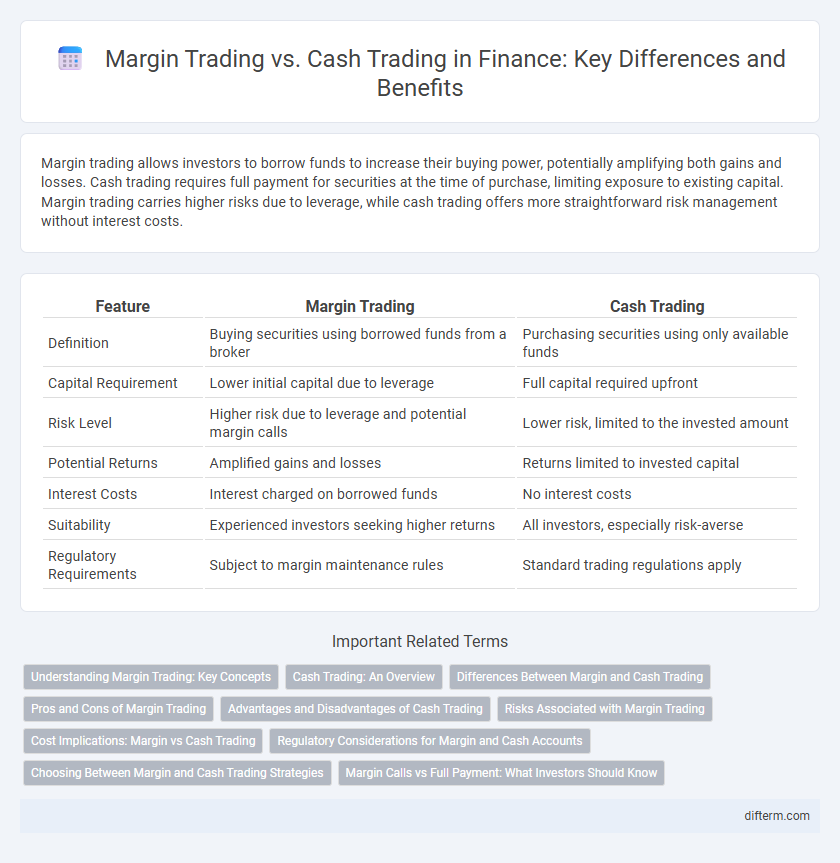

Margin trading allows investors to borrow funds to increase their buying power, potentially amplifying both gains and losses. Cash trading requires full payment for securities at the time of purchase, limiting exposure to existing capital. Margin trading carries higher risks due to leverage, while cash trading offers more straightforward risk management without interest costs.

Table of Comparison

| Feature | Margin Trading | Cash Trading |

|---|---|---|

| Definition | Buying securities using borrowed funds from a broker | Purchasing securities using only available funds |

| Capital Requirement | Lower initial capital due to leverage | Full capital required upfront |

| Risk Level | Higher risk due to leverage and potential margin calls | Lower risk, limited to the invested amount |

| Potential Returns | Amplified gains and losses | Returns limited to invested capital |

| Interest Costs | Interest charged on borrowed funds | No interest costs |

| Suitability | Experienced investors seeking higher returns | All investors, especially risk-averse |

| Regulatory Requirements | Subject to margin maintenance rules | Standard trading regulations apply |

Understanding Margin Trading: Key Concepts

Margin trading involves borrowing funds from a broker to purchase securities, allowing investors to leverage their capital and potentially increase returns. Key concepts include the initial margin (the investor's own capital), maintenance margin (minimum equity required to avoid a margin call), and margin calls (demands for additional funds when equity falls below maintenance levels). Understanding these elements is crucial for managing risks associated with leverage in margin trading compared to cash trading, where purchases are made solely with available funds.

Cash Trading: An Overview

Cash trading involves purchasing securities using available funds without borrowing, ensuring full ownership of the assets. This method mitigates the risk of margin calls and interest payments, providing a straightforward approach to investment. Investors benefit from simplicity and lower financial risk, making cash trading a preferred choice for risk-averse market participants.

Differences Between Margin and Cash Trading

Margin trading involves borrowing funds from a broker to purchase securities, amplifying both potential gains and losses, while cash trading requires using only the available capital without leverage. Margin trading carries higher risk due to interest costs and margin calls, whereas cash trading involves full payment upfront, limiting the risk to the invested amount. The key difference lies in the use of leverage in margin trading versus the straightforward, debt-free approach in cash trading.

Pros and Cons of Margin Trading

Margin trading allows investors to amplify potential returns by borrowing funds to increase their market exposure, offering opportunities for greater profits. However, it also carries the risk of magnified losses, as traders are liable for borrowed amounts plus interest, which can lead to significant financial distress. While margin trading provides access to larger positions and enhanced leverage, it demands careful risk management and understanding of market volatility to avoid margin calls and forced liquidation.

Advantages and Disadvantages of Cash Trading

Cash trading involves purchasing securities using only the investor's available funds, eliminating the risk of debt and margin calls. Advantages include simplified account management, no interest expenses, and reduced exposure to market volatility compared to margin trading. Disadvantages encompass limited purchasing power, slower capital deployment, and missed opportunities for amplified returns through leverage.

Risks Associated with Margin Trading

Margin trading involves borrowing funds to purchase securities, significantly increasing potential losses compared to cash trading where only owned capital is used. The risks associated with margin trading include margin calls, where investors must quickly deposit additional funds or sell assets to cover losses, possibly leading to forced liquidation at unfavorable prices. Volatility in the market can amplify these risks, resulting in losses that exceed the initial investment and increasing financial liability.

Cost Implications: Margin vs Cash Trading

Margin trading incurs interest costs on borrowed funds, which increases overall expenses and can amplify losses, while cash trading involves using only available capital without borrowing costs, minimizing risk and expense. Margin trading also may require maintenance margin deposits, leading to potential margin calls and forced liquidation if asset values decline. In contrast, cash trading avoids such obligations, offering more straightforward cost implications but limiting investment capacity to existing funds.

Regulatory Considerations for Margin and Cash Accounts

Regulatory considerations for margin and cash accounts differ significantly, with margin trading subject to stricter oversight by bodies such as the SEC and FINRA to mitigate the higher risk of leveraged positions. Margin accounts require compliance with federal regulations including Regulation T, which limits the amount of credit brokers can extend to investors for securities purchases. In contrast, cash accounts are primarily regulated to ensure timely settlement and prevention of free-riding, thereby involving fewer regulatory complexities compared to margin accounts.

Choosing Between Margin and Cash Trading Strategies

Margin trading allows investors to amplify potential returns by borrowing funds to increase their market exposure, but it carries higher risk due to leverage and interest costs. Cash trading involves using only the investor's available capital, reducing risk and avoiding debt, thus providing more control and simplicity in managing investments. Choosing between margin and cash trading strategies depends on an individual's risk tolerance, investment goals, and market conditions, balancing potential gains with financial stability.

Margin Calls vs Full Payment: What Investors Should Know

Margin trading requires investors to maintain a minimum equity level, known as the maintenance margin, to avoid margin calls that demand additional funds or the liquidation of assets. In contrast, cash trading involves full payment upfront, eliminating the risk of margin calls but limiting leverage opportunities. Understanding the risks of margin calls is crucial for investors using margin trading, as failure to meet margin requirements can result in forced asset sales and significant financial loss.

Margin trading vs Cash trading Infographic

difterm.com

difterm.com