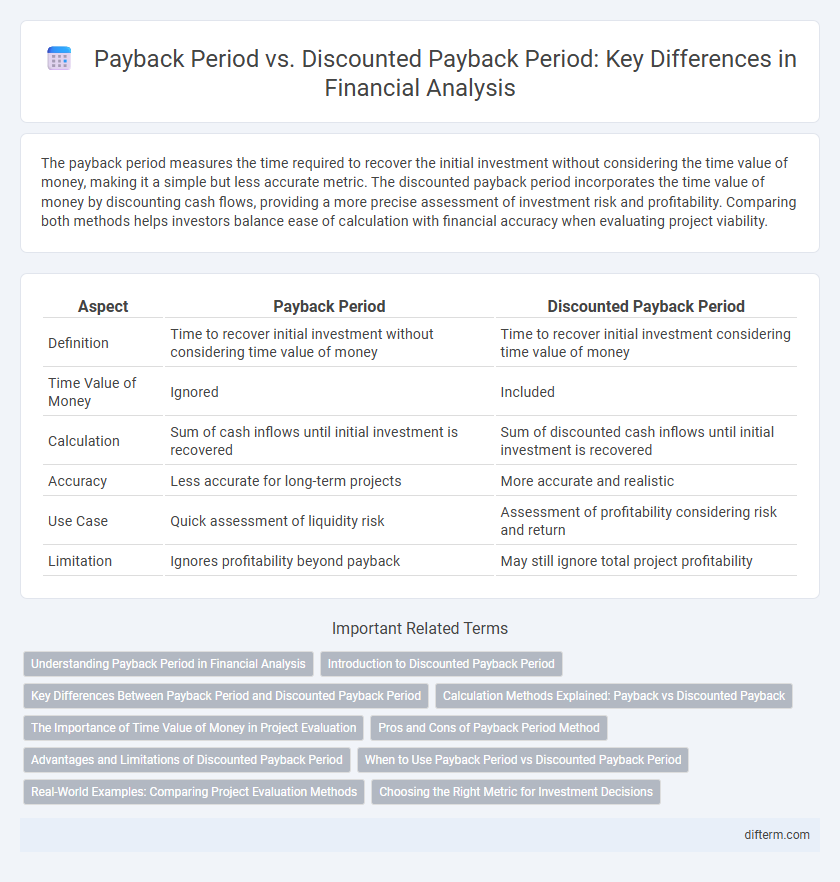

The payback period measures the time required to recover the initial investment without considering the time value of money, making it a simple but less accurate metric. The discounted payback period incorporates the time value of money by discounting cash flows, providing a more precise assessment of investment risk and profitability. Comparing both methods helps investors balance ease of calculation with financial accuracy when evaluating project viability.

Table of Comparison

| Aspect | Payback Period | Discounted Payback Period |

|---|---|---|

| Definition | Time to recover initial investment without considering time value of money | Time to recover initial investment considering time value of money |

| Time Value of Money | Ignored | Included |

| Calculation | Sum of cash inflows until initial investment is recovered | Sum of discounted cash inflows until initial investment is recovered |

| Accuracy | Less accurate for long-term projects | More accurate and realistic |

| Use Case | Quick assessment of liquidity risk | Assessment of profitability considering risk and return |

| Limitation | Ignores profitability beyond payback | May still ignore total project profitability |

Understanding Payback Period in Financial Analysis

The payback period measures the time required for an investment to generate cash flows sufficient to recover the initial cost, providing a simple evaluation of liquidity risk. The discounted payback period improves accuracy by incorporating the time value of money, discounting future cash flows to present value before calculating recovery time. This distinction helps financial analysts assess investment viability with greater precision, balancing simplicity with comprehensive risk assessment.

Introduction to Discounted Payback Period

The discounted payback period improves upon the traditional payback period by accounting for the time value of money, providing a clearer measure of investment risk and profitability. This method discounts future cash flows using a specific rate, usually the project's cost of capital, to determine how long it takes to recover the initial investment in present value terms. Understanding the discounted payback period is crucial for financial analysts as it offers a more accurate evaluation of an investment's break-even timeline compared to the simple payback period.

Key Differences Between Payback Period and Discounted Payback Period

The payback period measures the time required to recover the initial investment without accounting for the time value of money, while the discounted payback period incorporates cash flow discounting to reflect present value. Unlike the payback period, the discounted payback period provides a more accurate assessment of an investment's profitability by considering the opportunity cost and risk associated with future cash flows. Firms use the discounted payback period to evaluate projects with unequal cash flow timings or when the cost of capital is significant.

Calculation Methods Explained: Payback vs Discounted Payback

The payback period calculates the time required for an investment to generate cash flows equal to the initial cost without considering the time value of money. In contrast, the discounted payback period incorporates the net present value of future cash flows by discounting them at a specified rate, offering a more accurate measure of investment recovery time. This method adjusts for risk and opportunity cost, providing investors with a clearer assessment of project viability.

The Importance of Time Value of Money in Project Evaluation

Payback period measures the time required to recover the initial investment without accounting for the time value of money, potentially leading to misleading project viability assessments. Discounted payback period incorporates the time value of money by discounting cash flows, providing a more accurate evaluation of project profitability and financial risk. Understanding these differences is crucial for making informed investment decisions and optimizing capital allocation in financial management.

Pros and Cons of Payback Period Method

The payback period method offers simplicity and quick assessment of investment risk by measuring how fast initial costs are recovered, making it useful for projects with liquidity concerns. However, it ignores the time value of money and cash flows beyond the payback cutoff, potentially leading to suboptimal investment decisions in projects with long-term benefits. Despite its ease of use, reliance solely on payback period can underestimate profitability and overlook project sustainability.

Advantages and Limitations of Discounted Payback Period

The discounted payback period improves upon the traditional payback period by incorporating the time value of money, providing a more accurate measure of investment risk and profitability. It helps investors assess how long it takes to recover initial costs in present value terms, making it valuable for projects with varying cash flows over time. However, this method still ignores cash flows occurring after the payback cutoff and can be complex to calculate compared to the simple payback period.

When to Use Payback Period vs Discounted Payback Period

The payback period is best used for quick assessments of project liquidity and risk when cash flows are fairly uniform and time value of money is less critical. The discounted payback period is more appropriate for capital-intensive projects with significant cash flow variation or longer durations, as it accounts for the time value of money by discounting future cash flows. Investors and financial analysts prefer the discounted payback period when evaluating projects requiring precise profitability analysis and discount rate sensitivity.

Real-World Examples: Comparing Project Evaluation Methods

The payback period measures the time required to recoup the initial investment without considering the time value of money, making it simple but less accurate for long-term projects. The discounted payback period incorporates discounted cash flows, providing a more realistic timeline for recovering investment by factoring in the project's cost of capital. Real-world examples, such as infrastructure projects or capital-intensive manufacturing expansions, demonstrate that discounted payback often leads to better decision-making by accounting for project risk and cash flow timing.

Choosing the Right Metric for Investment Decisions

The payback period measures the time required to recover the initial investment without considering the time value of money, making it simple but less accurate for long-term projects. The discounted payback period incorporates the present value of cash flows, providing a more precise assessment of investment risk and profitability by accounting for discounting. Selecting the right metric depends on the project's complexity and the need for time value consideration to ensure informed capital budgeting decisions.

Payback period vs discounted payback period Infographic

difterm.com

difterm.com