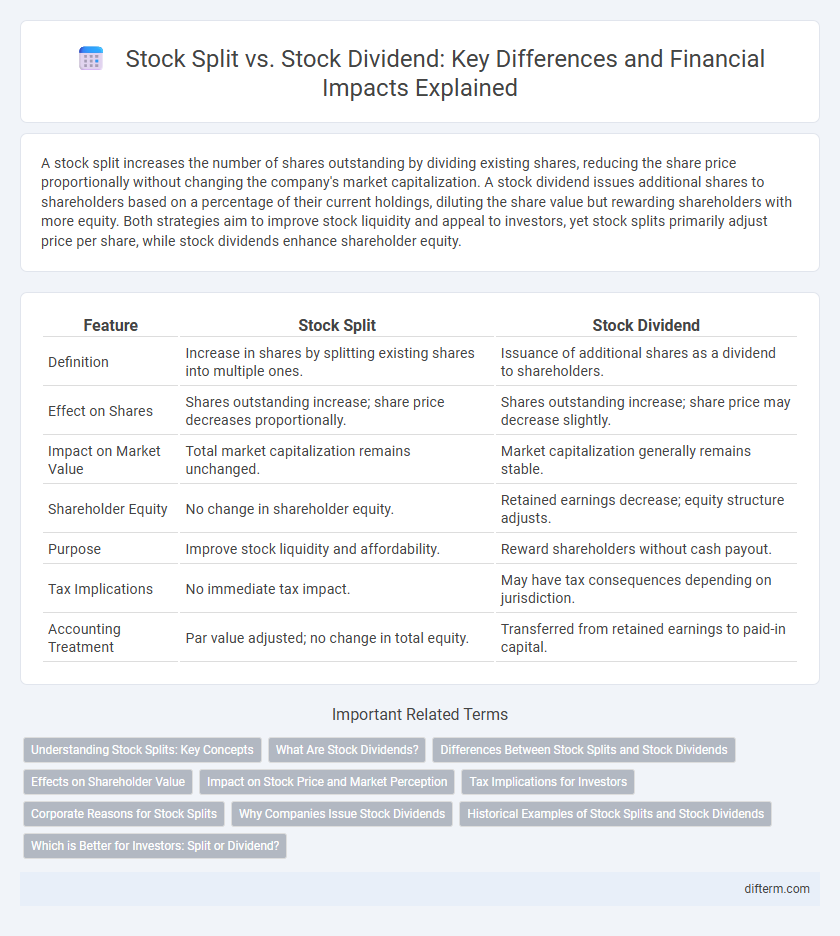

A stock split increases the number of shares outstanding by dividing existing shares, reducing the share price proportionally without changing the company's market capitalization. A stock dividend issues additional shares to shareholders based on a percentage of their current holdings, diluting the share value but rewarding shareholders with more equity. Both strategies aim to improve stock liquidity and appeal to investors, yet stock splits primarily adjust price per share, while stock dividends enhance shareholder equity.

Table of Comparison

| Feature | Stock Split | Stock Dividend |

|---|---|---|

| Definition | Increase in shares by splitting existing shares into multiple ones. | Issuance of additional shares as a dividend to shareholders. |

| Effect on Shares | Shares outstanding increase; share price decreases proportionally. | Shares outstanding increase; share price may decrease slightly. |

| Impact on Market Value | Total market capitalization remains unchanged. | Market capitalization generally remains stable. |

| Shareholder Equity | No change in shareholder equity. | Retained earnings decrease; equity structure adjusts. |

| Purpose | Improve stock liquidity and affordability. | Reward shareholders without cash payout. |

| Tax Implications | No immediate tax impact. | May have tax consequences depending on jurisdiction. |

| Accounting Treatment | Par value adjusted; no change in total equity. | Transferred from retained earnings to paid-in capital. |

Understanding Stock Splits: Key Concepts

Stock splits increase the number of outstanding shares by dividing existing shares into multiple new shares, effectively lowering the stock price without changing the company's market capitalization. This adjustment improves liquidity and makes shares more accessible to a broader range of investors while maintaining the same proportional ownership. Unlike stock dividends, which distribute additional shares as a form of profit sharing, stock splits primarily aim to optimize stock price and trading volume.

What Are Stock Dividends?

Stock dividends are distributions of additional shares to existing shareholders, increasing the total number of shares owned without altering the company's overall market capitalization. Unlike cash dividends, stock dividends provide shareholders with extra shares proportionate to their current holdings, often used to conserve company cash while rewarding investors. This strategy can enhance liquidity and signal confidence in the company's growth prospects without impacting immediate shareholder value.

Differences Between Stock Splits and Stock Dividends

Stock splits increase the number of outstanding shares by dividing existing shares, reducing the stock price proportionally without changing the overall market capitalization, while stock dividends distribute additional shares to shareholders, increasing the total shares but also diluting the value per share. Stock splits aim to improve stock liquidity and make shares more affordable, whereas stock dividends provide shareholders with extra shares as a form of reward without immediate cash payout. The key difference lies in the purpose: stock splits facilitate trading, and stock dividends serve as a method of profit distribution.

Effects on Shareholder Value

Stock splits increase the number of outstanding shares by dividing existing shares, leading to a lower price per share without changing the company's overall market capitalization, thus maintaining shareholder value. Stock dividends distribute additional shares to shareholders proportionally, which also dilutes the price per share but retains the same total equity value for investors. Both actions enhance liquidity and marketability of the shares while leaving the intrinsic shareholder value unaffected.

Impact on Stock Price and Market Perception

A stock split increases the number of shares outstanding by dividing each share, leading to a proportional reduction in the stock price without changing the company's market capitalization, often perceived as a positive signal of growth potential. In contrast, a stock dividend issues additional shares to shareholders, diluting earnings per share and potentially causing a slight decrease in stock price, which may be interpreted as a sign of limited cash flow or growth prospects. Market perception tends to favor stock splits for enhancing liquidity and accessibility, while stock dividends can be viewed as a modest reward but may raise concerns about underlying financial strength.

Tax Implications for Investors

Stock splits generally do not create immediate tax liabilities for investors because they only increase the number of shares while reducing the price per share proportionally, maintaining the total investment value; the cost basis per share is adjusted accordingly. In contrast, stock dividends can trigger taxable events if the dividends are paid in additional shares rather than cash, requiring investors to report the fair market value of the received shares as income. Understanding these tax implications is crucial for investors to manage their portfolios effectively and optimize after-tax returns.

Corporate Reasons for Stock Splits

Corporate reasons for stock splits include improving stock liquidity by increasing the number of shares outstanding, making shares more affordable and accessible to a broader range of investors. Companies often initiate stock splits to signal confidence in future growth and to maintain an optimal trading range for their stock price. Unlike stock dividends, stock splits do not distribute additional earnings but rather adjust the share structure to enhance marketability and attract retail investors.

Why Companies Issue Stock Dividends

Companies issue stock dividends to reward shareholders without depleting cash reserves, enhancing shareholder value by increasing the number of shares owned. Stock dividends signal confidence in future earnings and help improve liquidity by broadening the shareholder base. This strategy supports market perception and retains capital for operational or growth investments.

Historical Examples of Stock Splits and Stock Dividends

Apple Inc.'s 4-for-1 stock split in August 2020 is a prominent example, increasing share liquidity and making stock more accessible to retail investors. Conversely, Coca-Cola's 2012 stock dividend issuance, distributing additional shares instead of cash, rewarded shareholders while preserving company cash flow. Historical trends indicate stock splits aim to enhance marketability, whereas stock dividends often serve as a strategy to reward investors without affecting cash reserves.

Which is Better for Investors: Split or Dividend?

Stock splits increase the number of shares outstanding by dividing existing shares, making shares more affordable and enhancing liquidity without changing the company's market capitalization. Stock dividends distribute additional shares to shareholders, providing a direct increase in holdings that may lead to compounding returns over time. For investors seeking greater market liquidity and ease of trading, stock splits are preferable, while those aiming for long-term growth and reinvestment may find stock dividends more beneficial.

Stock Split vs Stock Dividend Infographic

difterm.com

difterm.com