Risk tolerance reflects an investor's emotional ability to endure market fluctuations, while risk capacity measures the financial ability to absorb potential losses without jeopardizing long-term goals. Balancing risk tolerance and risk capacity is crucial for constructing a personalized investment strategy that aligns with both psychological comfort and financial reality. Understanding the difference helps investors avoid overly aggressive or overly conservative portfolios that could undermine their financial objectives.

Table of Comparison

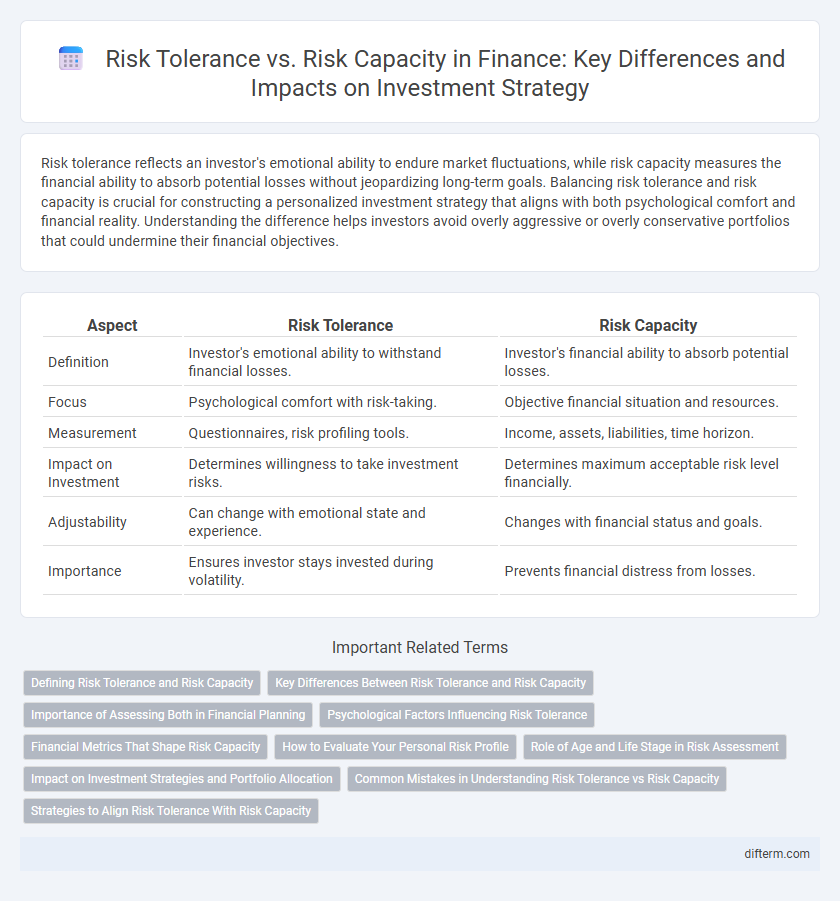

| Aspect | Risk Tolerance | Risk Capacity |

|---|---|---|

| Definition | Investor's emotional ability to withstand financial losses. | Investor's financial ability to absorb potential losses. |

| Focus | Psychological comfort with risk-taking. | Objective financial situation and resources. |

| Measurement | Questionnaires, risk profiling tools. | Income, assets, liabilities, time horizon. |

| Impact on Investment | Determines willingness to take investment risks. | Determines maximum acceptable risk level financially. |

| Adjustability | Can change with emotional state and experience. | Changes with financial status and goals. |

| Importance | Ensures investor stays invested during volatility. | Prevents financial distress from losses. |

Defining Risk Tolerance and Risk Capacity

Risk tolerance refers to an investor's psychological willingness to endure market fluctuations and potential losses without selling assets during downturns. Risk capacity evaluates the financial ability to absorb losses based on factors like income stability, time horizon, and liquidity needs. Understanding both risk tolerance and risk capacity is essential for creating an investment strategy aligned with personal financial goals and resilience.

Key Differences Between Risk Tolerance and Risk Capacity

Risk tolerance refers to an investor's emotional ability to endure market fluctuations and potential losses, while risk capacity is the objective financial ability to absorb losses without compromising goals. Key differences include that risk tolerance is subjective and influenced by personality and experience, whereas risk capacity is quantitative, based on income, assets, liabilities, and time horizon. Effective financial planning requires aligning both risk tolerance and risk capacity to create an investment strategy that balances psychological comfort with financial practicality.

Importance of Assessing Both in Financial Planning

Assessing both risk tolerance and risk capacity is crucial in financial planning to create a balanced investment strategy that aligns with an individual's psychological comfort and financial ability to absorb losses. Risk tolerance reflects an investor's emotional willingness to take risks, while risk capacity measures the actual financial ability to endure potential downturns without jeopardizing long-term goals. Integrating these assessments helps financial advisors tailor portfolios that optimize growth potential while minimizing the likelihood of financial distress.

Psychological Factors Influencing Risk Tolerance

Psychological factors influencing risk tolerance include an investor's emotions, past experiences, and cognitive biases, which shape their willingness to endure financial losses. Personality traits such as optimism, anxiety, and confidence heavily impact decision-making under uncertainty, affecting investment choices. Understanding these psychological elements is crucial for aligning risk tolerance with an individual's actual risk capacity to create effective financial strategies.

Financial Metrics That Shape Risk Capacity

Risk capacity is fundamentally influenced by financial metrics such as income stability, asset liquidity, debt levels, and emergency fund size, which collectively determine an investor's ability to endure potential losses without jeopardizing financial goals. Higher income and liquid assets typically enhance risk capacity by providing a buffer during market volatility, while elevated debt obligations and insufficient emergency savings can significantly constrain it. Evaluating these metrics allows financial advisors to tailor investment strategies that align with both the client's risk tolerance and realistic capacity to absorb risk.

How to Evaluate Your Personal Risk Profile

Evaluating your personal risk profile involves assessing both your risk tolerance--your emotional ability to withstand market fluctuations--and your risk capacity--your financial ability to absorb losses without compromising your goals. Quantitative tools like risk questionnaires and scenario analyses help measure psychological comfort, while financial statements and cash flow projections determine your economic resilience. Combining these insights enables tailored investment strategies aligning with your unique risk profile and long-term financial objectives.

Role of Age and Life Stage in Risk Assessment

Age and life stage critically influence risk tolerance and risk capacity, as younger investors often exhibit higher risk tolerance due to longer time horizons to recover from losses. In contrast, older individuals typically have reduced risk capacity, prioritizing capital preservation to secure retirement income. Assessing risk requires blending these factors to tailor investment strategies that align with both psychological comfort and financial necessity.

Impact on Investment Strategies and Portfolio Allocation

Risk tolerance determines the level of investment volatility an individual is emotionally willing to endure, influencing asset selection and portfolio diversification. Risk capacity assesses the financial ability to withstand losses without compromising long-term goals, shaping the proportion of high-risk versus low-risk assets. Aligning risk tolerance with risk capacity ensures optimal investment strategies and portfolio allocations that balance growth objectives with financial security.

Common Mistakes in Understanding Risk Tolerance vs Risk Capacity

Common mistakes in understanding risk tolerance versus risk capacity include confusing emotional willingness to take risks with actual financial ability to bear losses. Investors often overestimate their risk tolerance by ignoring objective measures of financial stability, such as emergency funds and income security. Failure to align investment strategies with true risk capacity can lead to inappropriate portfolio allocations and potential financial distress.

Strategies to Align Risk Tolerance With Risk Capacity

Aligning risk tolerance with risk capacity requires a thorough assessment of an investor's financial situation, including income stability, asset liquidity, and time horizon. Employing diversified investment portfolios and setting clear financial goals help mitigate potential losses while maintaining comfort with market fluctuations. Regularly reviewing and adjusting the risk profile ensures that investment strategies remain consistent with changing personal and market conditions.

Risk Tolerance vs Risk Capacity Infographic

difterm.com

difterm.com