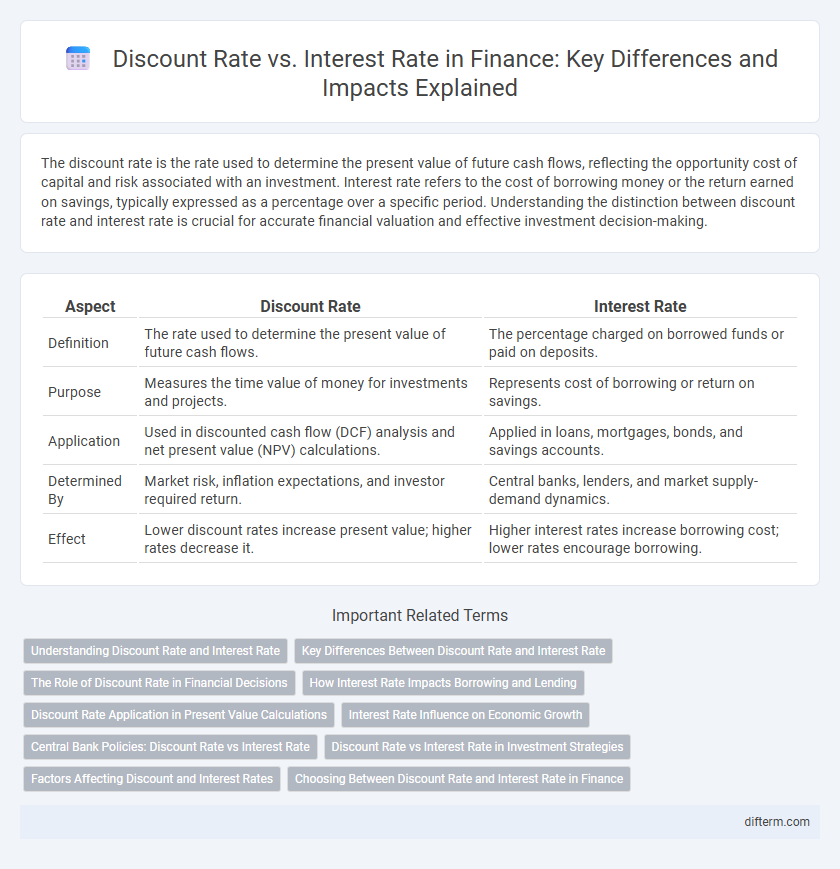

The discount rate is the rate used to determine the present value of future cash flows, reflecting the opportunity cost of capital and risk associated with an investment. Interest rate refers to the cost of borrowing money or the return earned on savings, typically expressed as a percentage over a specific period. Understanding the distinction between discount rate and interest rate is crucial for accurate financial valuation and effective investment decision-making.

Table of Comparison

| Aspect | Discount Rate | Interest Rate |

|---|---|---|

| Definition | The rate used to determine the present value of future cash flows. | The percentage charged on borrowed funds or paid on deposits. |

| Purpose | Measures the time value of money for investments and projects. | Represents cost of borrowing or return on savings. |

| Application | Used in discounted cash flow (DCF) analysis and net present value (NPV) calculations. | Applied in loans, mortgages, bonds, and savings accounts. |

| Determined By | Market risk, inflation expectations, and investor required return. | Central banks, lenders, and market supply-demand dynamics. |

| Effect | Lower discount rates increase present value; higher rates decrease it. | Higher interest rates increase borrowing cost; lower rates encourage borrowing. |

Understanding Discount Rate and Interest Rate

The discount rate represents the rate used to determine the present value of future cash flows, crucial for investment appraisal and valuation models. Interest rate reflects the cost of borrowing money or the return earned on savings over time, influenced by central bank policies and market conditions. Distinguishing between these rates aids in accurately assessing project viability and financial decision-making.

Key Differences Between Discount Rate and Interest Rate

The discount rate represents the rate used to determine the present value of future cash flows in discounted cash flow (DCF) analysis, reflecting the opportunity cost of capital and risk. The interest rate is the cost of borrowing money, expressed as a percentage of the principal, impacting loan payments and bond yields. Key differences include the discount rate being primarily used for valuation and investment decisions, while the interest rate governs borrowing costs and lending returns.

The Role of Discount Rate in Financial Decisions

The discount rate serves as a critical benchmark in financial decisions, determining the present value of future cash flows to assess investment viability. It reflects the opportunity cost of capital and risk associated with an investment, guiding firms in project evaluation and capital budgeting. Unlike the interest rate, which primarily influences borrowing costs, the discount rate directly impacts asset valuation and strategic financial planning.

How Interest Rate Impacts Borrowing and Lending

Interest rates directly influence borrowing costs by determining the amount borrowers pay over the principal, affecting loan affordability and demand. Higher interest rates typically reduce borrowing by increasing debt expenses, while lenders benefit from improved returns and greater incentive to supply credit. Central banks adjust interest rates to regulate economic activity, impacting credit flow, consumer spending, and investment decisions.

Discount Rate Application in Present Value Calculations

The discount rate is crucial in present value calculations as it reflects the time value of money and risk associated with future cash flows, allowing investors to determine the current worth of expected earnings. It serves as a benchmark that adjusts future cash flows to their present value, facilitating investment appraisal and capital budgeting decisions. Unlike the nominal interest rate, the discount rate accounts for inflation and risk premiums, making it integral to accurate financial forecasting and valuation.

Interest Rate Influence on Economic Growth

Interest rates play a crucial role in influencing economic growth by affecting borrowing costs for businesses and consumers, which in turn impacts investment and spending levels. Lower interest rates typically encourage increased capital expenditure and consumer spending, stimulating economic expansion, while higher rates tend to restrain borrowing and slow growth. Central banks strategically adjust interest rates to control inflation and maintain steady economic progress.

Central Bank Policies: Discount Rate vs Interest Rate

Central banks use the discount rate as the interest charged to commercial banks for short-term loans, influencing liquidity and credit availability. The interest rate, often referring to the benchmark policy rate like the federal funds rate, guides broader economic activity by impacting borrowing costs for consumers and businesses. Together, adjustments in the discount rate and key interest rates shape monetary policy effects on inflation, employment, and economic growth.

Discount Rate vs Interest Rate in Investment Strategies

The discount rate reflects the present value of future cash flows, directly impacting investment valuation by adjusting expected returns to their current worth. Interest rates serve as the cost of borrowing or the yield on savings, influencing the opportunity cost and funding expenses within investment strategies. Understanding the interplay between discount rate and interest rate is crucial for accurately assessing project viability and optimizing portfolio allocation.

Factors Affecting Discount and Interest Rates

Discount rates and interest rates are influenced by inflation expectations, central bank policies, and the overall economic environment. Credit risk and time horizon further impact the determination of these rates, as higher risk and longer durations typically increase both discounting and borrowing costs. Market liquidity and monetary supply also play critical roles in shaping the fluctuations of discount and interest rates within financial markets.

Choosing Between Discount Rate and Interest Rate in Finance

Choosing between discount rate and interest rate in finance depends on the specific application, where the discount rate is primarily used to calculate the present value of future cash flows, reflecting risk and opportunity cost. Interest rate typically refers to the cost of borrowing or the return on investment over time, influencing loan payments and savings growth. Financial analysts prioritize the discount rate for valuation and investment decisions, while interest rate is key in lending and credit assessments.

Discount Rate vs Interest Rate Infographic

difterm.com

difterm.com