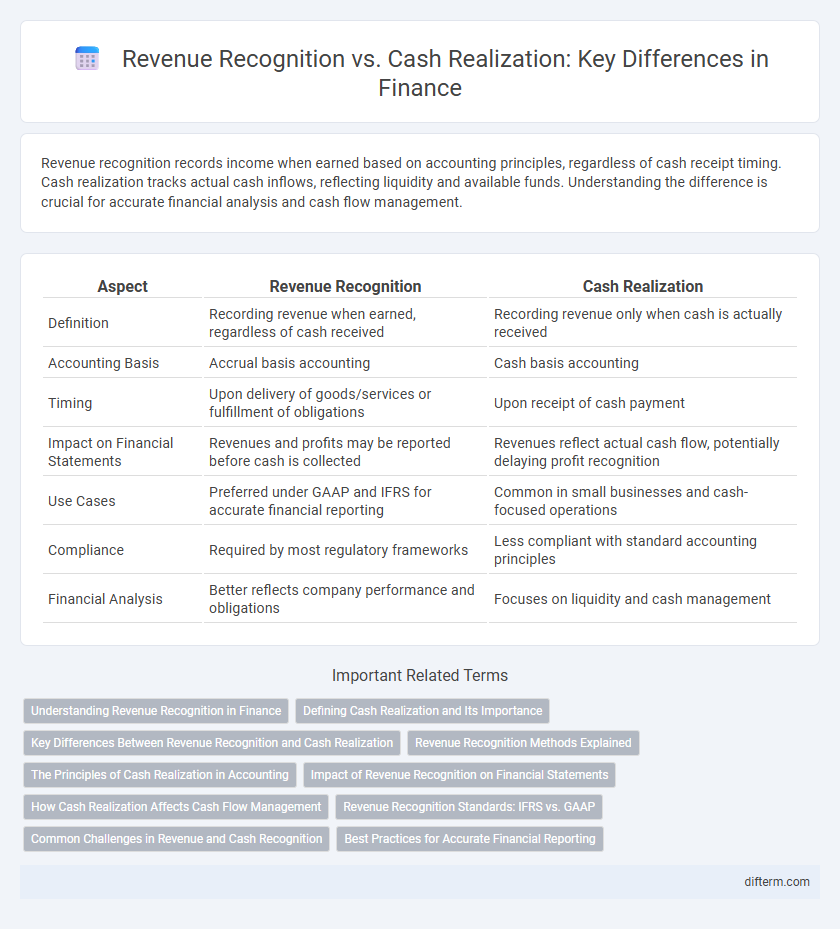

Revenue recognition records income when earned based on accounting principles, regardless of cash receipt timing. Cash realization tracks actual cash inflows, reflecting liquidity and available funds. Understanding the difference is crucial for accurate financial analysis and cash flow management.

Table of Comparison

| Aspect | Revenue Recognition | Cash Realization |

|---|---|---|

| Definition | Recording revenue when earned, regardless of cash received | Recording revenue only when cash is actually received |

| Accounting Basis | Accrual basis accounting | Cash basis accounting |

| Timing | Upon delivery of goods/services or fulfillment of obligations | Upon receipt of cash payment |

| Impact on Financial Statements | Revenues and profits may be reported before cash is collected | Revenues reflect actual cash flow, potentially delaying profit recognition |

| Use Cases | Preferred under GAAP and IFRS for accurate financial reporting | Common in small businesses and cash-focused operations |

| Compliance | Required by most regulatory frameworks | Less compliant with standard accounting principles |

| Financial Analysis | Better reflects company performance and obligations | Focuses on liquidity and cash management |

Understanding Revenue Recognition in Finance

Revenue recognition in finance involves recording income when it is earned, regardless of when cash is received, following accounting principles such as GAAP or IFRS. This method ensures that financial statements accurately reflect a company's performance by matching revenues with the related expenses within the same period. Cash realization focuses on the actual cash inflow, but revenue recognition provides a clearer picture of profitability and financial health by accounting for accrued revenues and receivables.

Defining Cash Realization and Its Importance

Cash realization refers to the process of converting receivables or billed amounts into actual cash collected by a business, reflecting the true liquidity status. It is crucial for managing cash flow, ensuring operational sustainability, and making informed investment or budgeting decisions. Understanding cash realization helps bridge the gap between accounting revenues recognized under accrual basis and the actual cash inflows driving financial health.

Key Differences Between Revenue Recognition and Cash Realization

Revenue recognition records income when earned, following accrual accounting principles, regardless of cash receipt, while cash realization logs income only upon actual cash inflow. Revenue recognition impacts financial statements by matching revenue with related expenses in the same period, enhancing accuracy in profitability analysis. Cash realization provides a clear view of liquidity by tracking real-time cash movements, crucial for cash flow management and operational decisions.

Revenue Recognition Methods Explained

Revenue recognition methods determine when and how revenue is recorded in financial statements, contrasting with cash realization which tracks actual cash inflows. The most common methods include the accrual basis, recognizing revenue when earned, and the cash basis, recognizing revenue when payment is received. Understanding these methods ensures compliance with accounting standards like GAAP and IFRS, directly impacting financial analysis, tax obligations, and business decision-making.

The Principles of Cash Realization in Accounting

The principles of cash realization in accounting emphasize recognizing revenue only when cash is actually received, ensuring accurate reflection of a company's liquidity and cash flow. This method differs from revenue recognition under accrual accounting, which records income when earned regardless of cash receipt, potentially leading to timing discrepancies. Adhering to cash realization principles helps maintain transparent financial statements by matching cash inflows with operational activities.

Impact of Revenue Recognition on Financial Statements

Revenue recognition directly affects the timing and amount of reported income on financial statements, influencing key metrics such as net income and earnings per share. This accounting principle ensures that revenue is recorded when earned rather than when cash is received, which can create discrepancies between reported profit and actual cash flow. Investors and analysts rely on this distinction to assess a company's financial health and operational efficiency accurately.

How Cash Realization Affects Cash Flow Management

Cash realization directly impacts cash flow management by determining the actual inflow of cash available for operational expenses and investments, influencing liquidity and working capital decisions. Unlike revenue recognition, which records income when earned regardless of payment receipt, cash realization ensures that only collected funds contribute to cash flow, affecting budgeting and forecasting accuracy. Effective cash realization strategies help optimize cash reserves, reduce reliance on external financing, and maintain financial stability within the organization.

Revenue Recognition Standards: IFRS vs. GAAP

Revenue recognition under IFRS follows the principle of recognizing revenue when control of goods or services is transferred to the customer, emphasizing performance obligations per IFRS 15. GAAP, governed by ASC 606, similarly recognizes revenue based on the transfer of control but includes detailed guidance on contract modifications and variable consideration. Differences between IFRS and GAAP in revenue recognition can impact financial reporting timing and amounts, affecting key performance metrics and cash flow analysis.

Common Challenges in Revenue and Cash Recognition

Revenue recognition often faces challenges such as timing differences, contract modifications, and estimating variable consideration, which complicate accurate reporting under ASC 606 or IFRS 15 standards. Cash realization risks arise from delayed payments, disputed invoices, and inconsistent collection processes, directly affecting liquidity and financial forecasting. Reconciling recognized revenue with actual cash inflows requires robust internal controls and coordination between sales, accounting, and treasury functions to minimize discrepancies and improve financial transparency.

Best Practices for Accurate Financial Reporting

Accurate financial reporting relies on distinguishing revenue recognition from cash realization to reflect true business performance. Implementing best practices such as adhering to the ASC 606 or IFRS 15 standards ensures revenue is recorded when earned, not merely when cash is received. Companies should maintain robust internal controls and utilize real-time accounting software to track revenue streams against cash flows, minimizing discrepancies and enhancing financial transparency.

revenue recognition vs cash realization Infographic

difterm.com

difterm.com