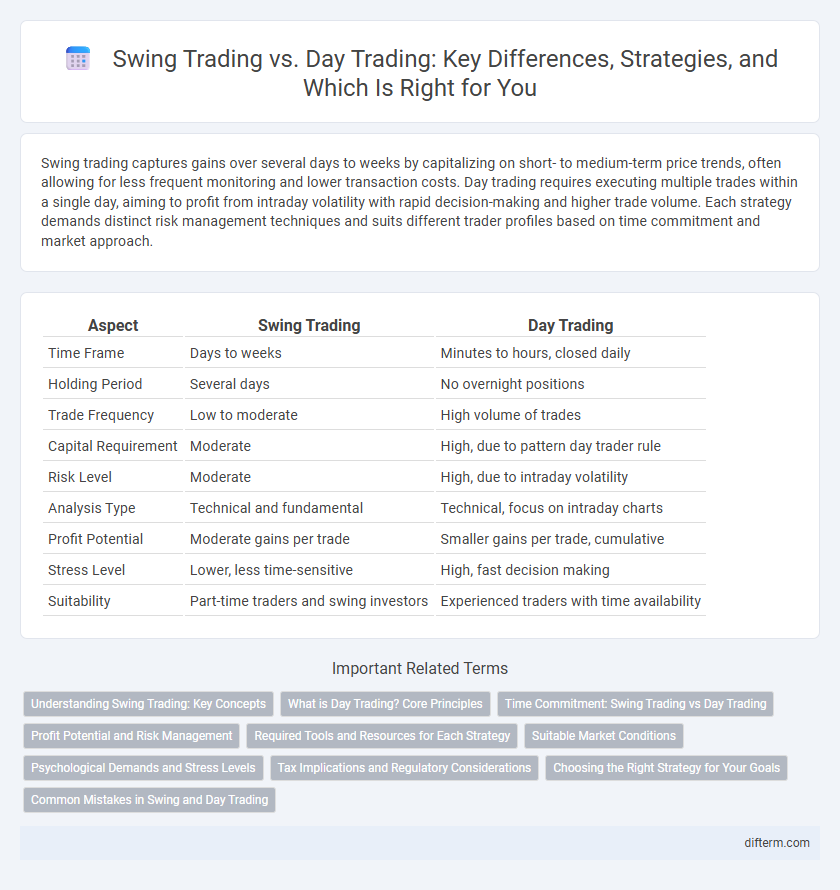

Swing trading captures gains over several days to weeks by capitalizing on short- to medium-term price trends, often allowing for less frequent monitoring and lower transaction costs. Day trading requires executing multiple trades within a single day, aiming to profit from intraday volatility with rapid decision-making and higher trade volume. Each strategy demands distinct risk management techniques and suits different trader profiles based on time commitment and market approach.

Table of Comparison

| Aspect | Swing Trading | Day Trading |

|---|---|---|

| Time Frame | Days to weeks | Minutes to hours, closed daily |

| Holding Period | Several days | No overnight positions |

| Trade Frequency | Low to moderate | High volume of trades |

| Capital Requirement | Moderate | High, due to pattern day trader rule |

| Risk Level | Moderate | High, due to intraday volatility |

| Analysis Type | Technical and fundamental | Technical, focus on intraday charts |

| Profit Potential | Moderate gains per trade | Smaller gains per trade, cumulative |

| Stress Level | Lower, less time-sensitive | High, fast decision making |

| Suitability | Part-time traders and swing investors | Experienced traders with time availability |

Understanding Swing Trading: Key Concepts

Swing trading involves holding positions for several days to weeks to capitalize on anticipated price moves, contrasting with the rapid buy-sell cycles of day trading. Key concepts include identifying market trends, using technical analysis tools like moving averages and support-resistance levels, and managing risk through stop-loss orders. Successful swing traders prioritize patience and market timing, aiming to capture medium-term gains while avoiding the noise of intraday volatility.

What is Day Trading? Core Principles

Day trading involves buying and selling financial instruments within the same trading day to capitalize on short-term price movements. Core principles include strict risk management, quick decision-making, and leveraging technical analysis tools like charts and indicators for timely entry and exit points. Successful day traders maintain discipline to control losses and maximize profits by closely monitoring market trends and news.

Time Commitment: Swing Trading vs Day Trading

Swing trading requires a moderate time commitment, as traders typically hold positions for several days to weeks, allowing for analysis and decision-making outside of market hours. Day trading demands intense focus and full market engagement, with positions opened and closed within the same trading day. The time sensitivity and rapid market moves of day trading contrast sharply with the longer-term strategy and flexibility inherent in swing trading.

Profit Potential and Risk Management

Swing trading offers higher profit potential by capturing medium-term market trends, often holding positions from days to weeks, allowing traders to benefit from larger price movements compared to day trading's rapid buy-sell cycles within a single day. Risk management in swing trading centers on setting wider stop-loss orders to accommodate market volatility, whereas day trading demands stricter risk controls with tight stop-losses due to the increased frequency of trades and intra-day price fluctuations. Effective profit potential in both strategies depends on disciplined use of technical analysis tools and adherence to preset risk-reward ratios tailored to the trader's preferred holding period.

Required Tools and Resources for Each Strategy

Swing trading requires robust charting software with advanced technical analysis tools to identify medium-term price patterns, alongside access to reliable market news and economic calendars for timing trades. Day trading demands real-time data feeds, high-speed execution platforms, and low-latency direct market access to capitalize on intraday price fluctuations, supported by multiple monitors for tracking various assets simultaneously. Both strategies benefit from risk management tools such as stop-loss orders and trading journals to optimize performance and discipline.

Suitable Market Conditions

Swing trading thrives in stable or moderately volatile markets, allowing traders to capture medium-term price movements over several days to weeks. Day trading suits highly liquid markets with significant intraday volatility, providing opportunities for rapid entry and exit within the same trading session. Understanding these distinct market conditions enhances decision-making and optimizes trading strategies.

Psychological Demands and Stress Levels

Swing trading typically involves holding positions for several days to weeks, which allows traders more time to analyze market trends and make calculated decisions, resulting in lower psychological stress compared to day trading. Day trading requires rapid decision-making and constant monitoring of price movements within a single trading day, leading to higher stress levels and increased mental fatigue. Effective stress management and emotional discipline are crucial for both strategies, but day trading demands quicker reflexes and resilience to volatile market conditions.

Tax Implications and Regulatory Considerations

Swing trading often results in holding positions beyond a single day, triggering short-term capital gains tax rates that are typically higher than long-term rates applied to holdings over one year; day trading profits are usually taxed as ordinary income due to the rapid buy-sell cycles within the same trading day. Regulatory considerations include the SEC's pattern day trader rule, which requires a minimum equity of $25,000 in a margin account for active day traders, whereas swing traders face fewer restrictions but must comply with general market regulations. Understanding these tax implications and regulatory frameworks is essential for traders to optimize after-tax returns and maintain compliance with financial authorities.

Choosing the Right Strategy for Your Goals

Swing trading involves holding positions for several days to weeks, capitalizing on medium-term price momentum, while day trading requires executing multiple trades within a single trading day to exploit short-term market fluctuations. Choosing the right strategy depends on factors such as risk tolerance, capital availability, market knowledge, and time commitment, with swing trading suited for those seeking flexibility and day trading favored by individuals who can dedicate significant time to active monitoring. Aligning your trading style with personal financial goals and market conditions enhances the potential for consistent returns and effective risk management.

Common Mistakes in Swing and Day Trading

Common mistakes in swing trading include holding losing positions too long due to emotional attachment and neglecting proper stop-loss placement, which leads to amplified losses. Day traders often err by overtrading, driven by impatience or chasing quick profits, resulting in increased transaction costs and reduced net gains. Both strategies demand disciplined risk management and adherence to trading plans to avoid these pitfalls effectively.

Swing Trading vs Day Trading Infographic

difterm.com

difterm.com