A margin call occurs when an investor's account equity falls below the broker's required maintenance margin, prompting a request for additional funds to restore the minimum balance. The maintenance margin is the minimum amount of equity that must be maintained in a margin account to avoid liquidation of positions. Understanding the difference between margin call and maintenance margin helps investors manage risk and maintain sufficient collateral during market fluctuations.

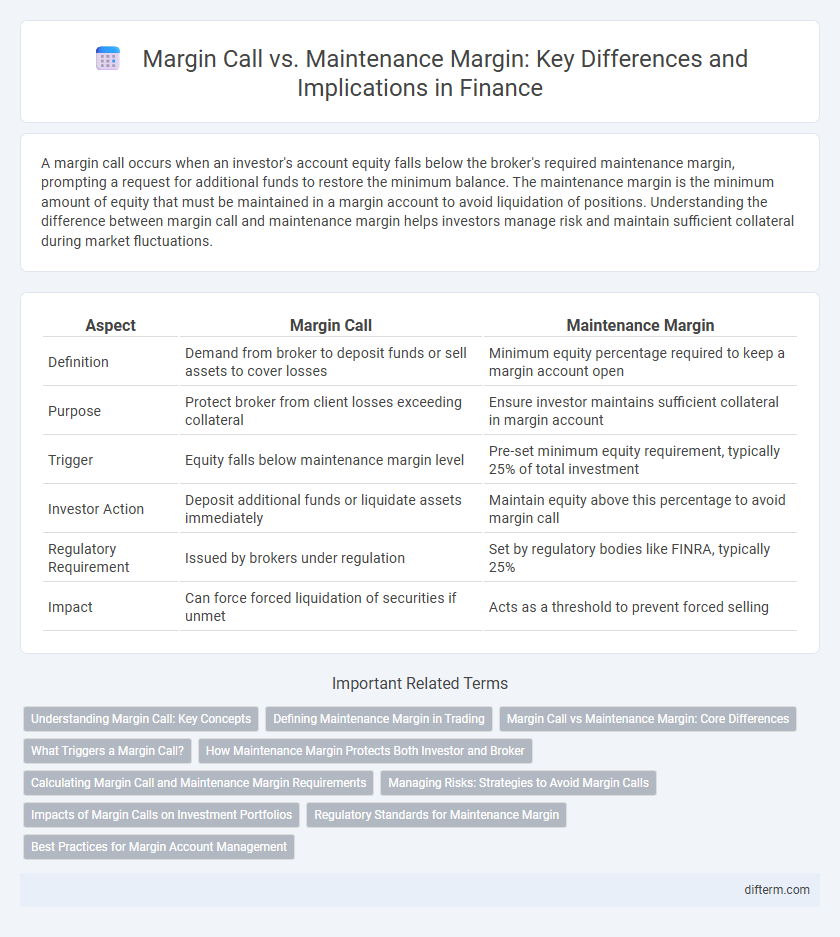

Table of Comparison

| Aspect | Margin Call | Maintenance Margin |

|---|---|---|

| Definition | Demand from broker to deposit funds or sell assets to cover losses | Minimum equity percentage required to keep a margin account open |

| Purpose | Protect broker from client losses exceeding collateral | Ensure investor maintains sufficient collateral in margin account |

| Trigger | Equity falls below maintenance margin level | Pre-set minimum equity requirement, typically 25% of total investment |

| Investor Action | Deposit additional funds or liquidate assets immediately | Maintain equity above this percentage to avoid margin call |

| Regulatory Requirement | Issued by brokers under regulation | Set by regulatory bodies like FINRA, typically 25% |

| Impact | Can force forced liquidation of securities if unmet | Acts as a threshold to prevent forced selling |

Understanding Margin Call: Key Concepts

A margin call occurs when an investor's equity falls below the maintenance margin requirement set by the broker, prompting a demand to deposit additional funds or securities. The maintenance margin is the minimum account balance that must be maintained after a purchase made on margin to avoid liquidation of assets. Understanding the relationship between margin calls and maintenance margin is crucial for effective risk management in leveraged trading.

Defining Maintenance Margin in Trading

Maintenance margin in trading refers to the minimum equity amount a trader must maintain in their margin account after purchasing securities on margin. If the account's equity falls below this threshold due to market fluctuations, a margin call occurs, requiring the trader to deposit additional funds or liquidate assets to meet the maintenance margin. This mechanism protects brokers from excessive losses by ensuring traders sustain sufficient collateral during open positions.

Margin Call vs Maintenance Margin: Core Differences

Margin call and maintenance margin are critical concepts in leveraged trading, where maintenance margin refers to the minimum equity balance an investor must maintain in their margin account after borrowing funds to trade. A margin call is triggered when the account's equity falls below this maintenance margin, requiring the investor to deposit additional funds or securities to restore the minimum balance. Understanding the distinction between maintenance margin and margin call is essential for managing risk and preventing forced liquidation of positions in volatile markets.

What Triggers a Margin Call?

A margin call is triggered when the equity in a trader's margin account falls below the broker's required maintenance margin level, which is typically a percentage of the total market value of the securities held as collateral. This shortfall occurs due to a decline in the market value of the securities, increasing the loan-to-value ratio beyond acceptable limits set by regulatory bodies or brokerage firms. To prevent forced liquidation, the trader must either deposit additional funds or securities to restore the account equity above the maintenance margin threshold.

How Maintenance Margin Protects Both Investor and Broker

Maintenance margin serves as a critical safeguard by requiring investors to maintain a minimum equity level in their margin accounts, protecting brokers from significant losses if asset values decline. This threshold prompts timely margin calls when account equity dips below the required amount, ensuring investors either deposit additional funds or liquidate positions to cover potential deficits. By enforcing these rules, maintenance margin minimizes the risk exposure for both parties, preserving financial stability and reducing the likelihood of default.

Calculating Margin Call and Maintenance Margin Requirements

Margin call occurs when an investor's account equity falls below the maintenance margin requirement, prompting a request to deposit additional funds or securities. The maintenance margin is typically set by brokerage firms, often around 25% of the total market value of securities held, to ensure sufficient collateral in the margin account. Calculating margin call involves subtracting the loan amount from the current value of securities and comparing it to the maintenance margin threshold; if equity is insufficient, a margin call is triggered.

Managing Risks: Strategies to Avoid Margin Calls

Managing risks in trading requires maintaining equity above the maintenance margin to prevent margin calls, which occur when account value falls below this minimum threshold set by brokers. Investors implement strategies such as setting stop-loss orders, regularly monitoring account balances, and diversifying portfolios to stabilize asset values and avoid forced liquidations. Effective margin management reduces potential losses and ensures sufficient collateral to meet margin requirements during market volatility.

Impacts of Margin Calls on Investment Portfolios

Margin calls occur when an investor's equity in a margin account falls below the maintenance margin requirement, forcing additional funds or asset liquidation to restore the minimum equity level. Failure to meet a margin call can lead to forced liquidation of securities, potentially locking in losses and altering the investment portfolio's risk profile. This process impacts portfolio diversification and long-term growth by increasing exposure to market volatility and reducing available capital for new opportunities.

Regulatory Standards for Maintenance Margin

Regulatory standards for maintenance margin are established by financial authorities such as the Federal Reserve Board, which sets minimum requirements to ensure brokers maintain sufficient equity in client accounts. The minimum maintenance margin typically ranges from 25% to 30% of the total market value of securities, designed to prevent excessive risk and protect market stability. A margin call occurs when an investor's equity falls below these regulatory thresholds, prompting an immediate need to deposit additional funds to comply with maintenance margin requirements.

Best Practices for Margin Account Management

Effective margin account management requires close monitoring of the maintenance margin to avoid margin calls, which occur when account equity falls below the broker's minimum requirement. Investors should maintain a buffer above the maintenance margin level, regularly reviewing portfolio volatility and account balance to prevent forced liquidations. Employing automated alerts and setting predefined risk limits enhances discipline and reduces the likelihood of margin calls disrupting investment strategies.

Margin call vs Maintenance margin Infographic

difterm.com

difterm.com