Robo-advisors offer cost-effective, automated portfolio management using algorithms to optimize investment strategies based on individual risk tolerance and goals. Human advisors provide personalized financial planning with nuanced insights, emotional support, and the ability to navigate complex situations that algorithms might not fully address. Choosing between robo-advisors and human advisors depends on the investor's preference for customization, cost, and the level of personal interaction desired.

Table of Comparison

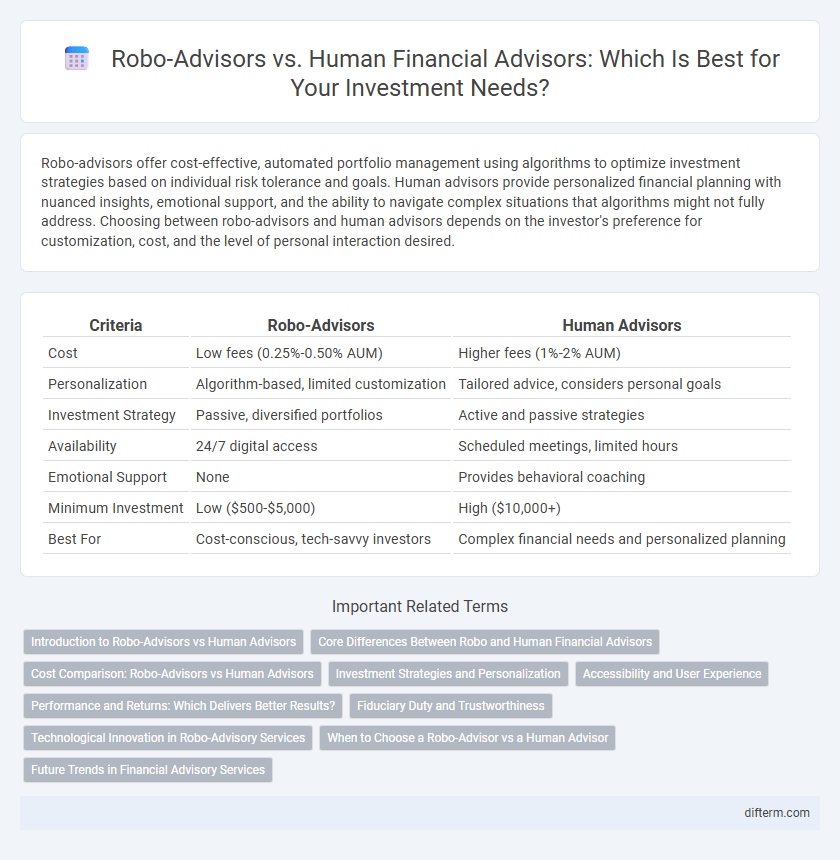

| Criteria | Robo-Advisors | Human Advisors |

|---|---|---|

| Cost | Low fees (0.25%-0.50% AUM) | Higher fees (1%-2% AUM) |

| Personalization | Algorithm-based, limited customization | Tailored advice, considers personal goals |

| Investment Strategy | Passive, diversified portfolios | Active and passive strategies |

| Availability | 24/7 digital access | Scheduled meetings, limited hours |

| Emotional Support | None | Provides behavioral coaching |

| Minimum Investment | Low ($500-$5,000) | High ($10,000+) |

| Best For | Cost-conscious, tech-savvy investors | Complex financial needs and personalized planning |

Introduction to Robo-Advisors vs Human Advisors

Robo-advisors utilize advanced algorithms and AI to provide automated, low-cost investment management tailored to individual risk profiles, appealing to tech-savvy investors seeking efficiency. Human advisors offer personalized financial planning and nuanced advice based on deep market experience and emotional intelligence, benefiting clients with complex financial goals. The growing integration of technology in wealth management highlights the complementary strengths of both advisory models in optimizing investment outcomes.

Core Differences Between Robo and Human Financial Advisors

Robo-advisors leverage algorithms and automated systems to offer low-cost, scalable investment management with minimal human intervention, ideal for clients seeking straightforward, data-driven guidance. In contrast, human financial advisors provide personalized advice, emotional support, and complex financial planning tailored to individual needs, especially valuable in nuanced situations involving estate planning or tax optimization. The core difference lies in the balance between technology-driven efficiency and empathetic, adaptive service influenced by human judgment.

Cost Comparison: Robo-Advisors vs Human Advisors

Robo-advisors typically charge annual fees ranging from 0.25% to 0.50% of assets under management, significantly lower than human advisors who often charge 1% or more. The automated nature of robo-advisors reduces overhead costs, enabling cost-efficient portfolio management ideal for investors with smaller account sizes. Human advisors, while more expensive, provide personalized financial planning and tailored advice, justifying their higher fees for clients seeking customized service.

Investment Strategies and Personalization

Robo-advisors utilize algorithm-driven investment strategies that offer efficient portfolio management through automated rebalancing and tax-loss harvesting, often at lower fees compared to human advisors. Human advisors provide personalized investment solutions by considering complex financial goals, emotional factors, and unique life circumstances that algorithms may overlook. While robo-advisors excel in standardized, data-driven strategies, human advisors deliver customized guidance and adapt strategies based on nuanced client needs and market insights.

Accessibility and User Experience

Robo-advisors offer 24/7 accessibility through intuitive digital platforms, enabling users to manage investments anytime with ease, often at lower costs than human advisors. Human advisors provide personalized guidance and nuanced financial planning, which can enhance user experience for complex situations but may require scheduled appointments and higher fees. The integration of advanced algorithms in robo-advisors continuously improves user interfaces, making financial management more accessible for tech-savvy investors.

Performance and Returns: Which Delivers Better Results?

Robo-advisors leverage advanced algorithms and real-time data analysis to optimize portfolio performance with lower fees and consistent rebalancing, often outperforming human advisors in cost-efficiency and tax-loss harvesting. Human advisors provide personalized investment strategies and can adapt to complex financial situations, potentially delivering higher returns through nuanced decision-making and behavioral insights. Studies reveal robo-advisors achieve average annual returns between 5% and 7%, while human advisors vary widely, with top performers exceeding robo-advisor returns in high-net-worth portfolios.

Fiduciary Duty and Trustworthiness

Robo-advisors leverage algorithms to provide cost-effective, unbiased investment advice, but they lack the personalized fiduciary duty upheld by human advisors who are legally obligated to act in their clients' best interests. Human advisors build trust through personalized communication, nuanced understanding of individual financial goals, and ethical accountability frameworks. While robo-advisors offer transparency and efficiency, the fiduciary responsibility and emotional intelligence of human advisors remain critical in complex financial decision-making.

Technological Innovation in Robo-Advisory Services

Robo-advisors leverage artificial intelligence, machine learning algorithms, and big data analytics to provide personalized investment strategies with greater efficiency and lower costs compared to human advisors. The integration of natural language processing (NLP) and real-time portfolio rebalancing enhances user experience and responsiveness to market fluctuations. Advances in blockchain technology ensure secure and transparent transactions, solidifying robo-advisory platforms as a cutting-edge solution in modern wealth management.

When to Choose a Robo-Advisor vs a Human Advisor

Robo-advisors are ideal for investors seeking low-cost, automated portfolio management with algorithm-driven asset allocation and minimal human intervention, typically suited for beginners or those with straightforward financial goals. Human advisors provide personalized financial planning, complex tax strategies, and tailored investment advice, which benefits high-net-worth individuals or clients facing intricate financial situations. Choosing between them depends on factors such as portfolio complexity, desired level of personal interaction, and the need for customized financial guidance.

Future Trends in Financial Advisory Services

Robo-advisors are rapidly evolving with advancements in artificial intelligence and machine learning, enabling more personalized and data-driven investment strategies at lower costs. Human advisors remain essential for complex financial planning and emotional guidance, particularly in volatile markets and retirement planning. The future of financial advisory services lies in hybrid models that integrate robo-advisor efficiency with human expertise, enhancing client trust and decision-making.

Robo-Advisors vs Human Advisors Infographic

difterm.com

difterm.com