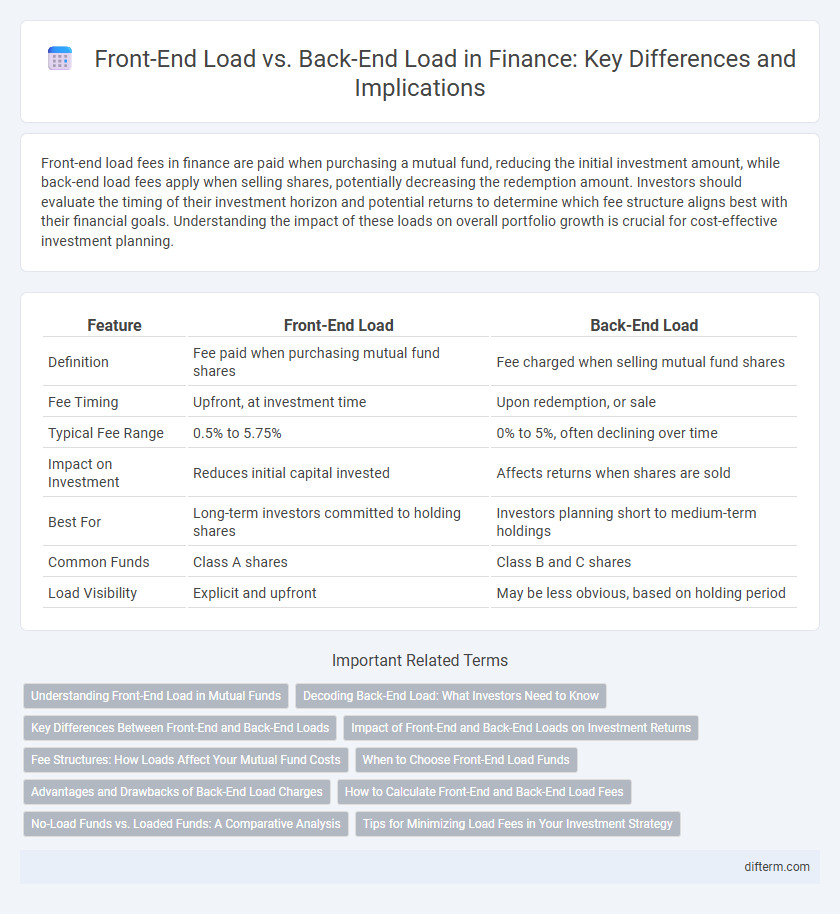

Front-end load fees in finance are paid when purchasing a mutual fund, reducing the initial investment amount, while back-end load fees apply when selling shares, potentially decreasing the redemption amount. Investors should evaluate the timing of their investment horizon and potential returns to determine which fee structure aligns best with their financial goals. Understanding the impact of these loads on overall portfolio growth is crucial for cost-effective investment planning.

Table of Comparison

| Feature | Front-End Load | Back-End Load |

|---|---|---|

| Definition | Fee paid when purchasing mutual fund shares | Fee charged when selling mutual fund shares |

| Fee Timing | Upfront, at investment time | Upon redemption, or sale |

| Typical Fee Range | 0.5% to 5.75% | 0% to 5%, often declining over time |

| Impact on Investment | Reduces initial capital invested | Affects returns when shares are sold |

| Best For | Long-term investors committed to holding shares | Investors planning short to medium-term holdings |

| Common Funds | Class A shares | Class B and C shares |

| Load Visibility | Explicit and upfront | May be less obvious, based on holding period |

Understanding Front-End Load in Mutual Funds

Front-end load in mutual funds refers to a sales charge or commission paid upfront when purchasing shares, typically expressed as a percentage of the investment amount. This fee reduces the initial capital invested but compensates brokers or financial advisors for their services. Understanding front-end loads helps investors evaluate total costs and potential returns compared to no-load or back-end load funds.

Decoding Back-End Load: What Investors Need to Know

Back-end load fees, also known as deferred sales charges, are fees investors pay when selling mutual fund shares, typically decreasing the longer the investor holds the fund. These charges compensate brokers or advisors and can impact overall returns if shares are sold prematurely, often within a period of five to seven years. Understanding back-end load structures helps investors optimize timing for selling shares to minimize costs and maximize investment growth.

Key Differences Between Front-End and Back-End Loads

Front-end load fees are charged at the time of the initial investment, reducing the amount of capital actually invested, while back-end load fees apply when shares are sold, typically decreasing over time to encourage longer holding periods. Front-end loads are common in Class A mutual funds, whereas back-end loads are often associated with Class B shares that convert to Class A after a set period. Understanding these fee structures is crucial for investors to optimize returns and select funds aligned with their investment horizon and liquidity needs.

Impact of Front-End and Back-End Loads on Investment Returns

Front-end loads reduce the initial amount invested, directly decreasing the capital working to generate returns, while back-end loads are charged upon redemption, potentially diminishing the net proceeds from the investment. The timing of these fees impacts compounding growth differently, with front-end loads affecting the investment horizon from the start and back-end loads influencing exit strategies and liquidity planning. Understanding these costs is critical for investors aiming to maximize long-term returns and align fee structures with their investment goals.

Fee Structures: How Loads Affect Your Mutual Fund Costs

Front-end loads are fees charged at the time of initial investment, reducing the amount of capital put to work in the mutual fund, typically ranging from 3% to 5%. Back-end loads, or contingent deferred sales charges (CDSC), apply when shares are sold, often decreasing over a period of several years to encourage long-term holding. Understanding these fee structures is crucial for investors to minimize costs and maximize net returns over the investment horizon.

When to Choose Front-End Load Funds

Front-end load funds are best chosen when investors plan to hold their investment long-term, as the initial sales charge is paid upfront, potentially reducing overall costs compared to frequent trading. These funds suit those who want immediate clarity on expenses and prefer avoiding redemption fees associated with back-end loads. Investors seeking to maximize returns by minimizing ongoing fees often select front-end load funds when market timing is uncertain.

Advantages and Drawbacks of Back-End Load Charges

Back-end load charges, commonly known as deferred sales charges, allow investors to avoid fees when initially purchasing mutual fund shares, promoting higher initial investment amounts. These charges are typically assessed only if the investor redeems shares within a specified period, incentivizing longer-term holding and aligning with strategic financial planning. However, back-end loads can diminish overall returns if shares are sold prematurely, and the potential for complex fee schedules may confuse investors, impacting transparent cost assessment.

How to Calculate Front-End and Back-End Load Fees

Calculate front-end load fees by multiplying the initial investment amount by the fund's front-end load percentage, which reduces the amount invested. Back-end load fees, also known as deferred sales charges, are calculated by applying the back-end load percentage to the redemption amount, often decreasing over time. Understanding the specific load schedules and percentages outlined in a fund's prospectus is essential for accurate fee computation.

No-Load Funds vs. Loaded Funds: A Comparative Analysis

No-load funds eliminate sales charges, allowing investors to allocate 100% of their capital directly into the investment, thereby maximizing initial purchasing power and long-term growth potential. Loaded funds, characterized by front-end loads or back-end loads, impose fees either at the time of purchase or redemption, which can diminish total returns despite potential advisory benefits. Evaluating expense ratios, investment objectives, and holding periods is essential to determining whether no-load or loaded funds align best with an investor's financial goals and cost sensitivity.

Tips for Minimizing Load Fees in Your Investment Strategy

Minimizing load fees in your investment strategy involves carefully selecting no-load or low-load mutual funds to reduce upfront and exit charges that erode returns. Prioritize funds with transparent fee structures and consider dollar-cost averaging to spread purchase timing, mitigating the impact of front-end loads. Regularly review and rebalance your portfolio to avoid unnecessary back-end load penalties while optimizing overall investment growth.

Front-end load vs Back-end load Infographic

difterm.com

difterm.com