Buybacks boost shareholder value by reducing the number of outstanding shares, often leading to higher earnings per share and stock price appreciation. Dividends provide direct income to shareholders, offering steady cash flow and appealing to income-focused investors. Companies choose buybacks for flexibility and tax efficiency, while dividends signal financial stability and long-term commitment.

Table of Comparison

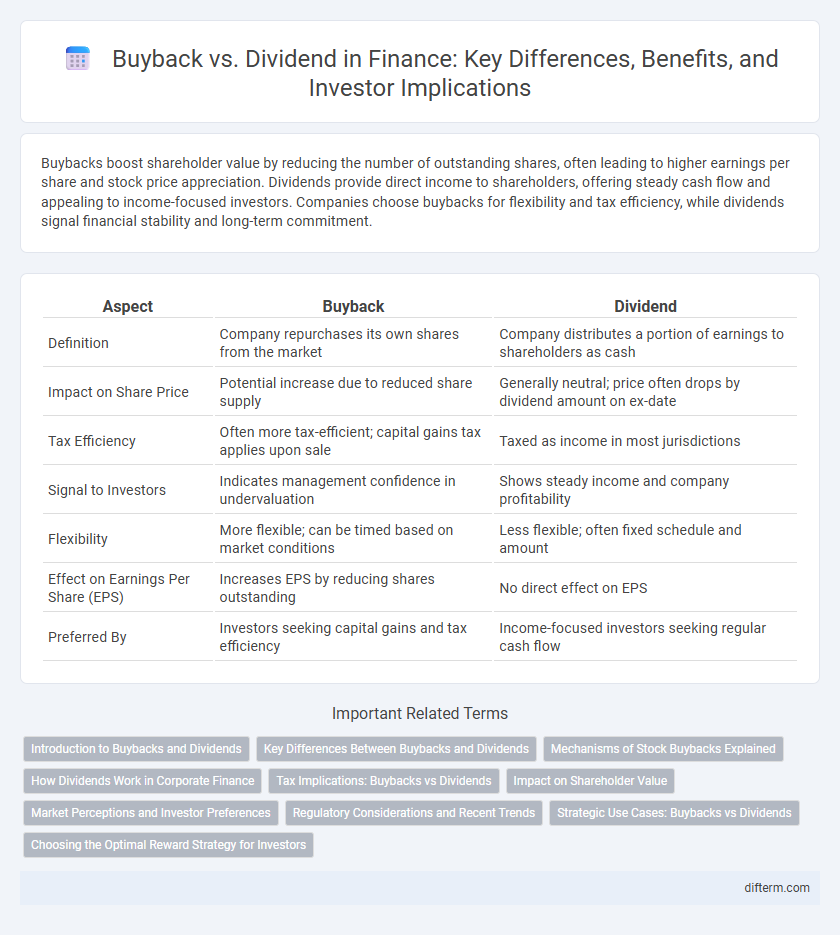

| Aspect | Buyback | Dividend |

|---|---|---|

| Definition | Company repurchases its own shares from the market | Company distributes a portion of earnings to shareholders as cash |

| Impact on Share Price | Potential increase due to reduced share supply | Generally neutral; price often drops by dividend amount on ex-date |

| Tax Efficiency | Often more tax-efficient; capital gains tax applies upon sale | Taxed as income in most jurisdictions |

| Signal to Investors | Indicates management confidence in undervaluation | Shows steady income and company profitability |

| Flexibility | More flexible; can be timed based on market conditions | Less flexible; often fixed schedule and amount |

| Effect on Earnings Per Share (EPS) | Increases EPS by reducing shares outstanding | No direct effect on EPS |

| Preferred By | Investors seeking capital gains and tax efficiency | Income-focused investors seeking regular cash flow |

Introduction to Buybacks and Dividends

Buybacks and dividends represent two primary methods companies use to return value to shareholders, with buybacks involving the repurchase of outstanding shares to reduce supply and potentially increase stock price. Dividends provide direct income to shareholders through regular cash payments, signaling company profitability and stability. Both strategies impact shareholder wealth differently and reflect management's approach to capital allocation.

Key Differences Between Buybacks and Dividends

Buybacks reduce the number of outstanding shares, thereby increasing earnings per share and potentially boosting stock price, while dividends provide direct cash payments to shareholders, offering immediate income. Buybacks offer flexibility to companies as they can be executed opportunistically without a recurring commitment, whereas dividends create an expectation of ongoing payments, impacting cash flow stability. Tax treatment also differs: buybacks often benefit shareholders through capital gains taxes, while dividends are typically taxed as ordinary income, influencing investor preferences.

Mechanisms of Stock Buybacks Explained

Stock buybacks, also known as share repurchases, involve a company purchasing its own shares from the open market, reducing the total number of outstanding shares and increasing earnings per share (EPS). This mechanism allows companies to return capital to shareholders without paying dividends, often signaling confidence in the firm's valuation and future prospects. Buybacks can also optimize capital structure by improving metrics like return on equity (ROE) and mitigating dilution from employee stock options.

How Dividends Work in Corporate Finance

Dividends represent a portion of a company's earnings distributed directly to shareholders, providing a tangible return on investment. They are typically paid in cash or additional shares and reflect a company's profitability and stable cash flow in corporate finance. Regular dividend payments signal financial health and can influence investor confidence and stock valuation.

Tax Implications: Buybacks vs Dividends

Buybacks are often favored by investors due to potential capital gains tax advantages, as profits from share repurchases are typically taxed at a lower rate than dividend income. Dividends are taxed as ordinary income, which can result in higher tax liabilities for shareholders depending on their tax bracket. Companies and investors must consider these tax implications when deciding between distributing profits through buybacks or dividends.

Impact on Shareholder Value

Buybacks reduce the number of outstanding shares, often boosting earnings per share (EPS) and potentially increasing stock prices, which can enhance shareholder value. Dividends provide immediate cash returns to shareholders, appealing to income-focused investors and signaling financial health. The optimal choice depends on company strategy, market conditions, and shareholder preferences, with buybacks favored for growth and dividends preferred for steady income.

Market Perceptions and Investor Preferences

Buybacks are often perceived by the market as a signal that management believes the stock is undervalued, potentially driving short-term price appreciation and appealing to investors seeking capital gains. Dividends attract income-focused investors prioritizing steady cash flow, enhancing shareholder loyalty and signaling firm stability. Market preference varies with economic cycles: buybacks dominate during growth phases for tax-efficient returns, while dividends gain favor in uncertain times for dependable income.

Regulatory Considerations and Recent Trends

Regulatory considerations for buybacks often include restrictions on timing and disclosure to prevent market manipulation, with the SEC enforcing Rule 10b-18 to provide a safe harbor for repurchases, while dividends face fewer regulatory constraints but require board approval and adherence to solvency tests under state laws. Recent trends show an increase in share buybacks as companies prioritize flexible capital return strategies amid evolving tax policies, whereas dividends remain a steady method favored for signaling long-term financial stability to investors. Market volatility and regulatory scrutiny are driving firms to balance repurchases and dividends strategically, aligning with shareholder preferences and compliance frameworks.

Strategic Use Cases: Buybacks vs Dividends

Strategic use cases for share buybacks include signaling undervaluation, improving earnings per share (EPS) metrics, and returning excess capital to shareholders with potential tax advantages. Dividends are strategically employed to provide consistent income streams, attract income-focused investors, and demonstrate financial stability and confidence in ongoing cash flow. Companies often balance buybacks and dividends to optimize capital allocation based on market conditions and shareholder preferences.

Choosing the Optimal Reward Strategy for Investors

Buybacks increase shareholder value by reducing the number of outstanding shares, often leading to a higher earnings per share (EPS) and stock price appreciation, benefiting investors seeking capital gains. Dividends provide immediate and predictable income, appealing to investors who prioritize regular cash flow and income stability. Companies should evaluate their financial health, market conditions, and investor preferences to choose the optimal strategy that balances growth potential with income distribution.

Buyback vs Dividend Infographic

difterm.com

difterm.com