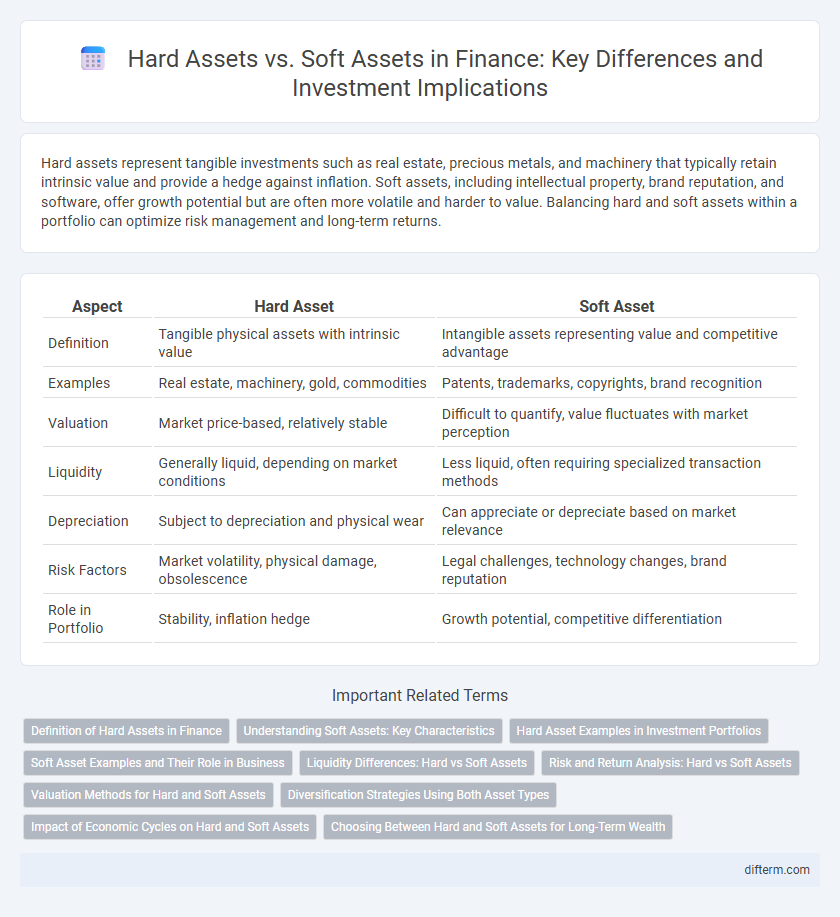

Hard assets represent tangible investments such as real estate, precious metals, and machinery that typically retain intrinsic value and provide a hedge against inflation. Soft assets, including intellectual property, brand reputation, and software, offer growth potential but are often more volatile and harder to value. Balancing hard and soft assets within a portfolio can optimize risk management and long-term returns.

Table of Comparison

| Aspect | Hard Asset | Soft Asset |

|---|---|---|

| Definition | Tangible physical assets with intrinsic value | Intangible assets representing value and competitive advantage |

| Examples | Real estate, machinery, gold, commodities | Patents, trademarks, copyrights, brand recognition |

| Valuation | Market price-based, relatively stable | Difficult to quantify, value fluctuates with market perception |

| Liquidity | Generally liquid, depending on market conditions | Less liquid, often requiring specialized transaction methods |

| Depreciation | Subject to depreciation and physical wear | Can appreciate or depreciate based on market relevance |

| Risk Factors | Market volatility, physical damage, obsolescence | Legal challenges, technology changes, brand reputation |

| Role in Portfolio | Stability, inflation hedge | Growth potential, competitive differentiation |

Definition of Hard Assets in Finance

Hard assets in finance refer to tangible, physical assets such as real estate, precious metals, machinery, and natural resources that hold intrinsic value. These assets provide a hedge against inflation and economic uncertainty due to their limited supply and physical presence. Investors often favor hard assets for portfolio diversification and long-term wealth preservation.

Understanding Soft Assets: Key Characteristics

Soft assets include intangible resources such as intellectual property, brand reputation, and customer relationships that contribute significantly to a company's value. These assets lack physical substance but can generate sustainable competitive advantages and long-term revenue streams. Unlike hard assets, soft assets are more challenging to quantify and require strategic management to maximize their financial impact.

Hard Asset Examples in Investment Portfolios

Hard assets in investment portfolios include tangible resources such as real estate, precious metals like gold and silver, and commodities like oil and agricultural products. These assets provide intrinsic value and serve as a hedge against inflation and market volatility due to their physical presence and scarcity. Investors often allocate a portion of their portfolio to hard assets to diversify risk and preserve wealth during economic downturns.

Soft Asset Examples and Their Role in Business

Soft assets include intellectual property, brand reputation, customer relationships, and software, playing a critical role in driving business growth and competitive advantage. These intangible assets enhance operational efficiency, foster innovation, and increase market value, often serving as key factors in mergers and acquisitions. Effective management of soft assets leads to improved customer loyalty, higher profit margins, and sustainable long-term success.

Liquidity Differences: Hard vs Soft Assets

Hard assets such as real estate, gold, and machinery typically exhibit lower liquidity, requiring more time and effort to convert into cash compared to soft assets like stocks, bonds, and patents, which can be swiftly traded on financial markets. The liquidity difference impacts investment strategy, with soft assets offering greater flexibility for short-term financial needs due to their ease of sale and marketability. Investors often balance portfolios by combining both asset types to optimize liquidity risk and capital preservation.

Risk and Return Analysis: Hard vs Soft Assets

Hard assets such as real estate, precious metals, and commodities typically offer lower volatility and act as a hedge against inflation, providing stable returns in uncertain markets. Soft assets like stocks, bonds, and intellectual property carry higher risk due to market fluctuations but often yield greater potential returns over time. Evaluating the risk-return tradeoff involves assessing asset liquidity, market sensitivity, and long-term growth prospects to optimize portfolio diversification.

Valuation Methods for Hard and Soft Assets

Valuation methods for hard assets typically involve cost approach, market comparison, and income capitalization, emphasizing tangible factors such as physical condition and replacement cost. Soft asset valuation relies on techniques like discounted cash flow analysis, brand equity measurement, and market-based approaches that consider intangibles like intellectual property and goodwill. Accurate valuation requires adjusting for asset liquidity, market volatility, and revenue-generating potential specific to the asset type.

Diversification Strategies Using Both Asset Types

Diversification strategies benefit from combining hard assets like real estate and precious metals with soft assets such as stocks and bonds to balance risk and return. Hard assets provide tangible value and inflation hedging while soft assets offer liquidity and growth potential. Integrating both asset types enhances portfolio resilience against market volatility and economic downturns.

Impact of Economic Cycles on Hard and Soft Assets

Economic cycles significantly influence the value and performance of hard assets such as real estate, commodities, and infrastructure, which often serve as tangible hedges against inflation and market volatility during downturns. Soft assets, including intellectual property, brand value, and digital assets, tend to be more sensitive to economic fluctuations, experiencing greater valuation swings due to changes in consumer demand and investment sentiment. During periods of economic expansion, soft assets typically appreciate faster due to increased innovation and market confidence, while hard assets provide stability and preserve wealth in recessionary phases.

Choosing Between Hard and Soft Assets for Long-Term Wealth

Choosing between hard and soft assets for long-term wealth involves evaluating tangible investments like real estate, gold, and commodities against intangible assets such as stocks, patents, and cryptocurrencies. Hard assets provide stability and hedge against inflation due to their physical nature and intrinsic value, while soft assets offer higher liquidity and growth potential driven by market performance and innovation. Diversifying between these asset classes balances risk and return, optimizing portfolio resilience and wealth accumulation over time.

Hard asset vs Soft asset Infographic

difterm.com

difterm.com