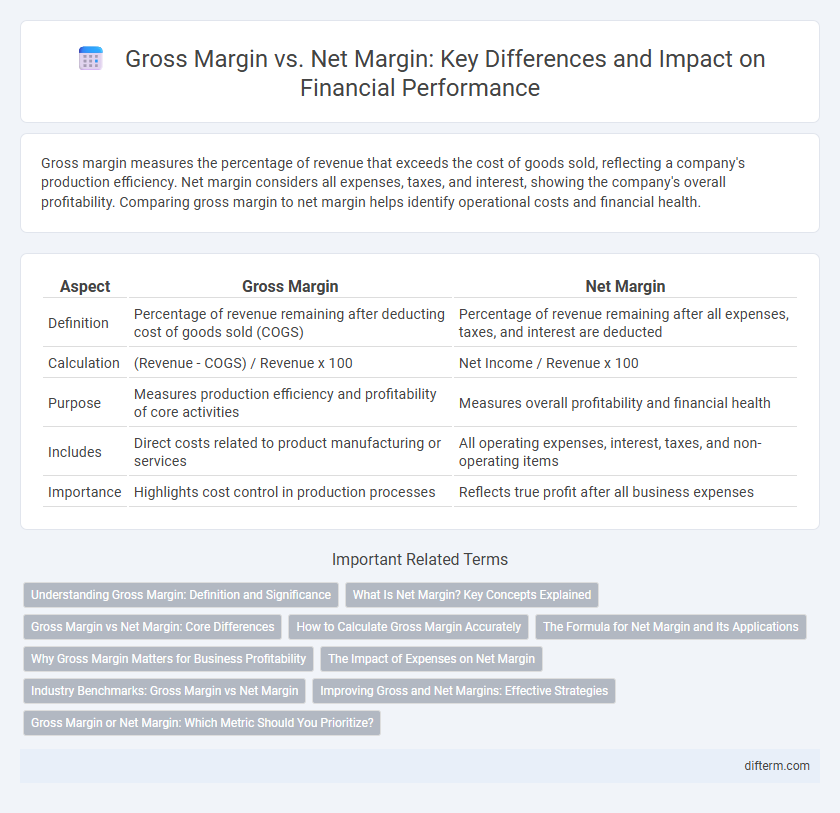

Gross margin measures the percentage of revenue that exceeds the cost of goods sold, reflecting a company's production efficiency. Net margin considers all expenses, taxes, and interest, showing the company's overall profitability. Comparing gross margin to net margin helps identify operational costs and financial health.

Table of Comparison

| Aspect | Gross Margin | Net Margin |

|---|---|---|

| Definition | Percentage of revenue remaining after deducting cost of goods sold (COGS) | Percentage of revenue remaining after all expenses, taxes, and interest are deducted |

| Calculation | (Revenue - COGS) / Revenue x 100 | Net Income / Revenue x 100 |

| Purpose | Measures production efficiency and profitability of core activities | Measures overall profitability and financial health |

| Includes | Direct costs related to product manufacturing or services | All operating expenses, interest, taxes, and non-operating items |

| Importance | Highlights cost control in production processes | Reflects true profit after all business expenses |

Understanding Gross Margin: Definition and Significance

Gross margin represents the percentage of revenue that exceeds the cost of goods sold (COGS), highlighting the efficiency of production and pricing strategies. It is calculated by subtracting COGS from total revenue and dividing the result by total revenue, providing insight into a company's core profitability before operating expenses. Understanding gross margin is crucial for evaluating operational performance and comparing profitability across industries.

What Is Net Margin? Key Concepts Explained

Net margin represents the percentage of revenue remaining after all operating expenses, interest, and taxes are deducted from total sales, reflecting a company's overall profitability. It is calculated by dividing net income by total revenue and indicates how efficiently a business converts sales into actual profit. Understanding net margin helps investors assess cost management effectiveness and the impact of non-operating expenses on a company's bottom line.

Gross Margin vs Net Margin: Core Differences

Gross margin measures the percentage of revenue remaining after deducting the cost of goods sold (COGS), highlighting production efficiency and pricing strategy. Net margin, however, reflects the overall profitability by accounting for all expenses, including operating costs, interest, and taxes, providing a comprehensive view of financial health. The core difference lies in gross margin focusing on direct production costs, while net margin encompasses total operational and financial expenses.

How to Calculate Gross Margin Accurately

Calculate Gross Margin accurately by subtracting the Cost of Goods Sold (COGS) from total revenue, then dividing the result by total revenue to express it as a percentage. This metric reflects the efficiency of production and pricing strategies by showing the proportion of revenue that exceeds direct production costs. Ensuring precise COGS data and consistent revenue recognition is critical for reliable gross margin calculations in financial analysis.

The Formula for Net Margin and Its Applications

Net Margin is calculated by dividing Net Profit by Total Revenue and multiplying by 100 to express it as a percentage, reflecting the company's overall profitability after all expenses. This metric is crucial for investors and analysts to assess the efficiency of cost management and the bottom-line performance of a business. Net Margin is widely applied in comparing profitability across companies and industries, guiding strategic decisions and financial forecasting.

Why Gross Margin Matters for Business Profitability

Gross margin measures the percentage of revenue remaining after deducting the cost of goods sold, providing insight into production efficiency and pricing strategy effectiveness. Maintaining a strong gross margin ensures a business covers operational expenses and generates sufficient profit before other costs like taxes and interest. Understanding gross margin helps identify areas for cost control and product line optimization, directly impacting overall profitability and financial health.

The Impact of Expenses on Net Margin

Gross margin highlights the percentage of revenue remaining after deducting the cost of goods sold, serving as an indicator of production efficiency. Net margin reveals the actual profitability by accounting for all expenses, including operating costs, taxes, interest, and depreciation, significantly impacting the bottom line. Higher expenses directly reduce net margin, emphasizing the importance of controlling overhead and non-operating costs to improve overall financial health.

Industry Benchmarks: Gross Margin vs Net Margin

Industry benchmarks reveal that gross margin typically ranges from 30% to 60% across sectors, reflecting core production efficiency, while net margin often falls between 5% and 15%, indicating overall profitability after operating expenses, taxes, and interest. A high gross margin paired with a low net margin suggests substantial overhead or non-operational costs impacting profitability. Comparing these margins helps investors and analysts assess a company's cost structure and financial health relative to industry standards.

Improving Gross and Net Margins: Effective Strategies

Improving gross and net margins requires targeted cost control and revenue enhancement strategies, such as optimizing supply chain management and implementing dynamic pricing models. Reducing direct production costs while increasing operational efficiency directly elevates gross margin, whereas controlling overhead expenses and minimizing tax liabilities significantly boosts net margin. Leveraging data analytics for precise financial forecasting and integrating automation tools can enhance margin performance, driving sustained profitability and competitive advantage.

Gross Margin or Net Margin: Which Metric Should You Prioritize?

Gross margin measures the percentage of revenue remaining after deducting the cost of goods sold, highlighting a company's production efficiency and pricing strategy. Net margin accounts for all expenses, taxes, and interest, providing a comprehensive view of overall profitability and financial health. Prioritize gross margin for insights into operational performance, while net margin is essential for assessing bottom-line profitability and long-term sustainability.

Gross Margin vs Net Margin Infographic

difterm.com

difterm.com