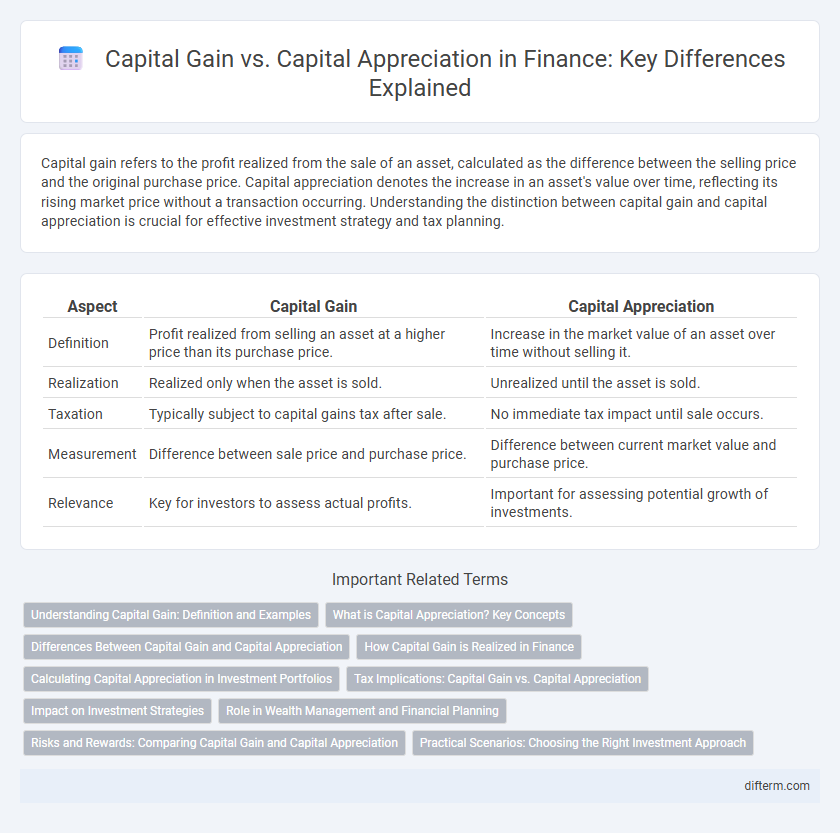

Capital gain refers to the profit realized from the sale of an asset, calculated as the difference between the selling price and the original purchase price. Capital appreciation denotes the increase in an asset's value over time, reflecting its rising market price without a transaction occurring. Understanding the distinction between capital gain and capital appreciation is crucial for effective investment strategy and tax planning.

Table of Comparison

| Aspect | Capital Gain | Capital Appreciation |

|---|---|---|

| Definition | Profit realized from selling an asset at a higher price than its purchase price. | Increase in the market value of an asset over time without selling it. |

| Realization | Realized only when the asset is sold. | Unrealized until the asset is sold. |

| Taxation | Typically subject to capital gains tax after sale. | No immediate tax impact until sale occurs. |

| Measurement | Difference between sale price and purchase price. | Difference between current market value and purchase price. |

| Relevance | Key for investors to assess actual profits. | Important for assessing potential growth of investments. |

Understanding Capital Gain: Definition and Examples

Capital gain refers to the profit realized from the sale of an asset, such as stocks or real estate, when the selling price exceeds the purchase price. For example, if an investor buys shares of a company at $50 each and sells them at $70, the $20 difference per share represents the capital gain. This differs from capital appreciation, which denotes the increase in the asset's market value over time without a sale transaction.

What is Capital Appreciation? Key Concepts

Capital appreciation refers to the increase in the market value of an asset or investment over time, excluding dividends or interest earned. It is a key indicator of an investment's performance, reflecting the growth potential of stocks, real estate, or other assets. Investors prioritize capital appreciation to build wealth by holding assets that appreciate in value, leveraging long-term market trends and economic growth.

Differences Between Capital Gain and Capital Appreciation

Capital gain refers to the profit realized from selling an asset at a price higher than its purchase price, whereas capital appreciation describes the increase in the asset's market value over time without a sale. Capital gain is a taxable event triggered by the actual transaction, while capital appreciation is an unrealized increase in value that only becomes taxable upon asset disposal. Understanding the distinction between these two concepts is essential for investment strategy, tax planning, and portfolio management.

How Capital Gain is Realized in Finance

Capital gain is realized when an asset is sold for a price higher than its original purchase value, resulting in a tangible profit. This profit becomes taxable income during the transaction, distinguishing it from capital appreciation, which is the increase in asset value that remains unrealized until sale. Accurate tracking of purchase price and sale price is essential for calculating capital gains in financial reporting and tax compliance.

Calculating Capital Appreciation in Investment Portfolios

Calculating capital appreciation in investment portfolios involves measuring the increase in the market value of assets over time, excluding dividends and interest income. This calculation is done by subtracting the original purchase price of the investment from its current market value, reflecting pure price appreciation. Capital appreciation is a key metric for investors focused on growth, distinct from capital gains which are realized only upon the sale of assets.

Tax Implications: Capital Gain vs. Capital Appreciation

Capital gain refers to the profit realized from the sale of an asset, which is typically subject to capital gains tax based on the holding period and tax laws. Capital appreciation reflects the increase in the asset's market value over time but remains unrealized and is not taxed until the asset is sold. Understanding the distinction is crucial for tax planning, as capital gains trigger tax events while appreciation impacts net worth without immediate tax consequences.

Impact on Investment Strategies

Capital gain directly affects investment strategies by providing explicit taxable income upon the sale of an asset, influencing decisions on holding periods and tax planning. Capital appreciation, representing the increase in an asset's value over time, encourages long-term investment approaches focused on wealth accumulation rather than immediate returns. Understanding the distinction enhances portfolio optimization by balancing potential income with growth objectives and tax implications.

Role in Wealth Management and Financial Planning

Capital gain represents the realized profit from selling an asset above its purchase price, playing a critical role in short-term wealth realization and tax planning strategies. Capital appreciation reflects the increase in an asset's market value over time, essential for long-term financial planning and portfolio growth. Effective wealth management balances both concepts to optimize returns, minimize tax liabilities, and align with individual risk tolerance and investment horizons.

Risks and Rewards: Comparing Capital Gain and Capital Appreciation

Capital gain represents the profit realized from selling an asset at a higher price than its purchase cost, often triggering immediate tax liabilities, which can impact net returns. Capital appreciation reflects the increase in an asset's market value over time without a sale, offering potential wealth growth but carrying market volatility risks and uncertain timing for profit realization. Investors must assess the trade-off between the liquidity and taxable event of capital gains versus the long-term growth potential and market exposure inherent in capital appreciation.

Practical Scenarios: Choosing the Right Investment Approach

Investors seeking immediate profits may prefer capital gains by buying and selling stocks or assets within a short timeframe to realize taxable income. Those focused on long-term wealth accumulation often prioritize capital appreciation, holding assets like real estate or growth stocks to benefit from market value increases over years. Balancing both approaches depends on individual financial goals, tax implications, and market conditions to optimize portfolio performance.

Capital gain vs capital appreciation Infographic

difterm.com

difterm.com