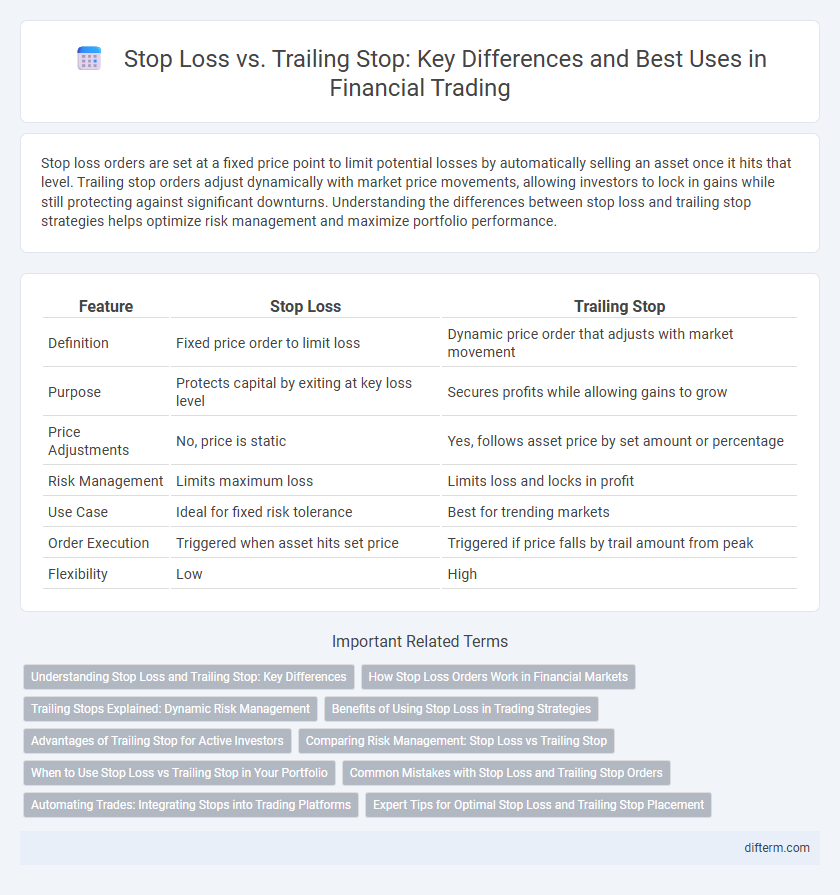

Stop loss orders are set at a fixed price point to limit potential losses by automatically selling an asset once it hits that level. Trailing stop orders adjust dynamically with market price movements, allowing investors to lock in gains while still protecting against significant downturns. Understanding the differences between stop loss and trailing stop strategies helps optimize risk management and maximize portfolio performance.

Table of Comparison

| Feature | Stop Loss | Trailing Stop |

|---|---|---|

| Definition | Fixed price order to limit loss | Dynamic price order that adjusts with market movement |

| Purpose | Protects capital by exiting at key loss level | Secures profits while allowing gains to grow |

| Price Adjustments | No, price is static | Yes, follows asset price by set amount or percentage |

| Risk Management | Limits maximum loss | Limits loss and locks in profit |

| Use Case | Ideal for fixed risk tolerance | Best for trending markets |

| Order Execution | Triggered when asset hits set price | Triggered if price falls by trail amount from peak |

| Flexibility | Low | High |

Understanding Stop Loss and Trailing Stop: Key Differences

Stop Loss orders are set at a fixed price point to limit potential losses by automatically selling a security when its price falls to that level. Trailing Stop orders adjust dynamically with market price movements, maintaining a set percentage or dollar amount below the highest price reached, allowing investors to lock in profits while limiting downside risk. Understanding these key differences helps traders optimize risk management strategies according to market volatility and individual investment goals.

How Stop Loss Orders Work in Financial Markets

Stop loss orders in financial markets automatically sell a security when its price falls to a predetermined level, limiting potential losses for investors. These orders are placed with brokers and remain active until triggered or canceled, providing a risk management tool that helps protect trading capital. By setting a stop loss, traders can enforce discipline and avoid emotional decision-making during market downturns.

Trailing Stops Explained: Dynamic Risk Management

Trailing stops offer dynamic risk management by automatically adjusting the stop-loss level as the security's price moves favorably, locking in gains while limiting downside risk. Unlike fixed stop losses, trailing stops move in sync with the market price, helping investors maximize profits in volatile markets. This adaptive mechanism enhances portfolio protection and aligns with strategic exit plans in active trading.

Benefits of Using Stop Loss in Trading Strategies

Stop loss orders offer precise risk management by automatically limiting potential losses to a predetermined level, essential for protecting capital in volatile markets. This tool ensures disciplined trading by removing emotional decision-making during market fluctuations, preserving portfolio stability. Incorporating stop loss orders into trading strategies enhances long-term profitability by preventing significant drawdowns and maintaining consistent risk control.

Advantages of Trailing Stop for Active Investors

Trailing stops offer active investors dynamic risk management by automatically adjusting stop levels as asset prices move favorably, preserving gains without constant monitoring. Unlike fixed stop loss orders, trailing stops lock in profits while allowing upside potential in volatile markets. This adaptive feature enhances portfolio protection and optimizes trade exits amid fluctuating financial conditions.

Comparing Risk Management: Stop Loss vs Trailing Stop

Stop Loss orders limit potential losses by closing a position at a predefined price, ensuring strict risk control. Trailing Stops dynamically adjust with market movements, allowing traders to lock in gains while managing downside risk more flexibly. Comparing risk management, Stop Loss prioritizes fixed loss thresholds, whereas Trailing Stop offers adaptive protection aligned with price trends.

When to Use Stop Loss vs Trailing Stop in Your Portfolio

Use a stop loss to limit potential losses by setting a fixed exit price, especially in volatile markets or for highly speculative positions. Opt for a trailing stop to lock in profits by allowing the stop price to adjust with favorable price movements, ideal for trending assets with upward momentum. Implement stop losses for risk control during market downturns and trailing stops to maximize gains while protecting against sudden reversals.

Common Mistakes with Stop Loss and Trailing Stop Orders

Common mistakes with stop loss orders include setting them too tight, causing premature exits during normal market volatility, and neglecting to adjust them as the asset price moves. Trailing stop errors often involve failing to set an appropriate trail distance, which can either lock in insufficient profits or expose traders to larger losses. Both orders require careful calibration based on asset volatility, trading strategy, and risk tolerance to optimize protection and profitability in volatile markets.

Automating Trades: Integrating Stops into Trading Platforms

Automating trades through integrating stop loss and trailing stop orders into trading platforms enhances risk management by allowing predefined exit points to execute automatically without manual intervention. Trailing stops dynamically adjust with market movements to lock in profits while limiting losses, whereas stop loss orders provide a fixed threshold to cap potential downside. These automated features improve trade efficiency and discipline, reducing emotional decision-making in volatile financial markets.

Expert Tips for Optimal Stop Loss and Trailing Stop Placement

Expert traders recommend setting a stop loss just below key support levels to minimize losses without triggering premature exits, while trailing stops should be placed at a percentage or dollar amount that aligns with the asset's volatility to protect gains effectively. Utilizing Average True Range (ATR) as a metric helps in determining optimal trailing stop distances, ensuring stops adapt to changing market conditions. Backtesting various stop loss and trailing stop strategies on historical price data enhances precision, reducing emotional decision-making in live trading scenarios.

Stop Loss vs Trailing Stop Infographic

difterm.com

difterm.com