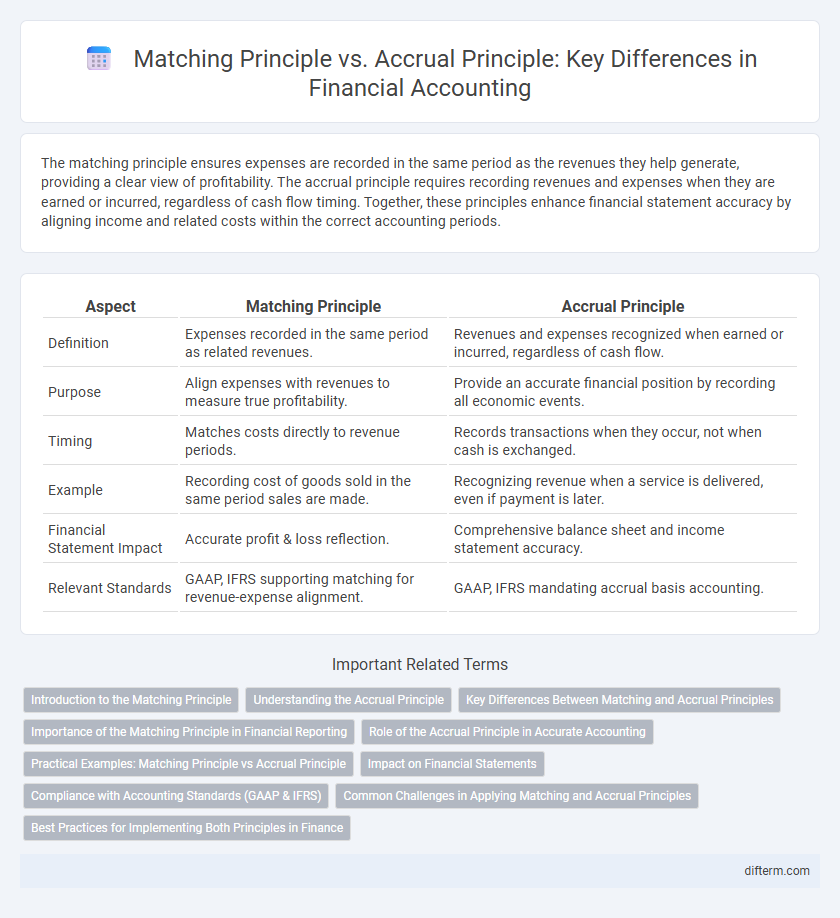

The matching principle ensures expenses are recorded in the same period as the revenues they help generate, providing a clear view of profitability. The accrual principle requires recording revenues and expenses when they are earned or incurred, regardless of cash flow timing. Together, these principles enhance financial statement accuracy by aligning income and related costs within the correct accounting periods.

Table of Comparison

| Aspect | Matching Principle | Accrual Principle |

|---|---|---|

| Definition | Expenses recorded in the same period as related revenues. | Revenues and expenses recognized when earned or incurred, regardless of cash flow. |

| Purpose | Align expenses with revenues to measure true profitability. | Provide an accurate financial position by recording all economic events. |

| Timing | Matches costs directly to revenue periods. | Records transactions when they occur, not when cash is exchanged. |

| Example | Recording cost of goods sold in the same period sales are made. | Recognizing revenue when a service is delivered, even if payment is later. |

| Financial Statement Impact | Accurate profit & loss reflection. | Comprehensive balance sheet and income statement accuracy. |

| Relevant Standards | GAAP, IFRS supporting matching for revenue-expense alignment. | GAAP, IFRS mandating accrual basis accounting. |

Introduction to the Matching Principle

The matching principle requires that expenses be recorded in the same accounting period as the revenues they help generate, ensuring accurate profit measurement. This principle is fundamental in accrual accounting, aligning costs with related income to reflect true financial performance. Proper application of the matching principle enhances financial statement reliability for investors and stakeholders.

Understanding the Accrual Principle

The accrual principle requires recognizing revenues and expenses when they are incurred, regardless of cash flow, ensuring that financial statements reflect a company's true financial performance during a period. This principle is fundamental for accurate matching of income and expenses, providing investors and stakeholders with a clear picture of profitability and operational efficiency. By adhering to the accrual principle, businesses avoid misleading financial results that could arise from cash-based accounting, supporting better decision-making and compliance with Generally Accepted Accounting Principles (GAAP).

Key Differences Between Matching and Accrual Principles

The matching principle requires expenses to be recorded in the same accounting period as the revenues they help generate, ensuring accurate profit measurement. The accrual principle recognizes revenues and expenses when they are earned or incurred, regardless of cash flow timing, providing a complete financial picture. While both principles support accrual accounting, the matching principle specifically emphasizes expense recognition in alignment with related revenues, whereas the accrual principle addresses the timing of both revenues and expenses.

Importance of the Matching Principle in Financial Reporting

The matching principle ensures that expenses are recorded in the same period as the revenues they help generate, providing a more accurate representation of a company's financial performance. This principle is fundamental for preparing reliable financial statements that reflect true profitability during an accounting period. By aligning expenses with revenues, the matching principle supports consistent financial analysis and decision-making for investors and managers.

Role of the Accrual Principle in Accurate Accounting

The Accrual Principle ensures financial transactions are recorded when they occur, regardless of cash flow timing, providing a more accurate representation of a company's financial position. This principle recognizes revenues and expenses in the period they are earned or incurred, aligning with the Matching Principle to match expenses with related revenues. Accurate accounting under the Accrual Principle enhances financial statement reliability, aiding stakeholders in making informed decisions.

Practical Examples: Matching Principle vs Accrual Principle

The matching principle requires expenses to be recorded in the same period as the revenues they help generate, such as recognizing the cost of goods sold when a sale is made. The accrual principle mandates recording revenues and expenses when they are earned or incurred, regardless of cash flow, like booking rent expense monthly even if payment occurs later. For example, a company that delivers services in December but receives payment in January records the revenue in December under accrual, while matching principle ensures expenses related to that revenue are also recorded in December.

Impact on Financial Statements

The matching principle ensures expenses are recorded in the same period as the revenues they help generate, which improves the accuracy of net income on financial statements. The accrual principle records revenues and expenses when they are earned or incurred, regardless of cash flow timing, providing a more comprehensive view of a company's financial position. Both principles enhance the reliability and relevance of financial statements by aligning income and expenses with the appropriate accounting periods.

Compliance with Accounting Standards (GAAP & IFRS)

The matching principle ensures expenses are recorded in the same period as the revenues they help generate, complying with GAAP and IFRS standards for accurate profit measurement. The accrual principle mandates recognition of revenues and expenses when they are incurred, regardless of cash flow, supporting the faithful representation of a company's financial position. Both principles uphold the integrity of financial statements by aligning with accounting frameworks, enhancing transparency and consistency in reporting.

Common Challenges in Applying Matching and Accrual Principles

Common challenges in applying the matching and accrual principles include accurately estimating expenses and revenues when timing differences occur, such as recognizing prepaid expenses and accrued liabilities. Companies often struggle with subjective judgments in allocating revenues and expenses to the proper accounting periods, leading to inconsistencies in financial reporting. Ensuring compliance with accounting standards like GAAP or IFRS requires meticulous documentation and frequent adjustments to reflect economic reality.

Best Practices for Implementing Both Principles in Finance

Implementing the matching principle requires accurately aligning expenses with the revenues they generate, ensuring financial statements reflect true profitability within the same accounting period. The accrual principle mandates recognizing revenues and expenses when they are incurred, not when cash transactions occur, to provide a realistic view of financial health. Best practices include utilizing robust accounting software, maintaining detailed transaction records, and regularly reconciling accounts to uphold compliance and enhance financial decision-making.

Matching principle vs Accrual principle Infographic

difterm.com

difterm.com