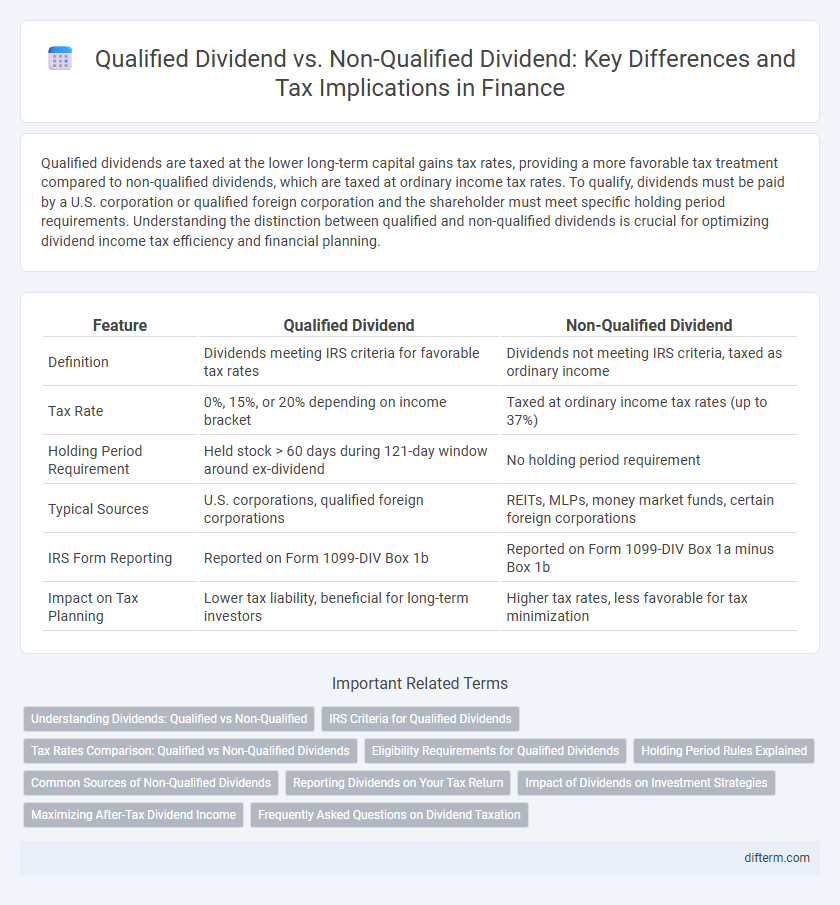

Qualified dividends are taxed at the lower long-term capital gains tax rates, providing a more favorable tax treatment compared to non-qualified dividends, which are taxed at ordinary income tax rates. To qualify, dividends must be paid by a U.S. corporation or qualified foreign corporation and the shareholder must meet specific holding period requirements. Understanding the distinction between qualified and non-qualified dividends is crucial for optimizing dividend income tax efficiency and financial planning.

Table of Comparison

| Feature | Qualified Dividend | Non-Qualified Dividend |

|---|---|---|

| Definition | Dividends meeting IRS criteria for favorable tax rates | Dividends not meeting IRS criteria, taxed as ordinary income |

| Tax Rate | 0%, 15%, or 20% depending on income bracket | Taxed at ordinary income tax rates (up to 37%) |

| Holding Period Requirement | Held stock > 60 days during 121-day window around ex-dividend | No holding period requirement |

| Typical Sources | U.S. corporations, qualified foreign corporations | REITs, MLPs, money market funds, certain foreign corporations |

| IRS Form Reporting | Reported on Form 1099-DIV Box 1b | Reported on Form 1099-DIV Box 1a minus Box 1b |

| Impact on Tax Planning | Lower tax liability, beneficial for long-term investors | Higher tax rates, less favorable for tax minimization |

Understanding Dividends: Qualified vs Non-Qualified

Qualified dividends benefit from lower tax rates, typically taxed at long-term capital gains rates ranging from 0% to 20%, depending on the taxpayer's income bracket. Non-qualified dividends are taxed at ordinary income tax rates, which can be significantly higher, affecting after-tax returns for investors. Understanding the distinction between these dividends is crucial for effective tax planning and maximizing investment income, especially in taxable accounts.

IRS Criteria for Qualified Dividends

Qualified dividends meet specific IRS criteria to benefit from lower long-term capital gains tax rates, including being paid by U.S. corporations or qualified foreign corporations and holding the stock for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date. Non-qualified dividends fail to meet these requirements and are taxed at ordinary income tax rates, which are generally higher. Understanding the IRS holding period and entity qualifications is crucial for accurate tax planning and minimizing dividend tax liability.

Tax Rates Comparison: Qualified vs Non-Qualified Dividends

Qualified dividends are taxed at favorable long-term capital gains rates ranging from 0% to 20%, depending on the taxpayer's income bracket, resulting in significant tax savings compared to ordinary income tax rates. Non-qualified dividends, also known as ordinary dividends, are taxed at the investor's standard federal income tax rate, which can be as high as 37%, increasing the overall tax burden. Investors benefit from knowing the distinction because holding stocks long enough to receive qualified dividends can reduce tax liabilities and enhance after-tax returns.

Eligibility Requirements for Qualified Dividends

Qualified dividends must be paid by a U.S. corporation or a qualified foreign corporation and meet specific holding period requirements, typically held for more than 60 days during the 121-day period surrounding the ex-dividend date. These dividends are taxed at the lower long-term capital gains tax rates, providing significant tax advantages over non-qualified dividends, which are taxed as ordinary income. To ensure eligibility, investors must carefully track the purchase and sale dates of dividend-paying stocks to satisfy the IRS holding period rules.

Holding Period Rules Explained

Qualified dividends receive favorable tax rates only if the shareholder meets strict holding period requirements, typically holding the stock for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date. Non-qualified dividends, on the other hand, do not meet these holding criteria and are taxed at ordinary income tax rates. Understanding and adhering to these holding period rules is crucial for investors aiming to minimize tax liability on dividend income.

Common Sources of Non-Qualified Dividends

Non-qualified dividends typically come from sources such as real estate investment trusts (REITs), master limited partnerships (MLPs), and dividends on employee stock options, which do not meet the holding period requirements for qualified dividends. These dividends are taxed at the individual's ordinary income tax rate rather than the lower capital gains rates applied to qualified dividends. Understanding the tax implications of non-qualified dividends is crucial for optimizing investment income and minimizing tax liability.

Reporting Dividends on Your Tax Return

Qualified dividends are reported on Form 1099-DIV and taxed at the lower long-term capital gains tax rates, requiring you to enter them on Schedule D and Form 1040. Non-qualified dividends, also reported on Form 1099-DIV, are taxed at ordinary income tax rates and must be included as part of your total income on Form 1040. Proper classification of these dividends is crucial for accurate tax reporting and minimizing your tax liability.

Impact of Dividends on Investment Strategies

Qualified dividends benefit from lower long-term capital gains tax rates, making them more attractive for investors seeking tax-efficient income and enhancing portfolio growth over time. Non-qualified dividends are taxed at higher ordinary income rates, which may reduce after-tax returns and influence investors to favor assets with qualified dividends or tax-advantaged accounts. Strategic allocation of dividend-paying stocks based on qualification status can optimize tax efficiency and overall investment performance.

Maximizing After-Tax Dividend Income

Maximizing after-tax dividend income requires a clear understanding of the tax advantages associated with qualified dividends, which are typically taxed at lower long-term capital gains rates, often 0%, 15%, or 20%, depending on the investor's taxable income bracket. Non-qualified dividends, taxed as ordinary income, can significantly reduce net returns, especially for high-income taxpayers facing marginal tax rates up to 37%. Prioritizing investment in stocks that pay qualified dividends and strategically timing dividend capture can enhance portfolio tax efficiency and increase overall after-tax income.

Frequently Asked Questions on Dividend Taxation

Qualified dividends are taxed at the lower long-term capital gains tax rates, which range from 0% to 20%, depending on the taxpayer's income bracket, while non-qualified dividends are taxed at ordinary income tax rates that can be as high as 37%. To be considered qualified, dividends must be paid by U.S. corporations or qualified foreign corporations, and the investor must meet the required holding period of more than 60 days within the 121-day period surrounding the ex-dividend date. Understanding the distinction between these dividend types is essential for optimizing tax liability and accurately reporting dividend income on IRS Form 1099-DIV.

Qualified Dividend vs Non-Qualified Dividend Infographic

difterm.com

difterm.com