Risk Parity strategically allocates portfolio weights to equalize risk contributions across assets, aiming to improve diversification and reduce volatility regardless of market conditions. Mean-Variance Optimization focuses on maximizing expected returns for a given level of risk by analyzing asset return correlations and variances but can be sensitive to estimation errors and extreme inputs. Investors seeking stable risk distribution often prefer Risk Parity, while those targeting specific return-risk trade-offs may opt for Mean-Variance Optimization despite its potential sensitivity.

Table of Comparison

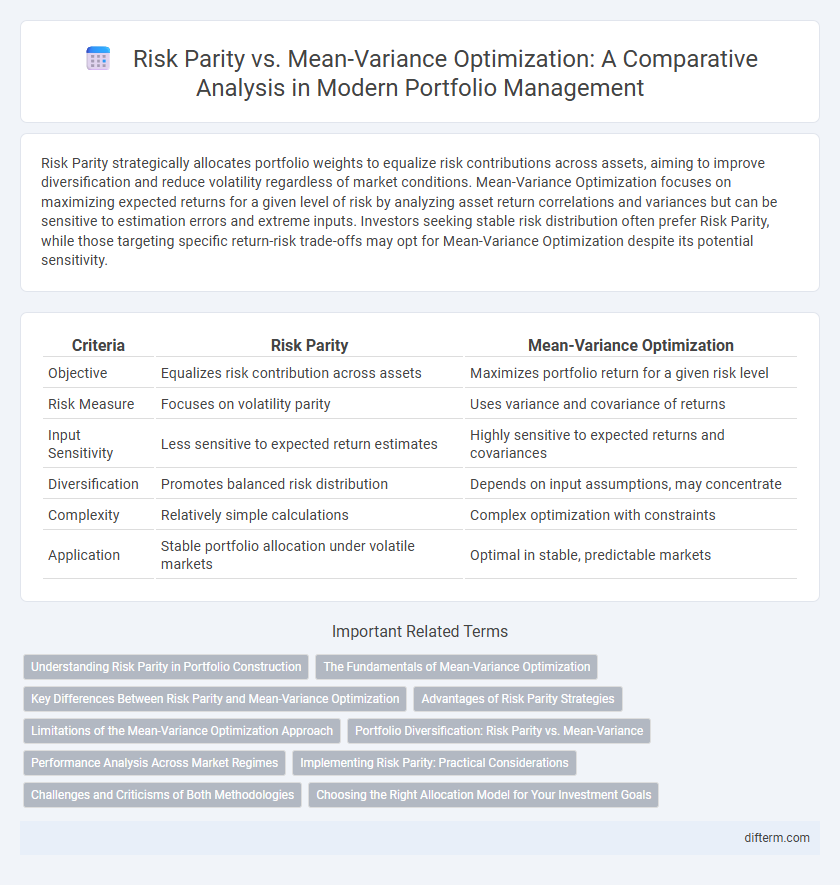

| Criteria | Risk Parity | Mean-Variance Optimization |

|---|---|---|

| Objective | Equalizes risk contribution across assets | Maximizes portfolio return for a given risk level |

| Risk Measure | Focuses on volatility parity | Uses variance and covariance of returns |

| Input Sensitivity | Less sensitive to expected return estimates | Highly sensitive to expected returns and covariances |

| Diversification | Promotes balanced risk distribution | Depends on input assumptions, may concentrate |

| Complexity | Relatively simple calculations | Complex optimization with constraints |

| Application | Stable portfolio allocation under volatile markets | Optimal in stable, predictable markets |

Understanding Risk Parity in Portfolio Construction

Risk Parity in portfolio construction emphasizes equalizing risk contributions from each asset class rather than focusing solely on expected returns and variances as seen in Mean-Variance Optimization. This approach enhances diversification by balancing volatility and reducing concentration in high-risk assets, potentially delivering more stable risk-adjusted returns. Understanding the mechanics of volatility scaling and correlation impacts is crucial for implementing effective risk parity strategies in multi-asset portfolios.

The Fundamentals of Mean-Variance Optimization

Mean-Variance Optimization centers on balancing portfolio return against risk by maximizing expected return for a given level of variance or minimizing variance for a target return, utilizing the covariance matrix of asset returns. This framework relies on inputs such as expected asset returns, variances, and covariances to construct an efficient frontier that guides optimal asset allocation. Despite its theoretical efficiency, Mean-Variance Optimization often faces challenges from estimation errors and sensitivity to input assumptions, impacting portfolio robustness.

Key Differences Between Risk Parity and Mean-Variance Optimization

Risk Parity allocates assets by equalizing risk contributions across portfolio components, emphasizing diversification to reduce volatility without relying heavily on expected returns. Mean-Variance Optimization targets maximizing returns for a given level of risk using estimated returns and covariances, which can lead to concentrated portfolios sensitive to estimation errors. The key difference lies in Risk Parity's reliance on risk allocation, whereas Mean-Variance Optimization depends primarily on return forecasts and risk-return trade-offs.

Advantages of Risk Parity Strategies

Risk Parity strategies offer enhanced diversification by allocating risk evenly across asset classes, reducing portfolio sensitivity to market volatility and drawdowns. These strategies tend to provide more stable returns under varying economic conditions compared to Mean-Variance Optimization, which relies heavily on historical return estimates that can be unstable. By mitigating concentration risk and improving risk-adjusted performance, Risk Parity serves as a robust approach for long-term portfolio management.

Limitations of the Mean-Variance Optimization Approach

Mean-Variance Optimization (MVO) often underestimates portfolio risk due to its reliance on historical return correlations and volatility, which can be unstable and non-stationary. This approach tends to produce portfolios highly sensitive to input assumptions, leading to concentrated asset allocations and poor out-of-sample performance. Moreover, MVO struggles with incorporating tail risks and extreme market events, limiting its effectiveness in real-world financial risk management.

Portfolio Diversification: Risk Parity vs. Mean-Variance

Risk Parity enhances portfolio diversification by allocating risk equally across asset classes, reducing concentration in high-volatility assets and improving stability. Mean-Variance Optimization relies on expected returns and covariance estimates, often leading to concentrated allocations in assets with higher predicted returns but increased estimation error risk. By balancing risk contributions instead of capital weights, Risk Parity achieves more robust diversification and potentially higher risk-adjusted returns under varying market conditions.

Performance Analysis Across Market Regimes

Risk Parity strategies tend to offer more stable and consistent returns across varied market regimes by focusing on equal risk contribution from asset classes, reducing volatility during downturns. Mean-Variance Optimization often delivers higher returns in trending markets but suffers from increased drawdowns and sensitivity to input estimation errors in volatile or sideways markets. Empirical studies highlight Risk Parity's robustness in crisis periods, while Mean-Variance Optimization excels in bullish environments with favorable asset correlations.

Implementing Risk Parity: Practical Considerations

Implementing Risk Parity involves allocating portfolio weights to equalize risk contributions, requiring accurate estimation of asset volatilities and correlations to ensure diversification benefits. Practical considerations include adjusting for changing market conditions through dynamic rebalancing and incorporating constraints to manage leverage and transaction costs. Robust risk models and stress testing enhance portfolio resilience compared to traditional mean-variance optimization, which relies heavily on expected returns and covariance estimates.

Challenges and Criticisms of Both Methodologies

Risk Parity faces challenges related to its reliance on historical volatility estimates, which can underestimate tail risks during market stress and lead to overexposure to low-volatility asset classes. Mean-Variance Optimization struggles with sensitivity to input assumptions, such as expected returns and covariance matrices, often resulting in unstable portfolios with concentrated holdings. Both methodologies are criticized for their potential to produce misleading allocation signals in the presence of non-stationary market conditions and estimation errors.

Choosing the Right Allocation Model for Your Investment Goals

Risk Parity focuses on balancing risk contributions across assets to create diversified portfolios that reduce drawdowns, while Mean-Variance Optimization aims to maximize returns for a given level of risk based on expected returns and covariances. Investors targeting stability and consistent risk exposure may prefer Risk Parity, whereas those seeking higher returns with calculated risk tolerance often opt for Mean-Variance Optimization. Assessing personal investment goals, risk appetite, and market assumptions is critical to selecting the appropriate allocation model.

Risk Parity vs Mean-Variance Optimization Infographic

difterm.com

difterm.com