A custodian bank safeguards a firm's or individual's financial assets, providing services such as settlement, custody, and asset servicing to ensure security and regulatory compliance. A depository primarily handles the electronic record-keeping and transfer of securities, facilitating smooth transactions and ownership transfers. While both play critical roles in the financial ecosystem, custodian banks offer broader asset management services compared to the transactional focus of depositories.

Table of Comparison

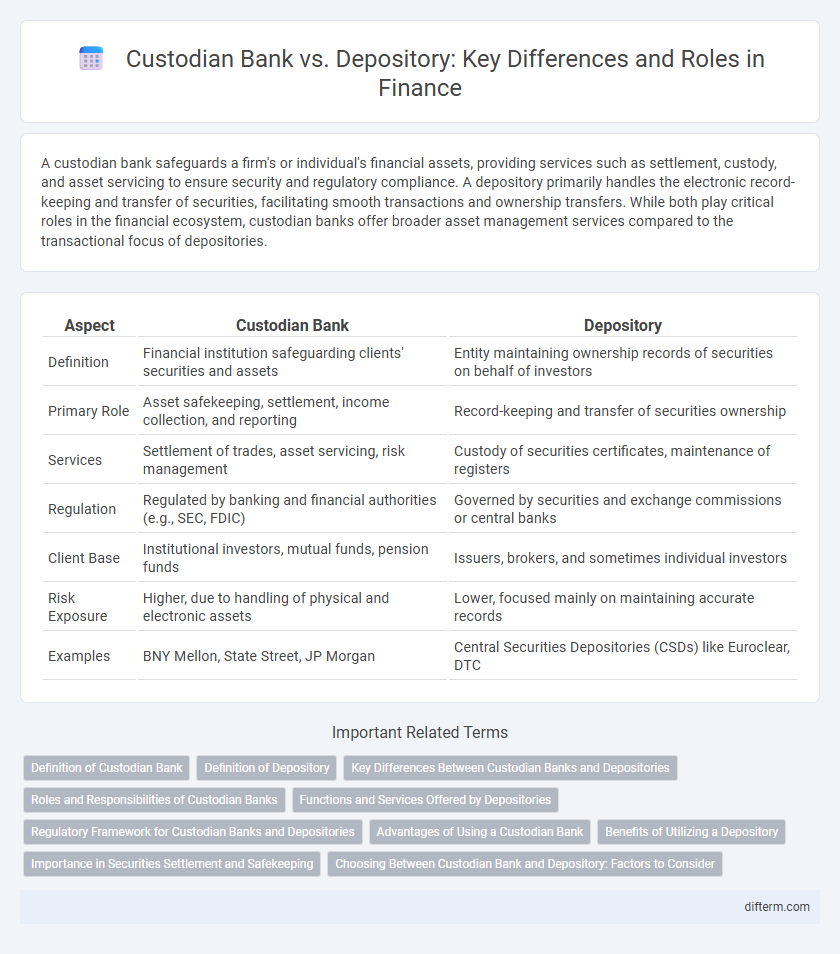

| Aspect | Custodian Bank | Depository |

|---|---|---|

| Definition | Financial institution safeguarding clients' securities and assets | Entity maintaining ownership records of securities on behalf of investors |

| Primary Role | Asset safekeeping, settlement, income collection, and reporting | Record-keeping and transfer of securities ownership |

| Services | Settlement of trades, asset servicing, risk management | Custody of securities certificates, maintenance of registers |

| Regulation | Regulated by banking and financial authorities (e.g., SEC, FDIC) | Governed by securities and exchange commissions or central banks |

| Client Base | Institutional investors, mutual funds, pension funds | Issuers, brokers, and sometimes individual investors |

| Risk Exposure | Higher, due to handling of physical and electronic assets | Lower, focused mainly on maintaining accurate records |

| Examples | BNY Mellon, State Street, JP Morgan | Central Securities Depositories (CSDs) like Euroclear, DTC |

Definition of Custodian Bank

A custodian bank is a specialized financial institution responsible for safeguarding a client's securities and assets, ensuring their safekeeping, settlement of transactions, and income collection. It acts as a trusted intermediary that holds and protects financial assets on behalf of institutional investors such as mutual funds, pension funds, and insurance companies. Unlike a depository, which primarily facilitates electronic recordkeeping and transfer of securities, a custodian bank provides comprehensive asset servicing including risk management, compliance administration, and corporate action processing.

Definition of Depository

A depository is a financial institution that holds securities such as stocks, bonds, and commodities in electronic or physical form to facilitate trading and settlement. It acts as a central repository for investors' assets, ensuring safety, efficient transfer, and accurate record-keeping. Unlike custodian banks, depositories primarily focus on providing electronic record maintenance and settlement services rather than offering a broader range of asset management and banking functions.

Key Differences Between Custodian Banks and Depositories

Custodian banks safeguard financial assets by providing services such as settlement, safekeeping, and asset servicing, catering primarily to institutional clients. Depositories, on the other hand, act as centralized repositories that hold securities in electronic form, facilitating the transfer and settlement of shares in the stock market. Unlike depositories, custodian banks offer a broader range of personalized financial services, including foreign exchange, tax reclamation, and corporate actions management.

Roles and Responsibilities of Custodian Banks

Custodian banks safeguard financial assets by holding securities on behalf of clients and ensuring their proper settlement and safekeeping, reducing the risk of loss or theft. They manage corporate actions, collect dividends, and handle tax reclaim processes, providing comprehensive administrative services that enhance investment security and efficiency. Unlike depositories that primarily facilitate the electronic recording and transfer of securities, custodian banks offer a broader range of fiduciary responsibilities and asset servicing functions.

Functions and Services Offered by Depositories

Depositories primarily provide electronic record-keeping services for securities, facilitating the dematerialization and transfer of shares to enhance efficiency and reduce risks associated with physical certificates. They offer services such as account maintenance, settlement of trades, pledge creations, and corporate action processing, ensuring seamless asset management for investors. Custodian banks, in contrast, focus on safeguarding client assets, handling a broader range of investment instruments, and offering additional financial services such as fund administration and reporting.

Regulatory Framework for Custodian Banks and Depositories

Custodian banks operate under stringent regulatory frameworks established by financial authorities such as the SEC and FINRA in the United States, ensuring robust oversight of asset safekeeping, settlement, and compliance with anti-money laundering (AML) laws. Depositories, governed by regulations like the Depository Trust Company (DTC) rules and Federal Reserve requirements, focus primarily on the secure electronic holding and transfer of securities to increase market efficiency and reduce settlement risks. Both entities must adhere to capital adequacy standards and operational risk management protocols, but custodian banks are subject to broader fiduciary responsibilities and regulatory scrutiny due to their comprehensive asset servicing roles.

Advantages of Using a Custodian Bank

Custodian banks offer comprehensive asset protection and risk management services, ensuring secure custody and segregation of client assets. They provide streamlined settlement processes and facilitate regulatory compliance, reducing operational risks for institutional investors. Enhanced reporting and global asset servicing capabilities enable efficient portfolio management and improved transparency.

Benefits of Utilizing a Depository

Utilizing a depository enhances the safety and efficiency of securities transactions by providing centralized custody and reducing settlement risks through electronic record-keeping. Depositories facilitate faster trade settlements and seamless transfer of ownership, significantly minimizing the risk of theft or loss of physical certificates. They also improve transparency and regulatory compliance, streamlining asset management for investors and financial institutions alike.

Importance in Securities Settlement and Safekeeping

Custodian banks play a critical role in securities settlement and safekeeping by providing comprehensive asset servicing, including settlement processing, corporate actions management, and risk mitigation for institutional investors. Depositories function as centralized entities that hold securities in electronic form, ensuring efficient transfer and registration of ownership, which is fundamental to the integrity and speed of settlement cycles. Together, custodian banks and depositories establish a secure infrastructure that underpins market liquidity, transparency, and investor confidence in financial markets.

Choosing Between Custodian Bank and Depository: Factors to Consider

Choosing between a custodian bank and a depository depends on the scope of asset protection and regulatory compliance required by the financial institution. Custodian banks offer comprehensive services including safekeeping, settlement, and reporting for institutional assets, while depositories primarily focus on the electronic record-keeping and transfer of securities. Key factors include the complexity of asset types, geographic reach, risk management capabilities, and cost-effectiveness of the service model aligned with the investor's operational needs.

Custodian Bank vs Depository Infographic

difterm.com

difterm.com