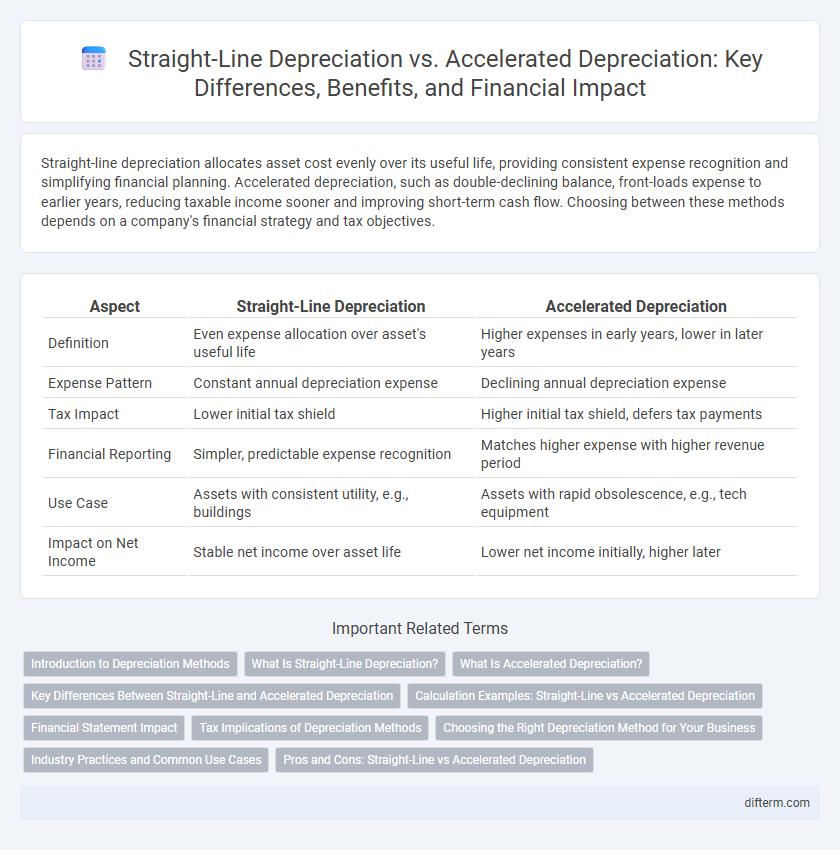

Straight-line depreciation allocates asset cost evenly over its useful life, providing consistent expense recognition and simplifying financial planning. Accelerated depreciation, such as double-declining balance, front-loads expense to earlier years, reducing taxable income sooner and improving short-term cash flow. Choosing between these methods depends on a company's financial strategy and tax objectives.

Table of Comparison

| Aspect | Straight-Line Depreciation | Accelerated Depreciation |

|---|---|---|

| Definition | Even expense allocation over asset's useful life | Higher expenses in early years, lower in later years |

| Expense Pattern | Constant annual depreciation expense | Declining annual depreciation expense |

| Tax Impact | Lower initial tax shield | Higher initial tax shield, defers tax payments |

| Financial Reporting | Simpler, predictable expense recognition | Matches higher expense with higher revenue period |

| Use Case | Assets with consistent utility, e.g., buildings | Assets with rapid obsolescence, e.g., tech equipment |

| Impact on Net Income | Stable net income over asset life | Lower net income initially, higher later |

Introduction to Depreciation Methods

Straight-line depreciation allocates an asset's cost evenly over its useful life, providing consistent expense recognition each accounting period. Accelerated depreciation methods, such as double declining balance or sum-of-the-years'-digits, front-load depreciation expenses to reflect higher asset usage or obsolescence in early years. Choosing the appropriate depreciation method impacts financial statements, tax liabilities, and asset management strategies.

What Is Straight-Line Depreciation?

Straight-line depreciation evenly allocates the cost of a tangible asset over its useful life, providing consistent annual expense amounts on financial statements. It is calculated by subtracting the asset's salvage value from its initial cost and dividing the result by the asset's estimated useful life. This method is commonly used due to its simplicity and predictability in expense reporting, which aids in budgeting and financial planning.

What Is Accelerated Depreciation?

Accelerated depreciation is a method that allocates higher depreciation expenses in the earlier years of an asset's life, enhancing tax deductions during the initial periods. Common approaches include the double declining balance and sum-of-the-years'-digits methods, which front-load depreciation expenses compared to the straight-line method. This technique improves cash flow management by reducing taxable income more rapidly, benefiting businesses with fast depreciating assets or those seeking to offset early operational costs.

Key Differences Between Straight-Line and Accelerated Depreciation

Straight-line depreciation allocates an equal expense amount over the asset's useful life, providing consistent expense recognition and simplicity in financial reporting. Accelerated depreciation methods, such as double-declining balance or sum-of-the-years-digits, recognize higher expenses in the early years, reducing taxable income more rapidly and improving cash flow in initial periods. Key differences include timing of expense recognition, impact on tax liabilities, and alignment with asset usage patterns, which influence financial strategy and reporting accuracy.

Calculation Examples: Straight-Line vs Accelerated Depreciation

Straight-line depreciation evenly allocates an asset's cost over its useful life, calculated by subtracting salvage value from the initial cost and dividing by the number of years, resulting in consistent annual expense recognition. Accelerated depreciation methods, such as double declining balance, front-load expenses by applying a fixed depreciation rate to the diminishing book value, leading to higher deductions in early years and reduced expenses later. For example, a $10,000 asset with a 5-year life and $1,000 salvage value depreciates $1,800 annually using straight-line, whereas accelerated depreciation might expense $3,600 in year one, decreasing progressively over the asset's lifetime.

Financial Statement Impact

Straight-line depreciation evenly allocates asset cost over its useful life, resulting in consistent expense recognition that stabilizes net income and facilitates predictable financial planning. Accelerated depreciation front-loads expenses, increasing depreciation costs in early years, which reduces taxable income and reported profits initially but enhances cash flow through tax deferrals. The choice between these methods directly affects key financial metrics such as earnings before interest and taxes (EBIT), net income, and asset book value on the balance sheet, influencing investor perceptions and loan covenants.

Tax Implications of Depreciation Methods

Straight-line depreciation provides a consistent expense deduction over an asset's useful life, resulting in steady, predictable reductions in taxable income and tax liability each year. Accelerated depreciation methods, such as Double Declining Balance, offer larger deductions in the early years, significantly reducing taxable income and tax payments upfront, which improves initial cash flow and tax deferral benefits. Choosing between these methods impacts corporate tax strategy by balancing immediate tax savings against long-term financial reporting and tax planning objectives.

Choosing the Right Depreciation Method for Your Business

Choosing the right depreciation method depends on your business's financial goals and tax strategy. Straight-line depreciation offers consistent expense allocation, ideal for stable asset usage, while accelerated depreciation provides higher initial deductions, benefiting cash flow management and tax deferral. Evaluating asset lifespan, usage patterns, and tax implications ensures alignment with long-term financial planning and compliance requirements.

Industry Practices and Common Use Cases

Straight-line depreciation is widely used in industries with assets that provide consistent utility over time, such as real estate and manufacturing, due to its simplicity and predictable expense allocation. Accelerated depreciation methods, like Double Declining Balance or MACRS, are preferred in technology and automotive sectors where rapid asset obsolescence occurs, allowing for higher initial expense recognition and tax benefits. Common use cases reflect these practices, with companies optimizing depreciation strategies to balance financial reporting accuracy and tax efficiency.

Pros and Cons: Straight-Line vs Accelerated Depreciation

Straight-line depreciation offers simplicity and consistency by allocating equal expense amounts over an asset's useful life, enhancing predictability in financial reporting and budgeting. Accelerated depreciation methods, such as double-declining balance, allow for higher expense recognition in early years, improving tax deferral and cash flow management but potentially distorting profitability metrics initially. Companies must weigh the straightforward approach of straight-line depreciation against the tax benefits and variable expense patterns of accelerated methods to align with strategic financial goals.

Straight-Line Depreciation vs Accelerated Depreciation Infographic

difterm.com

difterm.com