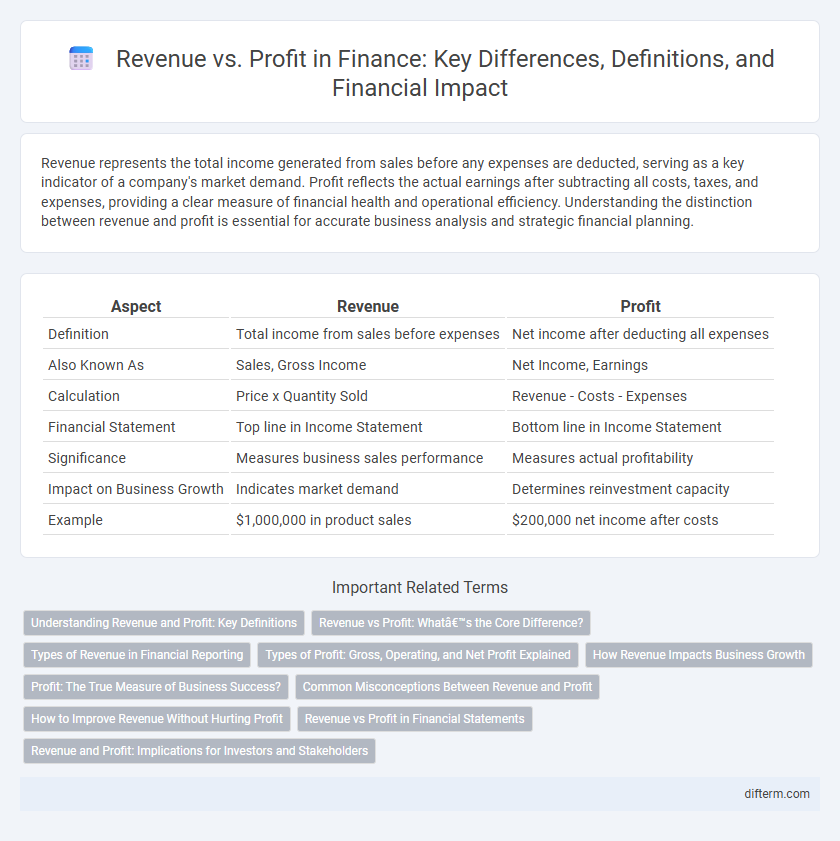

Revenue represents the total income generated from sales before any expenses are deducted, serving as a key indicator of a company's market demand. Profit reflects the actual earnings after subtracting all costs, taxes, and expenses, providing a clear measure of financial health and operational efficiency. Understanding the distinction between revenue and profit is essential for accurate business analysis and strategic financial planning.

Table of Comparison

| Aspect | Revenue | Profit |

|---|---|---|

| Definition | Total income from sales before expenses | Net income after deducting all expenses |

| Also Known As | Sales, Gross Income | Net Income, Earnings |

| Calculation | Price x Quantity Sold | Revenue - Costs - Expenses |

| Financial Statement | Top line in Income Statement | Bottom line in Income Statement |

| Significance | Measures business sales performance | Measures actual profitability |

| Impact on Business Growth | Indicates market demand | Determines reinvestment capacity |

| Example | $1,000,000 in product sales | $200,000 net income after costs |

Understanding Revenue and Profit: Key Definitions

Revenue represents the total income generated from sales of goods or services before any expenses are deducted. Profit, on the other hand, is the net income remaining after subtracting all costs, including operating expenses, taxes, and interest, from the total revenue. Understanding the distinction between revenue and profit is crucial for evaluating a company's financial health and operational efficiency.

Revenue vs Profit: What’s the Core Difference?

Revenue represents the total income generated from sales of goods or services before any expenses are deducted, serving as the top line of a company's income statement. Profit, often referred to as net income, is the amount remaining after all operating costs, taxes, and expenses have been subtracted from revenue, reflecting the company's actual earnings. Understanding the distinction between revenue and profit is crucial for assessing a business's financial health and operational efficiency.

Types of Revenue in Financial Reporting

Revenue in financial reporting includes several types such as operating revenue, non-operating revenue, and other income. Operating revenue primarily stems from a company's core business activities, including sales of goods or services, while non-operating revenue arises from ancillary sources like interest, dividends, or rent. Accurate classification of these revenue types is essential for assessing a company's financial health and profitability.

Types of Profit: Gross, Operating, and Net Profit Explained

Gross profit represents total revenue minus the cost of goods sold, highlighting the efficiency of production and sales processes. Operating profit accounts for gross profit minus operating expenses such as wages and rent, reflecting the profitability of core business activities. Net profit, often called the bottom line, is calculated by subtracting all expenses, including taxes and interest, from operating profit, providing a comprehensive measure of overall financial health.

How Revenue Impacts Business Growth

Revenue serves as the primary indicator of a company's market demand and sales performance, directly influencing cash flow essential for reinvestment and expansion. Higher revenue enables businesses to allocate resources toward innovation, marketing, and operational improvements, which drive sustainable growth. Consistently increasing revenue also enhances investor confidence and access to capital, fueling further business development.

Profit: The True Measure of Business Success?

Profit represents the true measure of business success by reflecting the net earnings after all expenses, taxes, and costs have been deducted from revenue. Unlike revenue, which only indicates the total income generated from sales or services, profit reveals the company's actual financial health and sustainability. Analyzing profit margins offers critical insights into operational efficiency, cost management, and long-term viability in the competitive market.

Common Misconceptions Between Revenue and Profit

Many individuals mistakenly equate revenue with profit, though revenue represents total income generated from sales before any expenses are deducted. Profit, specifically net profit, is the actual earnings remaining after subtracting costs such as operating expenses, taxes, and interest from revenue. This misunderstanding can lead to overestimations of a company's financial health and misinformed investment decisions.

How to Improve Revenue Without Hurting Profit

Increasing revenue without compromising profit requires strategic cost management and targeted marketing efforts that attract high-value customers. Streamlining operational inefficiencies and leveraging data analytics can identify profitable growth opportunities, ensuring expenses do not outpace income. Prioritizing products or services with higher profit margins alongside scalable sales channels maximizes revenue while preserving healthy profit margins.

Revenue vs Profit in Financial Statements

Revenue represents the total income generated from sales of goods or services before any expenses are deducted, serving as the top line on financial statements. Profit, appearing below revenue on the income statement, reflects the net income remaining after subtracting all operating costs, taxes, and interest from total revenue. Understanding the distinction between revenue and profit is essential for evaluating a company's financial health and operational efficiency.

Revenue and Profit: Implications for Investors and Stakeholders

Revenue represents the total income generated from sales before any expenses are deducted, serving as a primary indicator of a company's market demand and operational scale. Profit, calculated by subtracting costs from revenue, reveals the actual financial gain and efficiency in managing expenses. Investors and stakeholders analyze both metrics to assess business viability, growth potential, and overall financial health, with revenue indicating market traction and profit reflecting sustainability and return on investment.

Revenue vs Profit Infographic

difterm.com

difterm.com