Cost of debt is typically lower than the cost of equity because debt payments are tax-deductible and debt holders have a prior claim on assets, reducing investment risk. Equity investors demand higher returns due to greater risk exposure and the residual nature of their claims on company earnings. Understanding the balance between these costs is crucial for optimizing a company's capital structure and minimizing overall financing expenses.

Table of Comparison

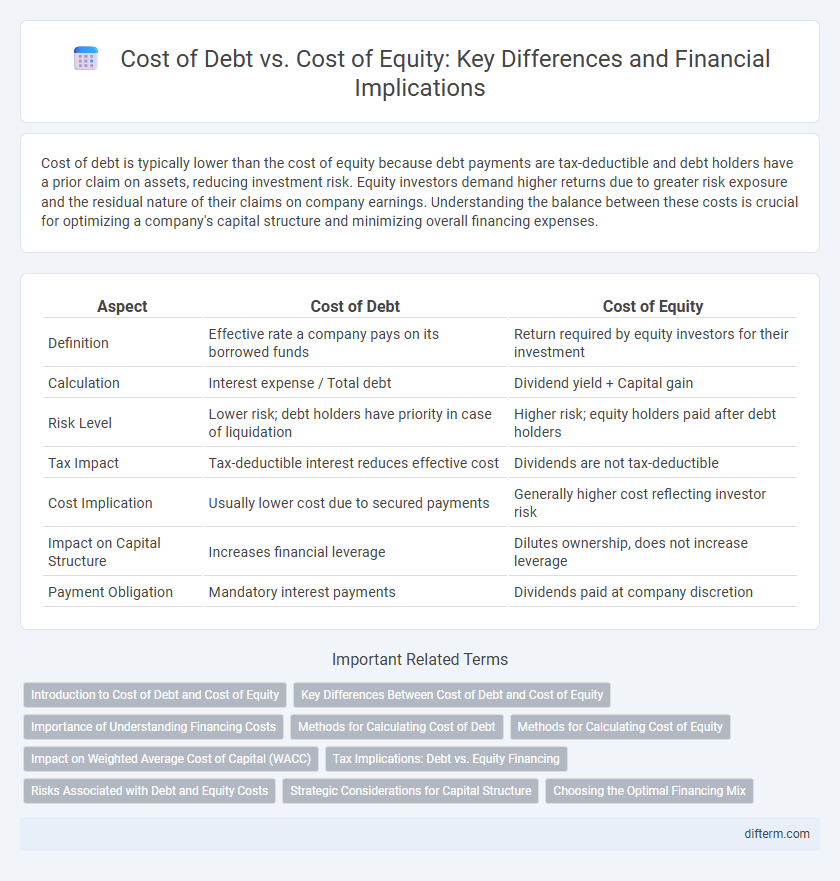

| Aspect | Cost of Debt | Cost of Equity |

|---|---|---|

| Definition | Effective rate a company pays on its borrowed funds | Return required by equity investors for their investment |

| Calculation | Interest expense / Total debt | Dividend yield + Capital gain |

| Risk Level | Lower risk; debt holders have priority in case of liquidation | Higher risk; equity holders paid after debt holders |

| Tax Impact | Tax-deductible interest reduces effective cost | Dividends are not tax-deductible |

| Cost Implication | Usually lower cost due to secured payments | Generally higher cost reflecting investor risk |

| Impact on Capital Structure | Increases financial leverage | Dilutes ownership, does not increase leverage |

| Payment Obligation | Mandatory interest payments | Dividends paid at company discretion |

Introduction to Cost of Debt and Cost of Equity

Cost of debt refers to the effective rate that a company pays on its borrowed funds, often measured after tax adjustments to reflect interest expense benefits. Cost of equity represents the return required by shareholders for investing in the company's equity, considering dividend expectations and capital gains. Both metrics are critical for determining a firm's weighted average cost of capital (WACC) and overall financial strategy.

Key Differences Between Cost of Debt and Cost of Equity

Cost of debt refers to the effective interest rate a company pays on its borrowed funds, typically lower due to tax deductibility of interest expenses and lower risk for lenders. Cost of equity represents the return required by shareholders for investing in the company, generally higher as equity investors face greater risk without guaranteed returns. Key differences include the impact on capital structure, tax implications, and the risk profiles associated with debt being a fixed obligation versus equity providing residual claims.

Importance of Understanding Financing Costs

Understanding the cost of debt and cost of equity is crucial for optimizing a company's capital structure and minimizing overall financing expenses. The cost of debt is typically lower due to tax deductibility of interest, while the cost of equity reflects higher risk and expected returns demanded by shareholders. Accurately assessing these costs enables better investment decisions and enhances shareholder value by balancing risk and cost efficiency.

Methods for Calculating Cost of Debt

The cost of debt is typically calculated using the effective interest rate on existing debt or the yield to maturity (YTM) on company bonds. Another method involves the risk-free rate plus a credit spread reflecting the borrower's default risk. Accurately estimating the cost of debt is crucial for weighted average cost of capital (WACC) calculations and overall capital budgeting decisions.

Methods for Calculating Cost of Equity

Calculating the cost of equity primarily involves models such as the Capital Asset Pricing Model (CAPM), which estimates the expected return based on risk-free rates, beta coefficients, and equity market premiums. Another method is the Dividend Discount Model (DDM), which calculates cost of equity by dividing the expected dividends per share by the current market price and adding the dividend growth rate. Each approach provides critical insights into shareholder expectations and investment risk, essential for capital structure decisions and valuation analysis.

Impact on Weighted Average Cost of Capital (WACC)

The cost of debt is typically lower than the cost of equity due to tax deductibility of interest expenses, which reduces the overall Weighted Average Cost of Capital (WACC). Increasing debt in a firm's capital structure can decrease WACC up to an optimal leverage point, beyond which financial risk raises both debt and equity costs. A balanced mix of debt and equity minimizes WACC, enhancing firm value and financing efficiency.

Tax Implications: Debt vs. Equity Financing

Interest paid on debt is tax-deductible, reducing a company's taxable income and effectively lowering the after-tax cost of debt. Equity financing involves dividend payments which are not tax-deductible, making the cost of equity higher compared to debt. Tax benefits associated with debt financing encourage firms to optimize their capital structure by balancing tax shields against financial risk.

Risks Associated with Debt and Equity Costs

The cost of debt typically carries lower risk for investors due to fixed interest payments and creditor priority in bankruptcy, but it increases financial leverage and potential bankruptcy risk for the company. Conversely, the cost of equity involves higher investor risk as equity holders are residual claimants, demanding greater returns to compensate for uncertainty and dividend variability. Understanding these risk profiles is crucial for optimizing a company's capital structure and minimizing overall cost of capital.

Strategic Considerations for Capital Structure

Cost of debt typically offers lower financing costs due to tax deductibility of interest, but increases financial risk through obligatory payments. Cost of equity reflects higher returns demanded by investors for bearing ownership risk, influencing the company's control and dilution of shares. Strategic capital structure balances these costs to optimize value, maintain financial flexibility, and minimize the weighted average cost of capital (WACC).

Choosing the Optimal Financing Mix

Choosing the optimal financing mix involves balancing the cost of debt and the cost of equity to minimize the company's weighted average cost of capital (WACC). Debt financing typically offers lower cost due to tax deductibility of interest, but excessive leverage increases financial risk and potential bankruptcy costs. Equity financing, while more expensive, reduces risk and preserves financial flexibility, making a strategic blend essential for maximizing firm value and shareholder wealth.

Cost of debt vs Cost of equity Infographic

difterm.com

difterm.com