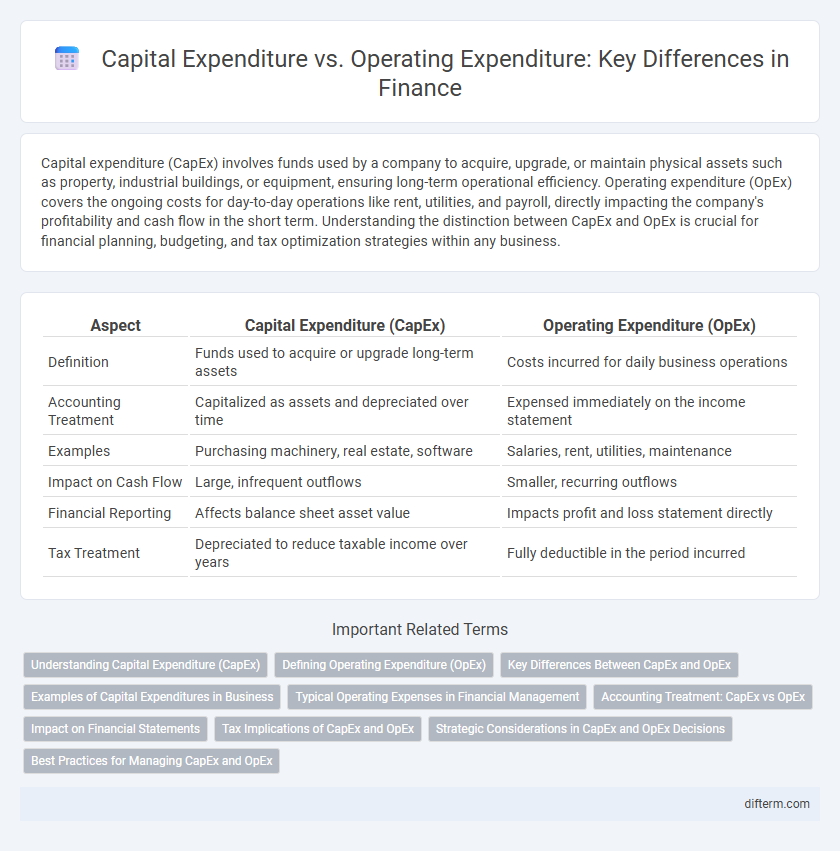

Capital expenditure (CapEx) involves funds used by a company to acquire, upgrade, or maintain physical assets such as property, industrial buildings, or equipment, ensuring long-term operational efficiency. Operating expenditure (OpEx) covers the ongoing costs for day-to-day operations like rent, utilities, and payroll, directly impacting the company's profitability and cash flow in the short term. Understanding the distinction between CapEx and OpEx is crucial for financial planning, budgeting, and tax optimization strategies within any business.

Table of Comparison

| Aspect | Capital Expenditure (CapEx) | Operating Expenditure (OpEx) |

|---|---|---|

| Definition | Funds used to acquire or upgrade long-term assets | Costs incurred for daily business operations |

| Accounting Treatment | Capitalized as assets and depreciated over time | Expensed immediately on the income statement |

| Examples | Purchasing machinery, real estate, software | Salaries, rent, utilities, maintenance |

| Impact on Cash Flow | Large, infrequent outflows | Smaller, recurring outflows |

| Financial Reporting | Affects balance sheet asset value | Impacts profit and loss statement directly |

| Tax Treatment | Depreciated to reduce taxable income over years | Fully deductible in the period incurred |

Understanding Capital Expenditure (CapEx)

Capital Expenditure (CapEx) refers to funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, or equipment, which provide long-term value and contribute to future growth. Unlike Operating Expenditure (OpEx), which covers day-to-day expenses, CapEx involves substantial investments that are capitalized and depreciated over time on the balance sheet. Understanding CapEx is crucial for financial planning as it impacts cash flow, asset management, and the company's long-term strategic development.

Defining Operating Expenditure (OpEx)

Operating Expenditure (OpEx) refers to the ongoing costs required for the daily functioning of a business, including expenses such as rent, utilities, salaries, and maintenance. Unlike Capital Expenditure (CapEx), which involves investments in long-term assets, OpEx covers short-term, recurring costs essential for operations. Effective management of OpEx is crucial for optimizing cash flow and maintaining profitability in financial planning.

Key Differences Between CapEx and OpEx

Capital expenditure (CapEx) involves long-term investments in physical assets such as property, equipment, or infrastructure that provide value over multiple accounting periods, while operating expenditure (OpEx) covers the ongoing costs necessary for daily business operations like salaries, rent, and utilities. CapEx impacts the balance sheet through asset capitalization and depreciation, whereas OpEx affects the income statement directly as expenses within the current period. Understanding these distinctions is crucial for financial planning, budgeting, and tax strategy optimization in corporate finance.

Examples of Capital Expenditures in Business

Capital expenditures in business typically include the purchase of physical assets such as machinery, property, and equipment necessary for production or operations. Investments in upgrading technology systems, acquiring vehicles, or constructing new facilities also represent capital expenditures. These long-term assets are recorded on the balance sheet and depreciated over time, distinguishing them from operating expenditures which are short-term expenses like rent, utilities, and salaries.

Typical Operating Expenses in Financial Management

Typical operating expenses in financial management include rent, utilities, salaries, office supplies, and maintenance costs essential for daily business operations. These expenses are recurring and directly impact cash flow and profit margins, distinguishing them from capital expenditures, which are long-term investments in assets. Effective management of operating expenses ensures operational efficiency and supports sustainable financial health.

Accounting Treatment: CapEx vs OpEx

Capital expenditure (CapEx) is recorded as a fixed asset on the balance sheet and depreciated over its useful life, reflecting long-term investment in physical assets. Operating expenditure (OpEx) is expensed immediately on the income statement, reducing net income in the period incurred due to routine business operations. This accounting treatment impacts cash flow analysis, tax deductions, and profit measurement, influencing financial planning and decision-making strategies.

Impact on Financial Statements

Capital expenditure (CapEx) directly affects the balance sheet by increasing assets and typically leads to depreciation expenses on the income statement over time. Operating expenditure (OpEx) impacts the income statement immediately by reducing net income as it covers day-to-day operational costs. The cash flow statement reflects CapEx under investing activities, while OpEx appears in operating activities, influencing liquidity differently.

Tax Implications of CapEx and OpEx

Capital expenditure (CapEx) typically offers tax advantages through depreciation deductions spread over multiple years, reducing taxable income gradually. Operating expenditure (OpEx), on the other hand, is fully deductible in the year incurred, providing immediate tax relief. Understanding the timing and impact of these tax implications is crucial for optimal financial planning and cash flow management.

Strategic Considerations in CapEx and OpEx Decisions

Strategic considerations in CapEx and OpEx decisions hinge on long-term asset growth versus short-term operational flexibility. Capital expenditure drives infrastructure expansion and technological upgrades, significantly impacting balance sheets and depreciation schedules. Operating expenditure, while recurring, supports day-to-day functions and allows adaptable budgeting to meet fluctuating market demands.

Best Practices for Managing CapEx and OpEx

Effective management of Capital Expenditure (CapEx) and Operating Expenditure (OpEx) involves rigorous budgeting and prioritization aligned with strategic business goals. Implementing detailed cost-benefit analysis and leveraging financial forecasting models enhance resource allocation and prevent overspending. Continuous monitoring through real-time expense tracking systems ensures transparency and supports agile adjustments in both CapEx and OpEx projects.

Capital expenditure vs Operating expenditure Infographic

difterm.com

difterm.com