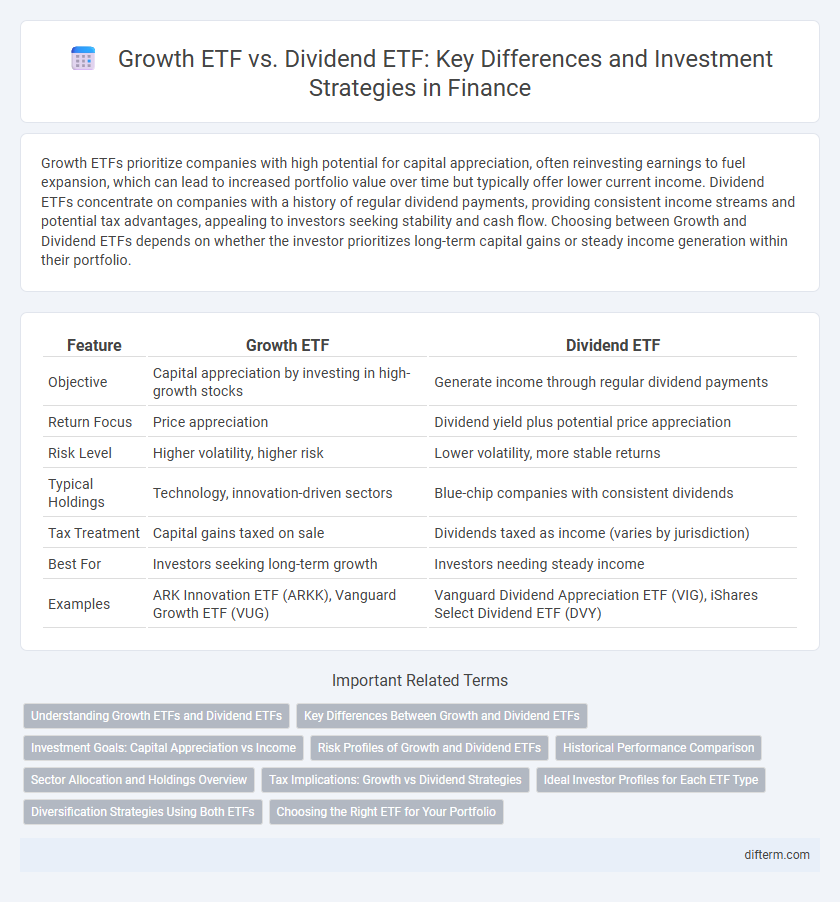

Growth ETFs prioritize companies with high potential for capital appreciation, often reinvesting earnings to fuel expansion, which can lead to increased portfolio value over time but typically offer lower current income. Dividend ETFs concentrate on companies with a history of regular dividend payments, providing consistent income streams and potential tax advantages, appealing to investors seeking stability and cash flow. Choosing between Growth and Dividend ETFs depends on whether the investor prioritizes long-term capital gains or steady income generation within their portfolio.

Table of Comparison

| Feature | Growth ETF | Dividend ETF |

|---|---|---|

| Objective | Capital appreciation by investing in high-growth stocks | Generate income through regular dividend payments |

| Return Focus | Price appreciation | Dividend yield plus potential price appreciation |

| Risk Level | Higher volatility, higher risk | Lower volatility, more stable returns |

| Typical Holdings | Technology, innovation-driven sectors | Blue-chip companies with consistent dividends |

| Tax Treatment | Capital gains taxed on sale | Dividends taxed as income (varies by jurisdiction) |

| Best For | Investors seeking long-term growth | Investors needing steady income |

| Examples | ARK Innovation ETF (ARKK), Vanguard Growth ETF (VUG) | Vanguard Dividend Appreciation ETF (VIG), iShares Select Dividend ETF (DVY) |

Understanding Growth ETFs and Dividend ETFs

Growth ETFs primarily invest in companies with high potential for capital appreciation, emphasizing reinvestment of earnings over dividend payouts. Dividend ETFs focus on companies with stable and consistent dividend payments, providing investors with regular income streams alongside potential growth. Selecting between Growth and Dividend ETFs depends on an investor's goal for capital gains versus income generation.

Key Differences Between Growth and Dividend ETFs

Growth ETFs primarily invest in companies with high potential for capital appreciation, often reinvesting earnings to fuel expansion, resulting in lower current income but higher long-term growth. Dividend ETFs focus on companies with stable, consistent dividend payouts, providing regular income and lower volatility, appealing to income-focused investors. The key differences lie in investment objectives, risk profiles, and income generation strategies, with Growth ETFs aiming for capital gains and Dividend ETFs targeting income stability.

Investment Goals: Capital Appreciation vs Income

Growth ETFs prioritize capital appreciation by investing in companies with high potential for earnings expansion, appealing to investors seeking long-term value increase. Dividend ETFs focus on generating steady income streams through stocks of companies with consistent dividend payouts, ideal for investors prioritizing reliable cash flow. Selecting between these ETFs depends on whether the investment goal is wealth accumulation or income generation.

Risk Profiles of Growth and Dividend ETFs

Growth ETFs typically exhibit higher volatility due to their focus on companies reinvesting earnings for expansion, leading to greater potential returns and elevated risk exposure. Dividend ETFs emphasize stable, income-generating stocks with consistent dividend payments, offering lower volatility and more predictable cash flow. Investors seeking aggressive capital appreciation may prefer growth ETFs, while those prioritizing capital preservation and income stability often lean towards dividend ETFs for risk management.

Historical Performance Comparison

Growth ETFs have generally outperformed dividend ETFs over the past decade, driven by technology and innovation sectors that exhibit higher capital appreciation. Dividend ETFs, while offering steady income through regular payouts, tend to show more resilience during market downturns due to their holdings in established, cash-generating companies. Historical data from 2013 to 2023 indicate growth ETFs averaged annual returns between 12-15%, whereas dividend ETFs yielded more modest returns around 7-9%, reflecting their income-focused investment strategy.

Sector Allocation and Holdings Overview

Growth ETFs typically emphasize technology, healthcare, and consumer discretionary sectors, reflecting companies with high earnings potential and reinvested profits to fuel expansion. Dividend ETFs concentrate on utilities, financials, and consumer staples sectors, featuring holdings known for consistent dividend payouts and stable cash flows. Sector allocation in Growth ETFs skews toward innovation-driven industries, whereas Dividend ETFs allocate assets to mature, income-generating companies with strong balance sheets.

Tax Implications: Growth vs Dividend Strategies

Growth ETFs typically generate capital gains, which are taxed only upon the sale of shares, allowing tax deferral and potential long-term capital gains rates that are generally lower than ordinary income tax rates. Dividend ETFs distribute regular dividends that are usually taxed as ordinary income unless qualified dividends apply, resulting in higher annual tax liabilities compared to growth ETFs. Investors seeking tax efficiency often prefer growth ETFs to minimize yearly tax exposure, while dividend ETFs suit those prioritizing steady income despite higher tax costs.

Ideal Investor Profiles for Each ETF Type

Growth ETFs suit investors seeking capital appreciation through exposure to companies with high earnings potential, typically younger individuals with higher risk tolerance and longer investment horizons. Dividend ETFs attract income-focused investors, often retirees or those needing steady cash flow, by investing in companies with strong, consistent dividend payouts and lower volatility. Evaluating investment goals, risk tolerance, and income needs is essential in selecting between Growth and Dividend ETFs.

Diversification Strategies Using Both ETFs

Incorporating Growth ETFs and Dividend ETFs in a portfolio enhances diversification by balancing capital appreciation with steady income streams, reducing overall risk exposure. Growth ETFs typically invest in companies with high earnings potential, offering aggressive growth opportunities, while Dividend ETFs focus on established firms that provide reliable dividends, ensuring consistent cash flow. Utilizing both ETF types allows investors to achieve a blend of long-term growth and income stability, optimizing portfolio performance across different market conditions.

Choosing the Right ETF for Your Portfolio

Growth ETFs prioritize companies with high potential for capital appreciation, often reinvesting earnings to fuel expansion, making them suitable for investors seeking long-term growth and higher risk tolerance. Dividend ETFs focus on companies with consistent dividend payouts, providing a steady income stream, ideal for investors aiming for regular cash flow and lower volatility. Balancing Growth and Dividend ETFs within a portfolio depends on individual financial goals, risk appetite, and the desire for income versus capital gain.

Growth ETF vs Dividend ETF Infographic

difterm.com

difterm.com